-

The governor, in the final year of his term, asked lawmakers to approve reforms that would fix the Virgin Islands Water and Power Authority's balance sheet.

January 29 -

"Markets are reading this as a strategic pause, not a policy shift," said Gina Bolvin, president of Bolvin Wealth Management Group.

January 28 -

Downgrades of three private universities in the Northeast reflect enrollment pressures facing the higher education sector, particularly in that region.

January 28 -

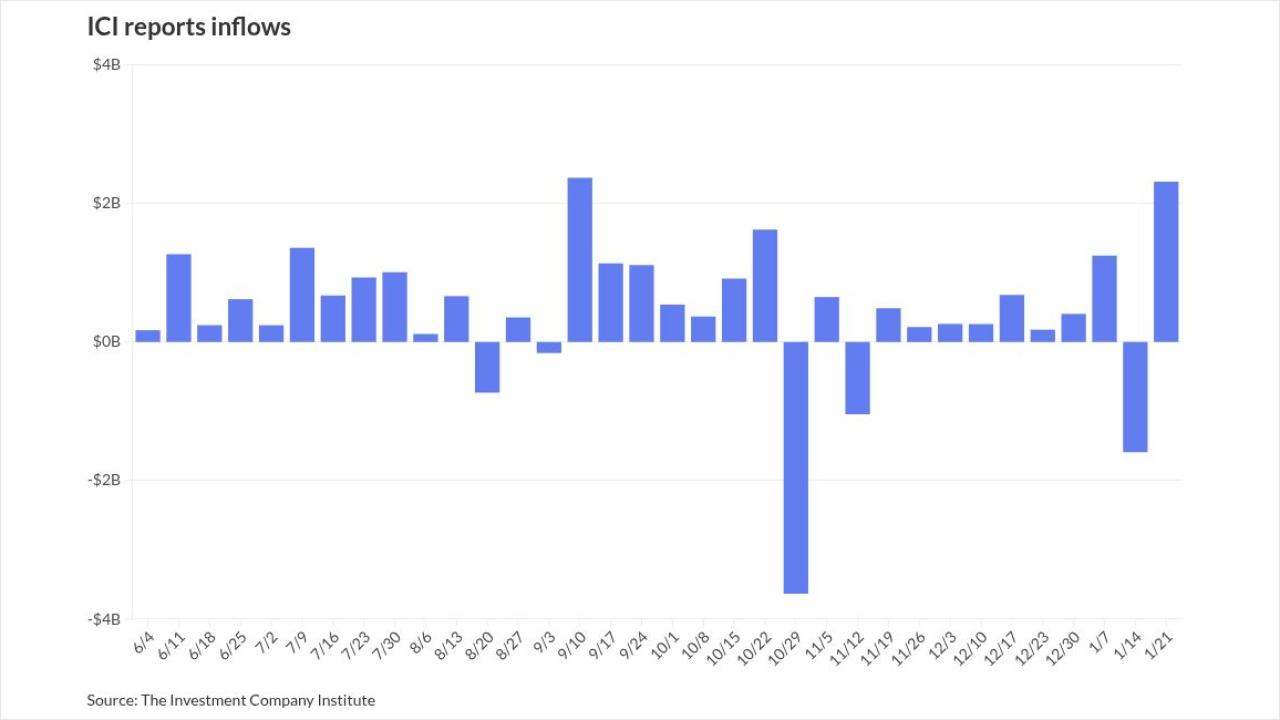

The muni market has rebounded from the technical pressures of the first half of last year — a result of surging issuance — said John Miller, head and CIO of First Eagle's municipal credit team.

January 27 -

The city's Department of Water and Power, which saw spreads widen after last year's deadly wildfires, upsized a revenue bond deal amid strong investor interest.

January 27 -

Chicago general obligation bond prices have dropped sharply since the start of the year, according to the Center for Municipal Finance's muni indices.

January 27 -

The top two municipal bond insurers wrapped over $41.828 billion in 2025, up from $41.166 billion in 2024, data shows.

January 27 -

After Ken Paxton's opinion said giving preferences based on sex or race is unconstitutional, his office set a new certification requirement for bond issuers.

January 27 -

Munis were steady Monday following the large cuts the asset class saw last week, specifically on Tuesday, Jan. 20.

January 26 -

Subordinate bondholders will likely be wiped out.

January 26