The municipal market fell as much as 10 to 12 basis points at one point on Monday amid the COVID-19 crisis and its ricocheting effects on the global economy.

But the municipal market is lagging the rest of the world because munis as an asset class are fundamentally more difficult to monitor and evaluate.

Given the fragmented state of the municipal market with more than 50,000 issuers, many different structures, low liquidity, archaic benchmarks, delayed and non-standard financial filings, the market is having to deal with this crisis moment by moment.

As participants unpack what is unfolding globally, there is room for caution and also opportunity, sources said.

“The baby is being thrown out with the bath water as all non-Treasury securities are being painted with the same viral paintbrush,” Peter Delahunt, managing director at Raymond James & Associates, said Monday.

He said while there is logical concern for negative impacts on tourism-related credits, oil-related credits and credits strained by pension liabilities, not all are negative.

“There are opportunities for sound essential services, which have fallen prey to the collateral damage due to the loss of liquidity from our markets.”

Others said investors and dealers are vulnerable and new issues are being impacted.

“It’s important for investors to compartmentalize this and realize that muni yields are down, but are now fairly disconnected from Treasury yields,” John Mousseau, president of Cumberland Advisors, said Monday.

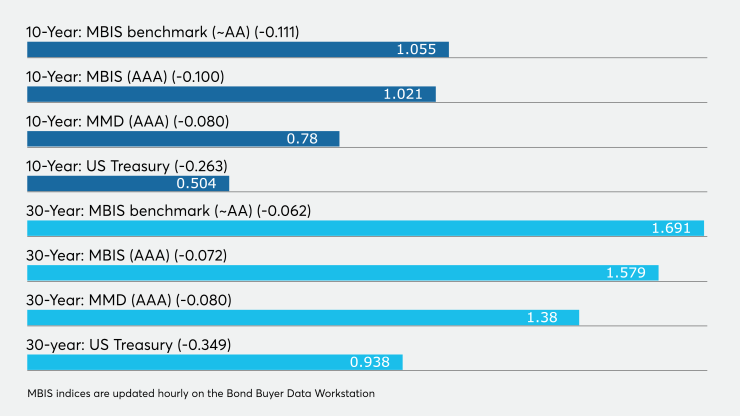

The 10-year muni to Treasury ratio on Monday was calculated at 153.8% while the 30-year muni to Treasury ratio stood at 147.3%, according to MMD.

Investors, Mousseau said, should expect anything but liquidity in this market.

“Dealers can’t hedge and the cost of carrying bonds is hurting,” he said, adding that underwriters are bringing new issues “gingerly” in what he described as an unprecedented market.

As the COVID-19 virus continues its spread — to nursing homes in Seattle to cruise ships to the head of the New York and New Jersey Port Authority to world leaders — all market participants are on edge and attempting to digest its effects.

“Our market does not react quickly. Investors may be unwilling to trade for fear of the prices they might discover, because liquidity is uncertain, and with such dynamism in the taxable market, it makes sense for most participants to wait a day and see where things settle,” Matt Fabian, partner at Municipal Market Analytics, said. “Trading will subside today. It's hard enough to write and talk about the market, let alone trade it.”

This market is hard to evaluate on a normal day. Throw in a worldwide pandemic and few are pricing munis at real levels.

“Good luck being a muni trader today,” a trader said. “End-of-day muni benchmarks don’t work as well in these fast-moving markets. Smart investors might look to Starbucks.”

Although the bumps Monday were not the biggest ever in one single day, the important takeaway of this data is that most of the biggest movements occurred during the 1980s. Interest rates were much higher during this era so a 25 basis point move was less significant than it would be today, according to Daniel Berger, senior market strategist, TM3/MMD.

Others agreed.

“At midday, it looks like total trading is running a little behind the pace of the last couple of days, which should serve as a reminder that the trades that are taking place will be repricing the entire market, so even for those participants who are staying on the sidelines today it will be important to watch the MSRB tape and also to watch the action in ETFs,” said Patrick Luby, senior municipal strategist at CreditSights.

“As of midday, trading in the bellwether fixed income ETFs (municipal and corporate bond funds) is running at a pretty good pace — MUB and VTEB both appear to be headed toward more volume than on Friday, demonstrating once again that the liquidity in fixed-income ETFs is different than the liquidity in the cash market for bonds. When today’s prices are reflected into tonight’s mutual fund NAVs we may see a pick-up in retail investors wanting to reduce exposure to high-yield and possibly even some profit taking in investment grade funds — If that happens with enough volume that portfolio managers will have to sell bonds, I think the bid side of the market will get tested.”

He said there could be both risks and rewards in the market moves now.

“This extreme move can be a source of opportunity as well as risk; but looking beyond today, I’m concerned about the potential unwind of all this,” Luby said.

Some said the municipal market is seeing unprecedented impacts on lower credit quality, yields, liquidity — and overall market activity.

“The [corona] virus is slowing economic activity worldwide and the bond market — by virtue of falling yields — is reflecting that,” Michael Pietronico, chief executive officer at Miller Tabak Asset Management, said Monday.

“Credit sector concerns are seeping into the municipal market — especially for bonds backed by airlines,” he said, referring to collapse in demand for air travel amid worldwide coronavirus precautions. “We would expect to see triple-A and double A-rated bonds begin to see more demand as global recession fears emerge,” Pietronico explained.

One West Coast strategist said that the bigger threat to high-yield particularly hasn’t yet been realized.

