-

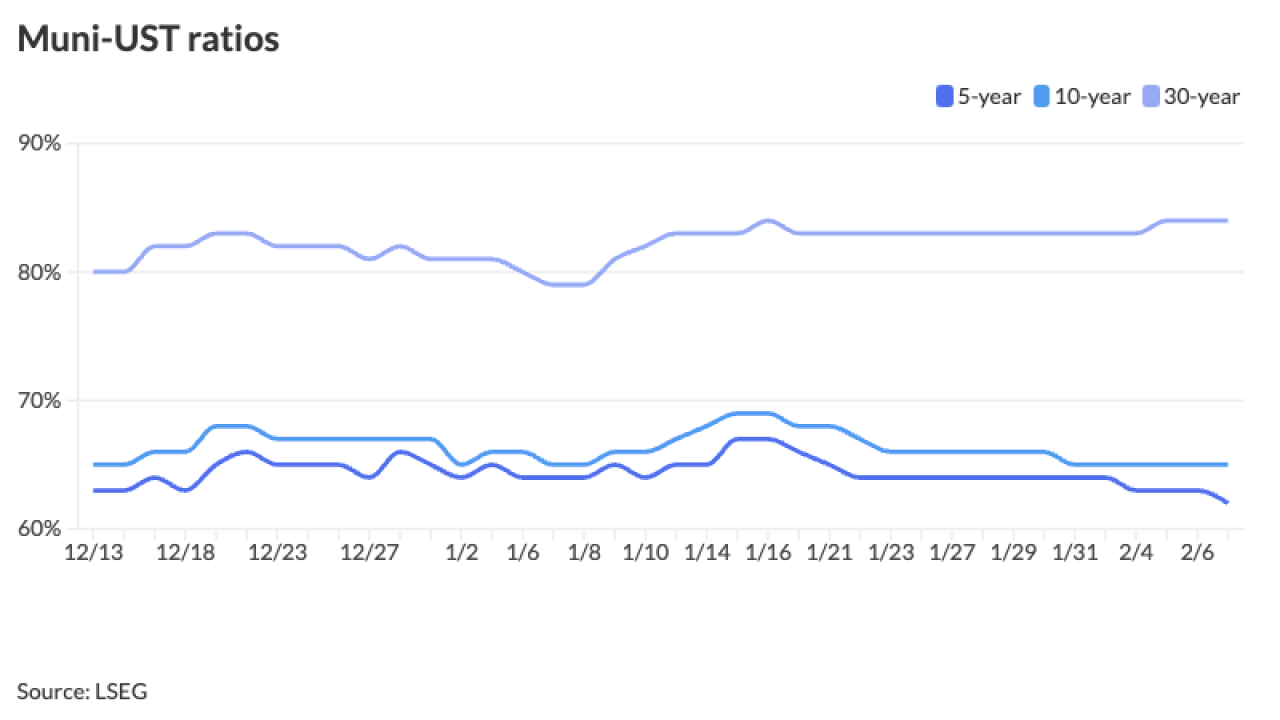

Market activity has been somewhat "subdued," and USTs yields have been "relatively well-behaved," though the 10- to 30-year rates have slightly underperformed, moving up three to five basis points, said Barclays strategist Mikhail Foux.

8h ago -

A plan to sharply cut Community Development Block Grant program staffing follows Trump's statement that he is inclined to eliminate the Federal Emergency Management Agency.

9h ago -

The Senate move provides an alternative pathway towards a final budget agreement as the House wrestles with an approach that could include key tax policy changes for the muni market.

11h ago -

The Trump administration singled out the Las Vegas-Los Angeles bullet train for praise Thursday, the same day the deal priced.

February 21 -

"Who got rich off this project? Where did those billions of dollars go?" asked Transportation Secretary Sean Duffy in announcing the federal review of the controversial bullet train.

February 21 -

Nakahata was appointed chief deputy executive director and chief operating officer of the California Infrastructure and Economic Development Bank.

February 21 -

Amid struggling office markets in San Francisco and Los Angeles, the cities are exploring office-to-residential conversions amid decades-old housing shortages.

February 21 -

Investors added $546.3 million to municipal bond mutual funds in the week ending Wednesday, following $238.5 million of inflows the prior week, according to LSEG Lipper data.

February 20 -

Washington's threats to state and local government funding took center stage when Illinois Gov. JB Pritzker delivered his seventh budget.

