On May 14, 2018, the Mark-Up Disclosure rule became the law of the land. For the first time brokers became required to put the amount of money they made on fixed income retail trades onto their trade confirmations. According to the Financial Industry Regulatory Authority's 2016 filing for proposing this rule change, “The proposed disclosure is expected to provide retail investors with valuable pricing information, encourage investor participation in the fixed income markets, and foster price competition among dealers, which may lower transaction costs for retail transactions in fixed income securities.”

BondWave has been measuring daily transaction costs on a post-trade basis since April 2016. Using a unique approach, BondWave has developed an algorithm that measures markups and markdowns (following industry convention we will refer to both as markups except where graphing them separately) on corporate, municipal and agency bonds. Using this algorithm, we decided to take a look at the trend in retail markups to determine if there has been a noticeable impact since the implementation of the disclosure rule.

WHAT DOES THE RULE REQUIRE?

Again quoting from FINRA’s 2016 proposal, “The proposed rule applies where the member buys (or sells) a security on a principal basis from (or to) a non-institutional customer and engages in one or more offsetting principal trades on the same trading day in the same security, where the size of the member’s offsetting principal trade(s), in the aggregate, equals or exceeds the size of the customer trade.” This represents the minimum disclosure required by the rule. Brokers also have the option to disclose markups and markdowns on more trades than the minimum. And some brokers are doing just that.

The information disclosed on the retail customer confirmation includes the markup in percentage terms and total dollars per trade. Brokers are also required to include a link to the relevant trade history for the bond, a timestamp for the retail client trade and an explanation of what the numbers mean.

THE DATA

Using FINRA’s BTDS (TRACE) and the MSRB’s RTRS (EMMA) databases, BondWave analyzed all trades in US corporate bonds and tax-exempt municipal bonds from Jan. 1, 2017 through Oct. 9, 2018 using a riskless principal algorithm. The goal of the algorithm is to identify trade pairs that are highly likely to be the two sides of a riskless principal trade. Dealer-to-dealer trades are matched with dealer-to-customer trades based on time, price and size. The difference between the prices of the two legs constitutes the markup for the trade pair. The data was then filtered to include only trades of 100 bonds or fewer to approximate retail trades. Table 1 shows the number of such trade combinations identified by year and product type.

THE ANALYSIS

Graph 1 is a time series of rolling monthly (21 trading days) average markups for US corporate bonds. All observations are equal weighted.

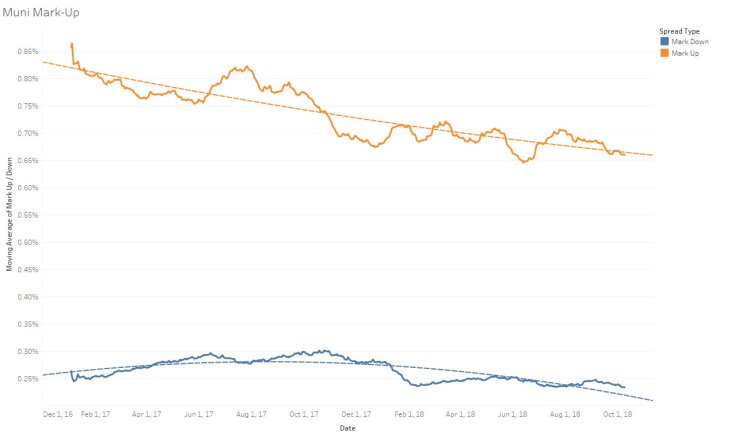

Graph 2 is a time series of rolling monthly (21 trading days) average markups for tax-exempt municipal bonds. All observations are equal weighted

For U.S. corporate markups and markdowns and for tax-exempt municipal bonds it is tempting to draw the conclusion that there has been a general decline in what brokers charge to retail investors to trade a bond. However, as we have seen in our research and has been demonstrated in research performed by regulators, there is a strong correlation between factors like trade size, yield, and duration and transaction costs. While we have already controlled for trade size in the data filter we have not yet controlled for yield or duration. Without controlling for these two variables it is possible that the apparent decline in markups or markdowns is actually due to a decrease in the duration or yield of bonds traded over time.

Using ratings as a proxy for yield and duration, we can normalize the data to minimize biases. Graph 3 contains US corporate bonds bucketed by duration. It is also filtered to include only bonds rated A or BBB. A and BBB rated U.S. corporate bonds constitute 70.3% of corporate bond trades in our sample.

Graph 4 contains tax-exempt municipal bonds bucketed by duration. It is also filtered to include only bonds rated AA and A. AA and A rated tax-exempt municipal bonds constitute 77.1% of municipal bond trades in our sample.

CONCLUSION

We need to be careful with the conclusions we draw given the relatively short amount of time that has passed since May 14. However, early returns on the impact of the new markup disclosure rule are mixed. There appears to be no impact so far when retail customers sell bonds. Markdowns are very stable over the entire time period. It is logical that this would be the case. In the low rate environment we have been in for the past decade, there has already been downward pressure on markdowns. With little yield left on a bond an excessively large markdown runs the risk of creating a negative yield on a trade. All parties prefer not to do trades that result in negative yields.

The data is less certain when customers buy bonds. There have been some ups and downs in markups, but they reside in a relatively tight range and do not perfectly correlate with implementation of the rule. However, the general relationship that markups are roughly twice the size of markdowns holds in three of the four categories examined. Only in municipal bonds with durations between five and ten years do we see a significant difference in which markups are several times the size of markdowns.