“It’s almost impossible to watch credit spreads blow out in other markets and not get to us at some point. Maybe it'll just pass by us but then someone says ‘I want to sell’ and then someone else says, ‘I want to sell.’ The reality is if you need to move something, you're going to have to pay. The damage hasn't been done yet. Retail hasn't yet figured it out.”

Benchmark services also had some perspectives.

“Munis are following the same pattern as Friday: Investment-grade bonds rallying, high-yield going the other direction. The ICE Muni Yield Curve is nine to 13 basis points lower, pushing further and further into uncharted territory,” ICE Data Services said in a market comment. “Yields are below 1% now out to 15 years. Even with the big move, the muni percent of Treasury yield continues increase dramatically, especially in the long end. Taxable yields are lower as well. High-yield bond spreads are moving wider; yields are five to 10 basis points higher, but even more in some sectors.”

“Such crazy times! Muni/Treasury ratios remain incredibly attractive on a historical basis, even with MMD yields at all-time lows, yet as one participant remarked: ‘Who wants to buy right here? The risk far outweighs any potentially reward!’" said Greg Saulnier, managing analyst at Refinitiv MMD.

“A wide variety of opinions also seems to be permeating the market leading to some volatile trading. Somebody will catch an order and buy bonds up 10 basis points, yet someone else will get tapped with a high-yield or corporate redemption list and have to sell at relaxed levels in order to generate cash,” Saulnier said.

In the first full week of March the market endured a major shift lower in yield, and much of the same appears in play for the coming week as volatility will remain high, according to Kim Olsan, senior vice president of municipal bond trading at FHN Financial and that is already playing out on Monday.

“While it was never possible for munis to mirror the massive moves in longer-dated USTs, generic curves were bumped in yield by as much as a 10 basis points,” she said. “MSRB data showed longer maturities responded more positively while the 3-7 year area lagged on a 15% volume decline.”

She added that Issuance is not abating and with yields pressing to new lows, issuers are finding generally favorable conditions.

“A $2 billion California GO deal will offer in-state inquiry ample opportunity,” Olsan said. “In fact, given the scope of the issue, non-California buyers may find spreads are interesting enough to be involved. The big question is whether real yields will deter more active participation.”

She said that with just three full weeks until the end of the quarter, those decisions will become more pressing. As an offset, ratios have blown out to extreme highs — with 10s now trading above 150% to USTs and in a position to become even cheaper.

Irrespective of low yields, the curve slope bears some comparison to 2016 when the market last faced a similar yield range in short-dated maturities, she noted.

“Yields inside five years were below 1% as Fed Funds sat at 0.25%-0.50%,” Olsan said. “The one major difference then was a rather steep slope of 229 basis points, which discouraged extreme reaches out the curve.”

March 2016 saw a 1-10 year slope of 122 basis points. Fast forward to the current period and the curve has flattened to 91 basis points, with a 1-10 year spread of just 32 basis points, she said.

“The relevancy of such flat conditions is that for municipal buyers it will force further curve extensions or lower credit considerations,” Olsan said. “For short duration needs, the 5-8 year area offers some value, as does the 15-20 year range where nearly 40 basis points can be found from 10-year yields.”

Eric Kazatsky, municipal strategist at Bloomberg Intelligence noted that it will be interesting to see how the market will choose to issue going forward.

“We draw somewhat of a conclusion by looking at what the reaction has been to lower UST rates, pre and post-tax reform for munis,” he said. “When 10-year UST hit the lows in 2016, taxable issuance really wasn't impacted.”

But when you add in two cups of fund flows, a stick of low rates and a quart of no advanced refundings and you get a delicious recipe for taxable muni sales, he added.

“The current scenario is decidedly not feeling like business as usual. Some proactive statements and policies from the leadership would be welcome,” said John Hallacy, contributing editor to The Bond Buyer said. “These signals if they materialize may even help to instill some modicum of confidence. We know the economy is solid now, but, can that status last if business activity falters? Monetary policy cannot assist alone. The fiscal policy side needs to ramp up. In the meantime, muni investors should enjoy the price gains. It may be some time before rates ramp up and income improves.”

Credit analysts also noted that Monday will be “a day that will be remembered for a while.”

“You have to keep in mind though that the stock market is different than the economy,” Dan White, director of government consulting and fiscal policy research at Moody’s Analytics, said adding that the economy was in pretty good shape — looking at the latest data — even though it will take a considerable hit over the next couple of months.

He said investors are in a good place with municipal bonds.

“It’s as good as it gets in the muni market,” White said. “Investors are in a safe asset class that has little chance of default. And this will continue to drive demand to taxable munis. Owning munis is a good place for investors to be right now.”

He did see one market negative — for issuers.

“Government policymakers are right now worried about the effects on their tax receipts,” he said.

But he added that a recent study by Moody’s Analytics showed that state and local governments are well placed to withstand an economic downturn.

“They have never been in a better position to weather a recession,” he said.

There is room for caution, though. The fiscal impact of the coronavirus outbreak combined with the collapse of oil and natural gas prices are likely to bring an end to three straight years of improvement in state budgets, according to William Glasgall, director of state and local initiatives at the Volcker Alliance in New York.

States with healthy rainy day funds are likely to face less stress than those with meager or no savings at all, he said.

States and municipalities are already totaling up potential losses in sales and occupancy taxes as tourism and business travel slows to a trickle. Interruption of supply chains linking the U.S. and China, the center of the viral epidemic, may also cut into online sales tax revenue. Meanwhile, crude oil plunging to $34, half its level at the start of 2020, will squeeze budgets in petroleum-producing states. Alaska, for one, built its

Christine Albano, Chip Barnett and Aaron Weitzman contributed to this report.