-

NABL sends detailed letter requesting guidance on interbank offered rates ruling

November 10 -

The omnibus bill drops a controversial measure to claw back unspent state COVID funds and includes long sought-after language to ease the transition away from LIBOR.

March 10 -

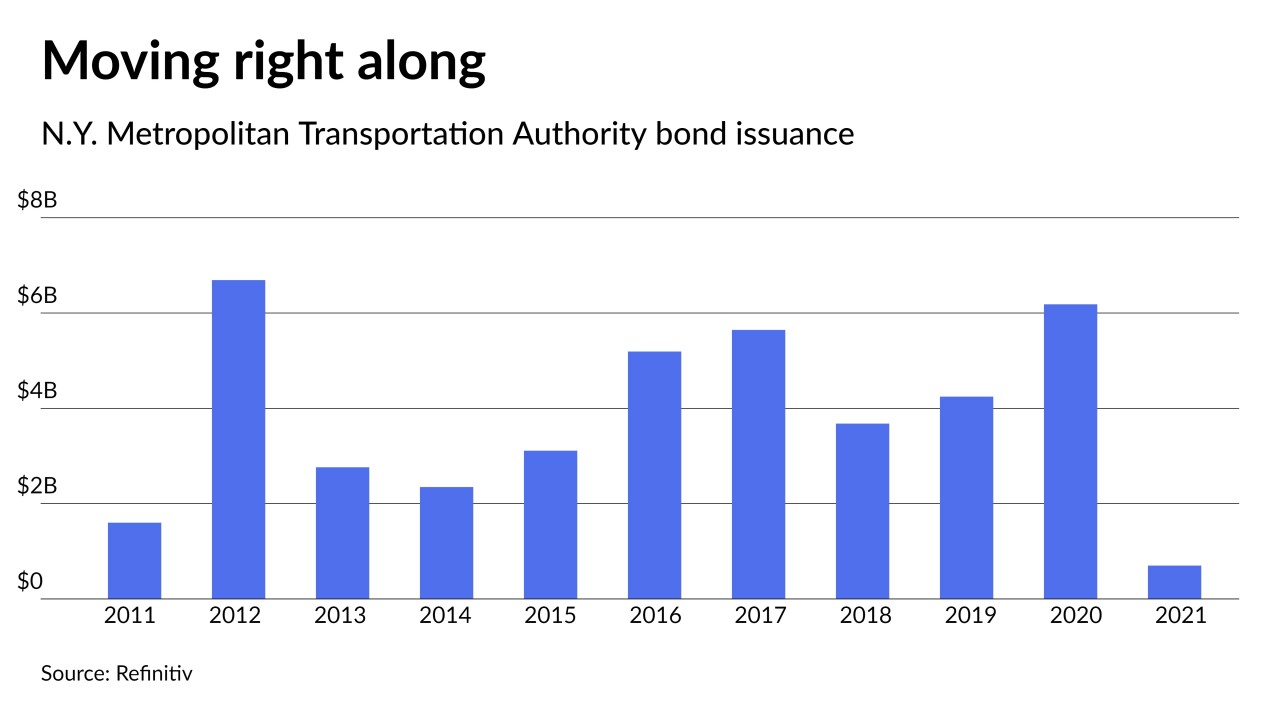

As the MTA works toward a post-pandemic future, Kevin Willens, formerly co-head of public finance at Goldman Sachs, becomes its chief financial officer.

January 28 -

The transition away from Libor presents challenges for small issuers with fewer resources to evaluate legacy contracts.

January 26 -

The Internal Revenue Service and Department of the Treasury have released final guidance on the transition away from Libor, designating SOFR as an alternative rate.

January 3 -

Recommending Libor-linked securities triggers important disclosure and fiduciary obligations.

December 8 -

The Federal Reserve told a judge not to scrap Libor as requested by consumers in a lawsuit because it would pose a risk to financial stability and undermine years of global planning for a transition to a new benchmark for borrowing rates.

August 16 -

A new GFOA advisory said the International Swaps and Derivatives Association has developed “more robust fallback language to specify the rate to be used upon a Libor cessation.”

March 4 -

The group specifically revised six of its model disclosure documents for risk disclosure including floating rate notes, fixed-rate bonds, interest rate swaps, forward delivery bonds, tender offer bonds and variable rate demand obligations.

January 14 -

The SEC's Office of Municipal Securities is moving ahead on the Libor transition and issued a detailed advisory Friday to the municipal securities market.

January 13