February 20 -

Trump's executive order raises concern about whether the SEC will pursue certain fraudsters, even if staff deems action warranted.

February 20 -

Some analysts believe that the muni market will ultimately be insulated from any changes in tax status because of the benefit it already provides.

February 20 -

The bonds are to be sold competitively in April.

February 20 -

Moody's is the latest rating agency to warn about a budget squeeze for Texas schools, which have been prolific issuers of voter-approved bonds in recent years.

February 20 -

Chicago aldermen delayed a vote on $830 million of general obligation bonds that Mayor Brandon Johnson wants to issue.

February 20 -

MSRB holistic review of its MA rules "likely to be a multi-year project," NAMA executive director says.

February 20 -

White Lake Township, Michigan, is facing legal action on two fronts: one of them related to the hack of its bond deal closing last year, the other a civil suit.

February 20 -

KBRA raised the airport's outlook to positive last week, citing its improving financial profile and very strong traffic.

February 20 -

The Investment Company Institute reported outflows of $336 million for the week ending Feb. 12, following $852 million of inflows the previous week.

February 19 -

The DOT cited the use of the tolls for transit as one of its reasons to terminate.

February 19 -

The South San Antonio Independent School District, which has had a state conservator, will now get a state-appointed board of managers and superintendent.

February 19 -

The Senate Committee on Environment and Public Works begins the process of untangling the bureaucratic red tape of permitting to speed the pace of infrastructure improvements and housing initiatives which often leverages bond proceeds.

February 19 -

Trump had promised during his campaign to terminate the electric vehicle charging station program.

February 19 -

Senior Vice President Tamika Reed will staff a new Montgomery, Alabama, office, and Vice President Narineh Panosian joins the firm in Los Angeles.

February 19 -

Women in Public Finance has announced the 2025 members of its board of directors and plans to expand its offerings as it nears its 30th anniversary.

February 19 -

In a first for the Midwest, a southern Illinois city plans to redevelop a mall using proceeds from sales tax and revenue bonds.

February 19 -

Municipals were narrowly mixed to start the holiday-shortened week, but the lighter supply should buoy the market.

February 18 -

The scandals surrounding New York City Mayor Eric Adams may lead to his removal from office, but the city's bonds are still insulated from the fallout, analysts say.

February 18 -

The state will have less money to spend in the upcoming fiscal year, according to projections certified in a process criticized by Oklahoma's attorney general.

February 18 -

State Farm's "emergency" rate increase request was rejected by California's insurance commissioner.

February 18 -

Former Women in Public Finance President, Illinois Finance Authority general counsel and Katten Muchin Rosenman partner Elizabeth Weber "was a class act all the way."

February 18 -

Most federal lease debt has large bullet maturities that require refinancing, asset sales or a new lease to avoid default.

February 18 -

Washington, D.C., Mayor Muriel Bowser declined to rule out tapping public money to renovate RFK Stadium to lure the NFL's Washington Commanders back to the city, though Council members are divided on the plan.

February 18 -

An investor-driven selloff followed the Los Angeles wildfires. ICE Data Services experts join to discuss the reaction, credit impact and growing role of climate risk data.

February 18 -

-

With eye-popping infrastructure needs, market participants discussed how this will influence issuers' plans, from demand to disclosure.

February 18 -

Texas officials are eying ways to protect a massive state-funded school property tax cut from being eroded by local bond issues and tax increases.

February 18 -

PFM, Ramirez & Co. and other advisory firms are adding to rosters of municipal finance experts as the tax exemption hangs in the balance.

February 18 -

"This week's rate volatility made muni trading challenging as Treasury rates have been moving up and down abruptly on the back of inflation releases and tariff news," said Barclays strategist Mikhail Foux.

February 14 -

They say if the board continues its current approach there will be years more of litigation with outcomes showing the board's positions are "baseless."

February 14 -

Mitchell spent 20 years at J.P. Morgan before joining InspereX.

February 14 -

With questions and analysis still swirling around a deadly crash at Ronald Reagan Washington National Airport, concerns arise about enplanement levels, traffic patterns, and credit ratings affecting the region's major airports.

February 14 -

Yields and market volatility "positively correlated with trading volume," a research report published by MSRB finds.

February 14 -

In 2017, Congress moved from budget resolution to reconciliation legislation in less than six weeks.

