-

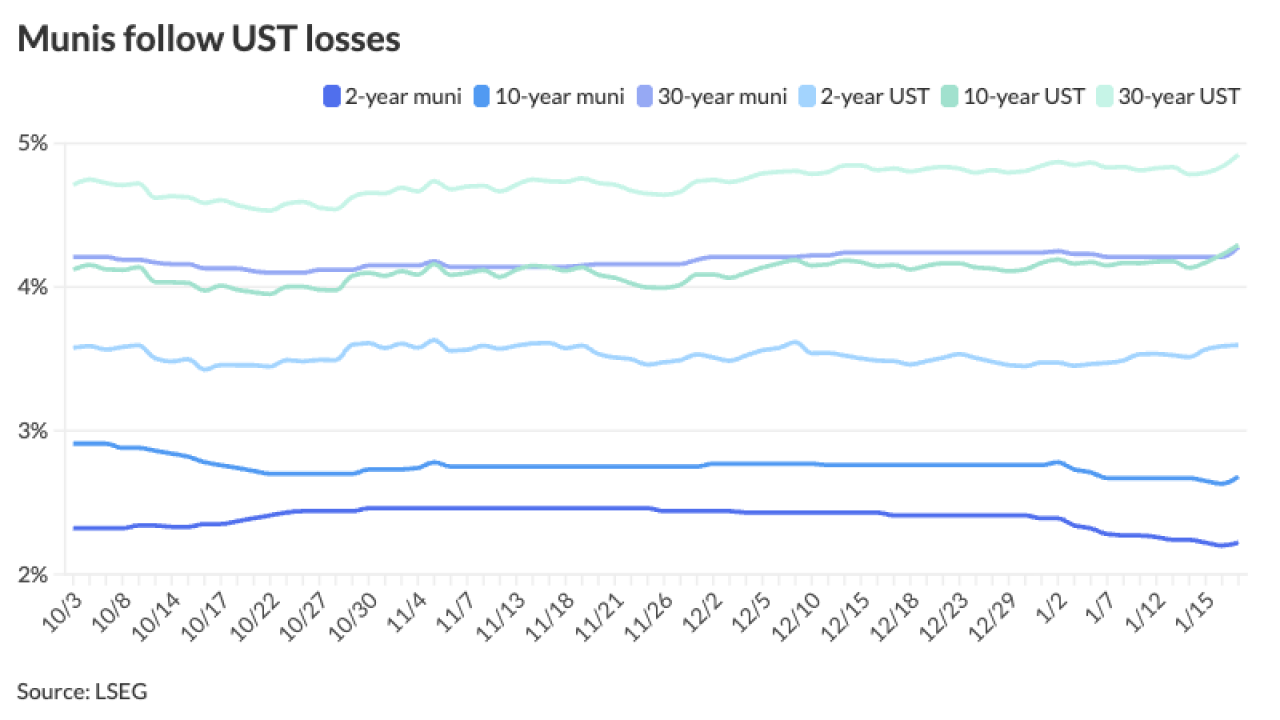

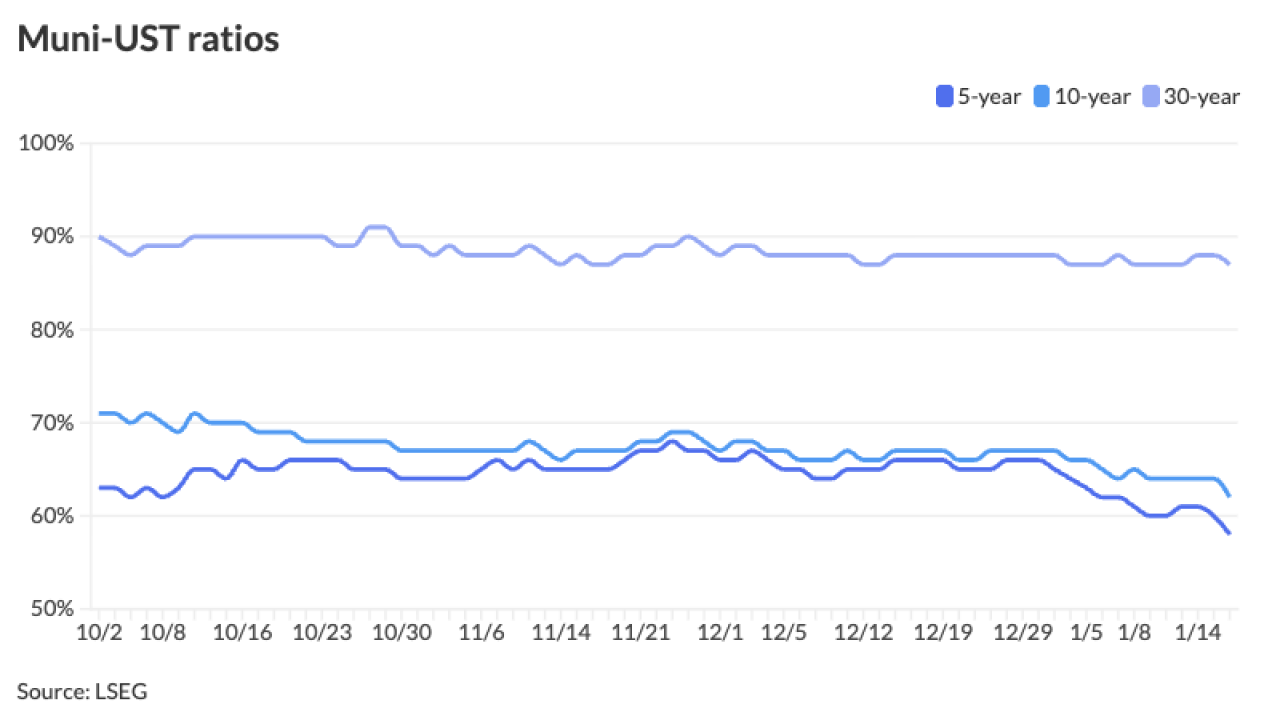

Munis were the best-performing U.S. fixed-income asset class through the first three weeks of January, but the strong performance has created some problems, Barclays strategists said.

January 23 -

It could signal the issuer did not get the best price during a negotiated deal, officials said.

January 23 -

This would be the state's first bond issuance since 2023.

January 23 -

"Of all these headlines, there's no direct concern for the muni market or municipal issuers. It's just tangential concerns of what this does for the economy and rates," said Brad Libby, fixed income credit analyst at Wellington Management and a fixed income portfolio manager with Hartford Funds.

January 22 -

Current events and financial developments outside of the muni sector mean that investors should hold off buying munis until rates correct, said Matt Fabian, president of Municipal Market Analytics.

January 21 -

Native American Tribes are culling through new rules from the U.S. Treasury Department that could boost economic development.

January 21 -

The rates market is "on edge" as global fiscal and geopolitical pressures collide, said James Pruskowski, managing director at Hennion & Walsh.

January 20 -

Republican Ken Paxton said his first-of-its-kind legal opinion aims to dismantle diversity, equity, and inclusion practices in the Lone Star State.

January 20 -

Fitch's three-notch senior bond downgrade reflects "substantial credit risk."

January 20 -

The new-issue calendar is an estimated $10.836 billion, with $6.979 billion of negotiated deals on tap and $3.857 billion of competitives.

January 16