-

How is the buy side approaching portfolio management in a post-Fed tapering, rising-rate environment? Participants will discuss mutual fund flows, taxables, dealer inventories and more.

April 7 -

Experts share their insights on the current state and road ahead for the public finance sector.

December 23 -

Experts discuss electronic trading, machine learning and more in this Leaders forum interview.

December 23 -

Experts explore the E, S and G and what it means for issuers and investors.

December 22 -

Experts discuss the proliferation of chief diversity officers across the industry and what it may mean for future progress in diversity.

December 21 -

The program helped South Carolina’s local governments bridge financial gaps resulting from lost revenues or delayed collections regardless of population size.

December 17 -

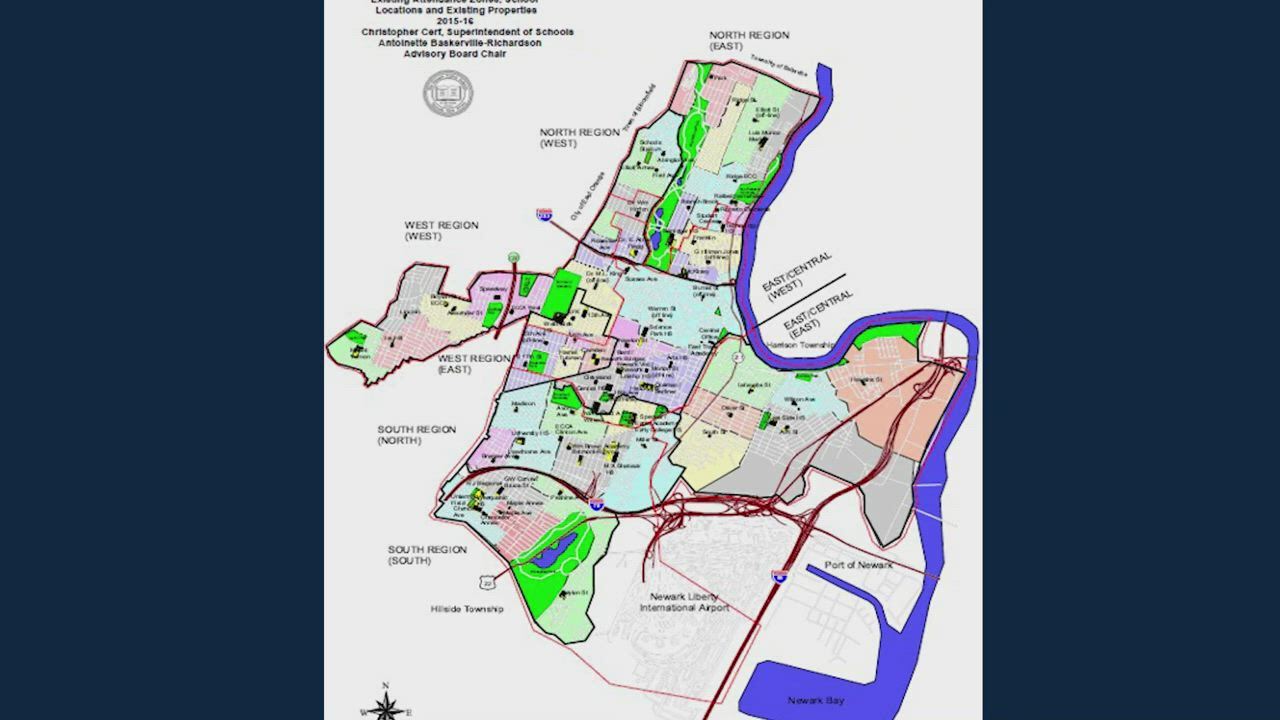

The financing was effectively an inaugural issuance, as it marked the Board’s first issuance after transitioning back to local board control after operating under state control for 25 years.

December 17 -

The Health Care winner is the $300 million taxable bond issuance by the SouthEast Alaska Regional Health Consortium to fund construction of a critical access replacement hospital. The issuer is a nonprofit, tax-exempt tribal health consortium and this was their first public bond issuance.

December 17 -

The Small Issuer honoree is the Buffalo Sewer Authority for its $49.2 million issuance of sewer system environmental impact revenue bonds, the authority’s first bond sale since 2003.

December 17 -

The project used a P3 structure to overcome adverse market conditions to successfully finance much-needed development along a major travel route.

December 17