February 14 -

Photos from The Bond Buyer's annual National Outlook Conference.

February 14 -

Sweetwater Union High's rocket-fast transformation from an accounting practices bad apple to ratings upgrades and positive outlooks is expected to boost its bond program.

February 14 -

Investors added $238.5 million to municipal bond mutual funds in the week ending Wednesday, following $1.124 billion of inflows the prior week, according to LSEG Lipper data.

February 13 -

As Congress begins hammering out the budget resolutions that will shape the country's fiscal future, muni lobbyists double down on efforts to keep the tax-exemption in place.

February 13 -

The legislation comes as the municipal market industry fends off threats to tax-exempt municipal bonds.

February 13 -

The rating for Baylor Scott & White Health in Texas was upgraded, while Presbyterian Healthcare Services in New Mexico was downgraded by Moody's.

February 13 -

A federal court has given an outside debtor-in-possession loan "superpriority" over the bondholders' lien.

February 13 -

Portfolio managers seem more sanguine about threats to the tax exemption from Congress.

February 13 -

Ohio Gov. Mike DeWine wants to raise the sports gaming tax to pay for stadiums and he does not want the state to issue bonds to finance stadium development.

February 13 -

The rising costs of federal debt, an impending budget showdown, and Congressional turmoil is highlighting the complex relationship between Treasury securities and municipal bonds.

February 13 -

DeSantis' proposed all government activities budget is 2.5% lower than the current year's budget.

February 13 -

Inflation is front and center this week, with the consumer price index report released on Wednesday and the producer price index on Thursday.

February 12 -

The study comes as the city faces a growing structural budget deficit and shrinking reserves that led to negative bond rating outlooks.

February 12 -

The deeper the proposed cuts, the more the municipal market fears for the fate of tax-exempt bonds.

February 12 -

The tax exemption has been in place for more than 110 years, but Republicans say its removal is vital for prolonging many parts of the Tax Cuts and Jobs Act.

February 12 -

As many regions across the U.S. face housing shortages

February 12 -

As the municipal market navigates the world of technology and AI

February 12 -

After a record year of issuance -- and two years of rising inflation -- how are issuers meeting the growing needs for upgrades of existing infrastructure along with investments in new projects?

February 12 -

Attendees of The Bond Buyer National Outlook Conference 2025 will have the opportunity to vote in a live market survey,

February 12 -

-

The concentration of the retail investor has grown in a market that often struggles with liquidity.

February 12 -

The 2017 Tax Cuts and Jobs Act expire at the end of 2025, and taxes will rise automatically if Congress does not act.

February 12 -

Join our panel of industry leaders as they discuss

February 12 -

Charter schools drove the worst January ever for impairments since Municipal Market Analytics began tracking default trends, the firm said in a Feb. 5 report.

February 12 -

The executive director of the Puerto Rico Oversight Board suggested non-settling bondholders might be offered recoveries of about 4% of the principal due.

February 11 -

Blake G. Washington discussed Medicare, the MTA and more at a luncheon with the Citizens Budget Commission.

February 11 -

Municipals were cut up to four basis points, depending on the scale, while UST yields rose up to four basis points out long.

February 11 -

BlackRock's move comes as money continues to flow out of muni mutual funds into ETFs and SMAs.

February 11 -

Audit activity in the municipal market ebbs and flows with the IRS budget.

February 11 -

A bill would allow homeowners to receive the interest accrued on insurance payments for lost or damaged property, rather than lenders.

February 11 -

Governors in the drought-prone region are asking their legislatures for funding to boost future water supply or to repair aging water infrastructure.

February 11 -

Munis continue to outpace USTs as ratios on the front end continue to richen relative to USTs, Jason Wong said.

February 10 -

Lawsuits are mounting against the Trump administration's aggressive actions to cut federal spending.

February 10 -

Management is hiring a municipal advisor to evaluate its financial strategy.

February 10 -

Hilltop and other firms say more recent SEC off-channel communications settlements eliminated "costly and burdensome" requirements that were imposed on them.

February 10 -

"Our job is to take that volatility, figure out what's noise, figure out what's reality, and lean into the opportunities as we see them," said Alex Petrone, director of fixed income at Rockefeller Asset Management.

February 10 -

Huntington has hired Dan Kelly as head of municipal underwriting. The industry veteran will bolster the bank's strategy of pursuing larger transactions.

