Puerto Rico’s per capita debt load is far lower than that of the mainland U.S. states.

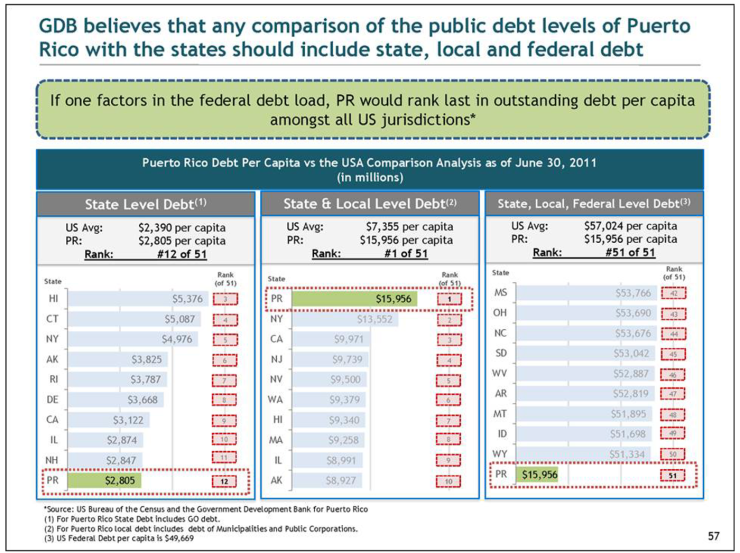

Recent discussions of Puerto Rico’s debt levels by both Puerto Rico officials and the Financial Oversight & Management Board for Puerto Rico represent that the island’s per capita debt levels are far higher than the average per capita levels of mainland states in the U.S. However, that analysis compares only state-level debt and ignores both the local government debt and federal debt that is also supported by mainland taxpayers.

The Facts:

- Residents of Puerto Rico are not required to pay federal income taxes.

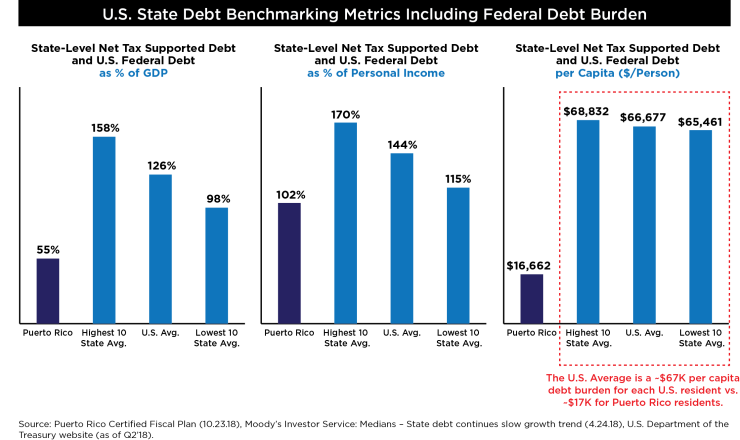

- When you include the state and federal debt that is borne by mainland U.S. residents, Puerto Rico’s per capita debt load is 75% lower than the average for even the 10 states with the lowest per capita debt burdens in the country (see chart).

The Commonwealth has acknowledged this key difference between itself and the mainland states’ tax burden in the past. For example, in an

On top of that, the island would likely have much higher tax revenues if it improved its ability to effectuate tax collections, as currently it is ranked by the World Bank as

As the island with the highest Gross Domestic Product (GDP) in the Caribbean and with a beneficial status as part of the United States, Puerto Rico should be moving to resolve its overall debt situation in 2019. Making sure real figures and straight talk are part of the solution for Puerto Rico is an important aspect of reaching that goal. Trust and transparency will be an essential part of the Commonwealth’s reentry into the capital markets to attract investment and develop a modern and resilient infrastructure and economy.

This commentary was produced as part of