-

The S&P issuer rating upgrade marks the second for Oklahoma since September when Moody's raised its rating a notch to Aa1.

March 26 -

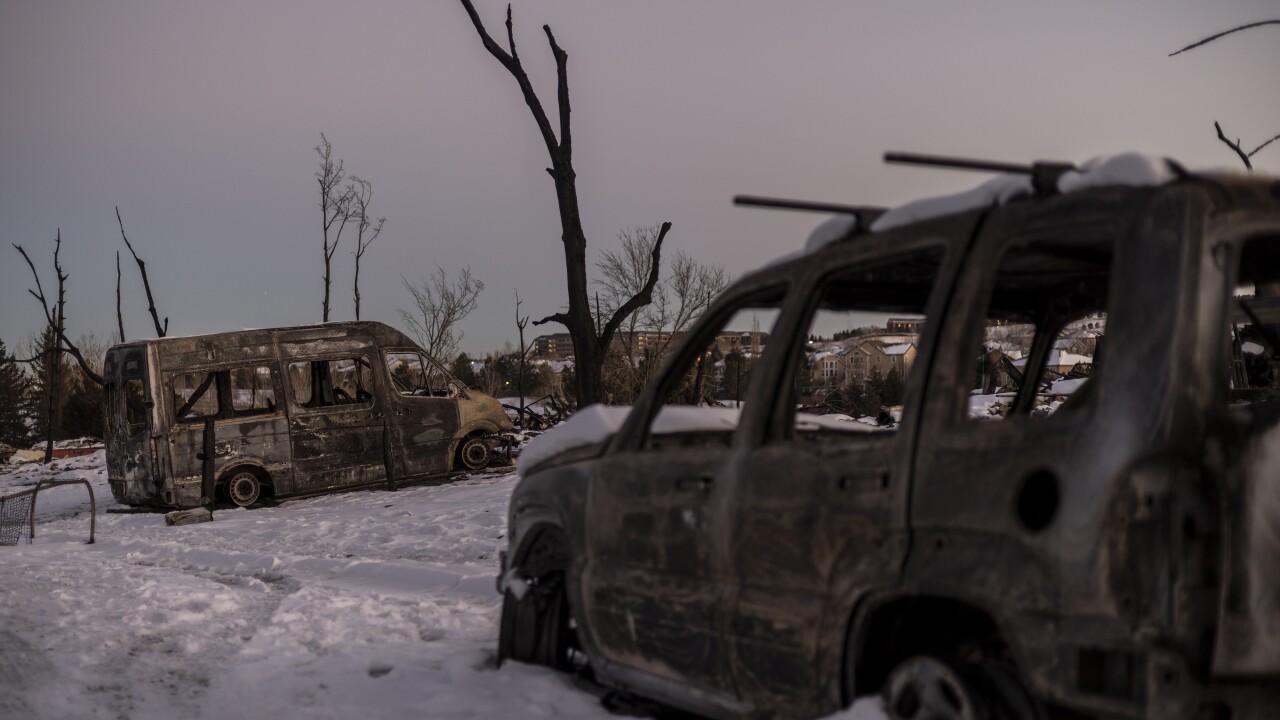

The legislation would create a bond-financed reinsurance program to stabilize the homeowner's insurance market, which has been impacted by wildfires.

March 26 -

Goldman Sachs was tapped to lead a sales tax revenue bond issue to finance an arena to replace Paycom Center, home of the NBA's Thunder.

March 25 -

Houston, Phoenix, and Dallas are taking action to address fiscal challenges brought on by litigation, state actions and a ballot measure.

March 25 -

An Oklahoma agency is borrowing $1.15 billion through an unrated tax-exempt Public Finance Authority bond deal to build and equip a tire factory backed by Finnish interests.

March 24 -

The rating agency cited a tax cut package enacted by the state last year and uncertainty over federal policies for the outlook revision to stable from positive.

March 21 -

The city council approved the private placement of up to $325 million of notes to commence funding for a $1 billion convention center expansion project.

March 19 -

Bond-issuing infrastructure districts and development zones were a focus of legislation passed by Utah lawmakers during a session that ended March 7.

March 18 -

The nonprofit Wood River Community Housing Trust uses municipal bonds as part of its toolkit to finance workforce housing in the pricey Sun Valley, Idaho, area.

March 14 -

If the seven states dependent on the Colorado River don't craft a new operating agreement, the federal government could end up doing it for them.

March 12