February 10 -

The Lone Star State is expected to add 225,000 jobs in 2025, down from 244,000 last year, according to the Dallas Federal Reserve's annual forecast.

February 7 -

Yields have fallen over the past few weeks, so "any decent excuse that rates move up a little bit after that big rally" may have occurred as the market digested the report — which was a "little bit of a mixed bag" — after the initial headline figure, said Jeff MacDonald, EVP and head of fixed income at Fiduciary Trust International.

February 7 -

A state board moved toward instituting salary-based employee premium health insurance payment system as a way to avoid a looming $1.3 billion deficit in the government's health plan budget.

February 7 -

Texas Sen. John Cornyn remains a supporter of private activity bonds, his staff told BDA.

February 7 -

Southern California Edison reveals more about its potential liability in two Los Angeles fires.

February 7 -

Both houses of the Virginia state government have advanced budget bills that include rebates to taxpayers from surpluses fattened by federal funding and robust tax collections, a trend that concerns policy experts.

February 7 -

Josh Shapiro suggested modest spending hikes — and even more modest revenue growth.

February 7 -

Investors added $1.124 billion to municipal bond mutual funds in the week ending Wednesday, following $741.6 million of inflows the prior week, according to LSEG Lipper data.

February 6 -

The ratings agency cited weaker than expected financial performance in fiscal 2024 and a slow anticipated recovery in coming years.

February 6 -

MSRB CEO Mark Kim said the current regulatory outlook in Washington "is uncertain."

February 6 -

Kutak Rock LLP has doubled its public finance footprint in Minnesota with the addition of four new public finance attorneys to its Minneapolis team.

February 6 -

The NYC TFA will test how the national news cycle has affected the market's appetites.

February 6 -

The directive appears to apply to discretionary grant programs and not state formula funds.

February 6 -

Detroit Public Schools Community District has taken the state Treasury Department to court over its ability to use operating tax revenue to pay down bonds.

February 6 -

A Moody's Ratings upgrade means Hawaii DOT's airport division is headed to market with across-the-board double-A ratings.

February 6 -

The Metropolitan Atlanta Rapid Transit Authority will issue $475 million in green sales tax revenue bonds for capital projects and refunding.

February 6 -

Walrath will support BAM's underwriting and credit departments in executing every credit BAM insures and advise the bond insurer on other legal matters.

February 6 -

The short-lived federal funding freeze from President Donald Trump and jeopardy of tax-exempt status are just the latest issues plaguing the muni bond industry.

February 6 -

Muni yields were bumped one to eight basis points, depending on the scale, while UST yields fell three to 10 basis points, with the greatest gains out long.

February 5 -

A recent Texas Supreme Court decision will force the city to increase the amount of property tax revenue allocated to a dedicated drainage and street fund.

February 5 -

Connecticut's governor proposed a new public finance tool as part of a broad plan to improve the state's resiliency against extreme weather and climate change.

February 5 -

Transportation officials and lawmakers are exploring the road ahead for the Highway Trust Fund, electric vehicle user fees, and the reauthorization of the surface transportation bill as friction over funding mounts.

February 5 -

As Chicago Public Schools tries to get its fiscal house in order, it faces management turmoil, risks to federal funding and threatened immigration raids.

February 5 -

The top five bond financings totaled more than $6 billion.

February 5 -

Tax exemption concerns — though an elimination is unlikely — and the loss of federal stimulus will "most assuredly pull forward delayed issuance, with the first half of 2025 volume to exceed second half volume," said James Welch, a municipal portfolio manager at Principal Asset Management.

February 4 -

The muni industry is trying to get to the bottom of questions around how the House arrived at savings estimates for eliminating the tax exemption.

February 4 -

San Francisco's commercial real estate struggles, Oakland's looming bankruptcy concerns, and the broader economic headwinds facing the Bay Area take center stage in this episode. Chris Thornberg of Beacon Economics and public policy analyst Marc Joffe join senior reporter Keeley Webster to discuss the impact of hybrid work trends, housing shortages, tax policies, and what it will take for these cities to stabilize their financial futures.

February 4 -

S&P Global Ratings revised the outlook on Southern California Edison and its parent company citing the potential depletion of the state's bond wildfire fund.

February 4 -

The Treasury department aims to stand it up within the next 12 months.

February 4 -

From two Colorado lines to more Amtrak service, Southwest states are advancing passenger rail projects, but the Trump administration may slow that roll.

