-

Municipal bond issuance in the region was down 11.7% year-over-year in 2021, as new money, refunding, taxable and tax-exempt volume all slipped.

February 25 -

A state-by-state review of 2021 issuance in the Far West.

February 25 -

Issuers in California sold more than $86 billion of municipal bonds in 2021.

February 24 -

A state-by-state review of 2021 issuance in the Southeast.

February 24 -

Overall volume in the Southeast rose 1.8% last year even as taxable issuance plunged and refunding deals shriveled up.

February 23 -

A state-by-state review of 2021 issuance in the Midwest.

February 23 -

Municipal bond issuance in the Midwest reversed course last year, falling by 7.4% to $77.5 billion.

February 22 -

Federal aid propped up municipalities’ already strong revenue and credit conditions, making them less apt to need short-term funding in 2021.

February 22 -

Education and utilities were the municipal sectors that shrank the most.

February 22 -

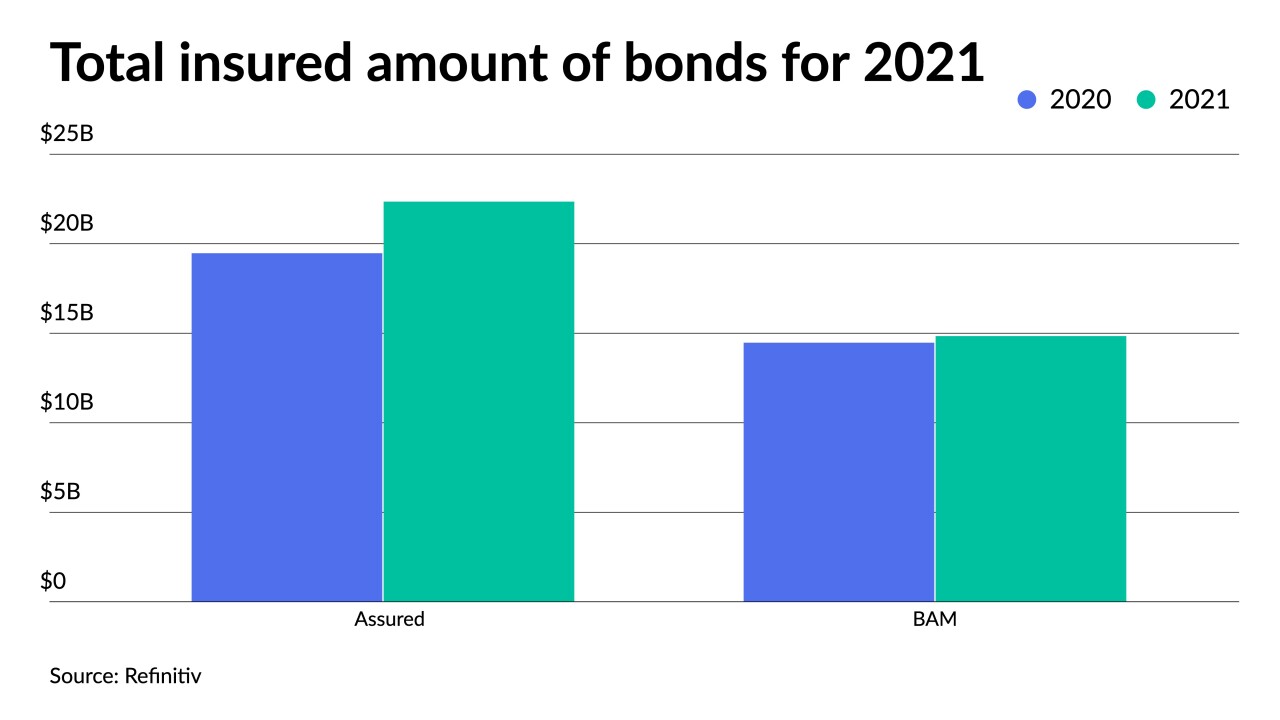

As issuance hit $480.03 billion in 2021, the insurance industry wrapped 7.8%, up slightly from 7.1% in 2020. Deals with insurance totaled $37.522 billion, more than the $34.428 billion in 2020, according to Refinitiv data.

February 22