-

Municipal bond insurance may have finished 2018 down 18.1% from where it was the year before, but it outpaced the 23.5% volume dip the overall industry saw due to changes in tax legislation.

February 25 -

Development was down 50.4%, healthcare was off by 42.7%, and electric power declined 40.1%. The slides compared with an overall decline of 23.5% in total issuance.

February 25 -

Following a late-2017 rush to market of advance refundings and private-activity bonds in the run-up to the implementation of new tax legislation, supply in 2018 -- particularly refunding issuance -- suffered a steep decline.

February 25 -

Issuers in the Northeast sold $95.5 billion of municipal bonds in 2018, off 21.3% from 2017 with an even more pronounced fourth-quarter drop.

February 22 -

A state-by-state review of first half 2018 issuance in the Far West.

August 24 -

Issuance was down 27% in the region from the first half of 2017, and almost 30% in California, its largest market.

August 23 -

A state-by-state review of first half 2018 issuance in the Southeast.

August 23 -

The region's volume numbers were supported by favorable market conditions that drove several large gas prepay deals.

August 22 -

A state-by-state review of first half 2018 issuance in the Midwest.

August 22 -

Volume was off in eight of the region's 11 states in the wake of tax reform and the end of advance refundings.

August 21 -

A state-by-state review of first half 2018 issuance in the Southwest.

August 21 -

Bond volume in the region fell sharply in the first half of 2018, though one expert saw the 16% drop as better than anticipated.

August 20 -

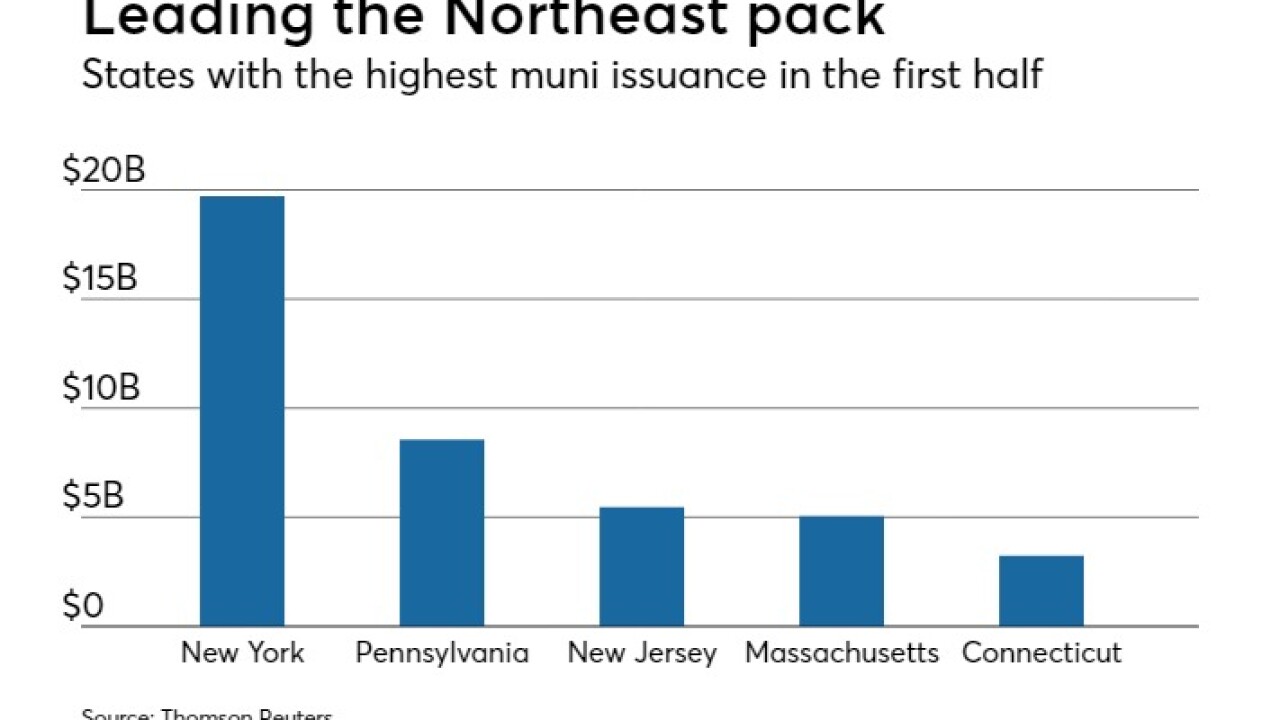

A state-by-state review of first half 2018 issuance in the Northeast.

August 20 -

2018 first-half volume drops after tax reform.

August 20 -

Municipal bond volume is running 18.1% lower than last year’s historic level, in line with analyst expectations given the enormous impact the new tax legislation has had on the market.

August 20 -

Municipalities had less need for borrowing to bridge gaps in cash flow and therefore curtailed their issuance of notes

August 20 -

Issuance in these sectors all plummeted by 50% or more in the first half of 2018 in what was generally a weak first half for overall municipal issuance.

August 20 -

The par amount of insured debt decreased in the first half of 2017 but the percentage of bonds issued that carry insurance climbed.

August 20 -

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

A state-by-state review of 2017 municipal bond issuance issuance in the Far West.

March 2