February 4 -

To close out the day, USTs remained mixed, with yields rising on the short end and falling out long, while munis were changed up to a basis point, depending on the curve.

February 3 -

The San Joaquin Hills Transportation Corridor Agency tapped reserves to make early bond payments saving $203 million. It's parent agency, the Transportation Corridor Agencies, hopes to save $1.79 billion with additional early pay downs by 2030.

February 3 -

Issuers, trade organizations, and investors team up to fight the threat to the tax-exempt status of municipal bonds by laying out its effect on borrowing, the housing market, and infrastructure costs.

February 3 -

Gov. Kathy Hochul's $252 billion state budget proposal calls for lower-bracket income tax cuts and one-time cash payouts for everyone.

February 3 -

Analysts Chris Collins and Melissa Nicandri were among the 64 passengers and crew aboard American Airlines flight 5342.

January 31 -

January's municipal bond supply "will end up being heavier compared with the normally slow start of the year, but the pipeline should remain quite robust," Barclays said.

January 31 -

January's volume was $35.243 billion in 486 issues, up 10.8% from $31.817 billion in 554 issues in 2024, according to LSEG data.

January 31 -

The zero-interest loan fund was announced following a Thursday meeting of CHFFA, the conduit chaired by Ma that will administer the program.

January 31 -

The offering document for a White Lake Township bond sale sheds more light on the hack criminals used to intercept funds between the underwriter and borrower.

January 31 -

MSRB believes "it's an appropriate time" to launch a holistic review of its municipal advisor rules, CEO Mark Kim said.

January 31 -

The legislation would permit a state government conduit issuer to sell bonds to bolster the last-resort FAIR Plan in the wake of Los Angeles-area wildfires.

January 31 -

The school wants to be able to offer bonds supported by its general fund and not just bonds its revenue streams.

January 30 -

Investors added $741.7 million to municipal bond mutual funds in the week ending Wednesday, following $2.078 billion of inflows the prior week, according to LSEG Lipper data.

January 30 -

Dealer groups are urging the Municipal Securities Rulemaking Board to change the way it charges fees to municipal advisors.

January 30 -

A group of Democratic states Thursday filed a fresh motion for an injunction, arguing the administration may continue to freeze federal funds despite the recission.

January 30 -

The legislation would change which state official enforces 2022's Energy Discrimination Elimination Act and remove bond and note sales from a contract ban.

January 30 -

State and local governments are on strong financial footing and are investing in Treasury securities as chaotic federal moves shake out.

January 30 -

Municipal market advocates plan to use the data to support the case to Congress for preserving the tax exemption.

January 30 -

The Dallas-based firm, which was acquired last year by Texas Regional Bank, is expanding its underwriting reach in Texas and other states aided by new hires.

January 30 -

The recovery of local governments and utilities from hurricanes Helene and Milton continues but the outlook for next season and beyond is troubling.

January 30 -

Even with the possibility of inflation and fiscal policy-induced headwinds, there is much to be optimistic about in the muni market, despite some possible near-term turbulence, said GW&K strategists.

January 29 -

U.S. District Court Judge Laura Taylor Swain extended the bankruptcy's litigation stay to March 24 as mediators expressed hope about progress on a deal.

January 29 -

Legislation to create an education savings account program that would cost an initial $1 billion and serve nearly 100,000 students advanced out of a committee.

January 29 -

Two public electric utilities in Los Angeles County received negative outlooks from S&P citing costs, liabilities, and litigation stemming from wildfires.

January 29 -

MSRB Chair Warren "Bo" Daniels stressed the importance of issuer feedback as beta testing for the modernized EMMA website continues.

January 29 -

The ruling came as the White House issued follow-up guidance saying only affect a portion of federal funds would be affected and that the pause could be as brief as a day.

January 29 -

McGrorry and Palacios have been at Ramirez for over a decade, but their working relationship predates their time at the firm.

January 29 -

Bond proposals are included in recent budget proposals from the Minnesota and North Dakota governors, as the region's 2026 spending plans begin to take shape.

January 29 -

The Fed meets this week, but the probability of another cut at Wednesday's meeting seems low amid elevated inflation and growth data, said Matt Fabian, a partner at Municipal Market Analytics.

January 28 -

A group of Democratic states as well as a national association representing not-for-profit organizations said they would sue to block the move.

January 28 -

The former U.S. Representative has said he would focus on road safety and cutting red tape.

January 28 -

The lobby trying to protect the tax exemption is working overtime as the threat appears very real.

January 28 -

The top 10 saw some movements in 2024, with Greenberg Traurig and Chapman and Culter entering the top 10, while Gilmore & Bell and Bracewell were bumped to the top 15.

January 28 -

The high court agreed to review a June Oklahoma Supreme Court ruling that found state funding for a Catholic virtual charter school violates the constitution.

January 28 -

The new roles for the longtime employees are part of the firm's strategy to prioritize internal promotions.

January 28 -

The turnpike authority brings a $1.3 billion new and refunding bond deal to market this week after a toll hike sparked a spate of bills to rein in its powers.

January 28 -

The Local Government Commission needs to approve the proposed competitive sale.

January 28 -

The SEC's muni office chief stopped short of saying there might be enforcement imminent.

January 28 -

"There are a lot of moving parts here with the potential to either help or hinder the Fed's quest for price stability and maximum employment" this year, noted BMO Deputy Chief Economist Michael Gregory, who says the Fed will "stand pat."

January 28 -

Tech stocks suffered on "worries that Beijing is becoming increasingly competitive in the high-stakes artificial intelligence race," said José Torres, senior economist at Interactive Brokers.

January 27 -

The president suggested federal aid could be sent directly to states instead of through FEMA.

January 27 -

Gloria's pointed comments about the county's responsibility caused a stir in the days since he delivered the speech, which sets the table for budget talks in coming months.

January 27 -

Sycamore Advisors adds two quantitative experts, PFM boosts its workforce consulting team and more talent shifts in December.

January 27 -

As state and local governments are charged with funding 3/4ths of the country's infrastructure, the catastrophic wildfires in Los Angeles highlight even more the municipal bond market's vital role in keeping the U.S. competitive globally and maintaining the heart of fiscal federalism at home.

January 27 Bond Dealers of America

Bond Dealers of America -

The Massachusetts Clean Water Trust has seen higher demand from local utilities for loans because of climate change threats and clean water regulations.

January 27 -

Kroll Bond Rating Agency downgraded Chicago's general obligation bonds to A-minus from A, citing high fixed costs and one-time fixes. The outlook is negative.

January 27 -

Issuance for next week falls to an estimated $5.151 billion, with $3.959 billion of negotiated deals and $1.193 billion of competitive deals on tap.

January 24 -

The muni veteran's friends remember him as a "connector," with a boundless ability to form relationships.

January 24 -

Gov. Joe Lombardo replaced his budget chief as the legislature's Democratic leaders criticized the Republican for submitting an out-of-balance budget.

January 24 -

Ongoing work to potentially simplify the new issue disclosure submission process and discussion of dealer supervisory obligations will be among topics on deck at the Municipal Securities Rulemaking Board's upcoming quarterly board meeting.

January 24 -

Bondholders say the Puerto Rico Energy Bureau is legally required to set rates to cover all bond principal and pre- and post-petition interest due. The board disagrees.

January 24 -

As Republicans hash out their promised tax package, the debate over the bill's scoring method carries implications for tax-exempt municipal bonds.

January 24 -

The municipal bond market's initial negative reaction to this month's Southern California wildfires has eased, with secondary spreads starting to tighten.

January 24 -

The agency's figures represent the most actions filed in their respective periods since at least 2000.

January 24 -

Investors added $2.028 billion to municipal bond mutual funds in the week ending Wednesday, following $251.7 million of outflows the prior week, according to LSEG Lipper data.

January 23 -

Chicago plans to sell roughly $830 million of general obligation bonds to finance its 2024-28 capital improvement plan, according to the city's finance team.

January 23 -

The introduction of new engines in a northern power plant and the opening of a solar farm in the south have reduced the authority's operating costs.

January 23 -

The Maryland Department of Transportation moves to shore up its debt service while funding bridge repairs, airport modernization, and rail improvements with a $21.2 billion budget commitment.

January 23 -

The bill, which would enact on the federal level similar pro-gun legislation adopted by many Republican states, has gained 21 co-sponsors, including Senate Finance Chair Mike Crapo, R-Idaho.

January 23 -

Some observers say Jenniffer González Colón, who took office in January, may be more open to compromise with Puerto Rico Electric Power Authority bondholders.

January 23