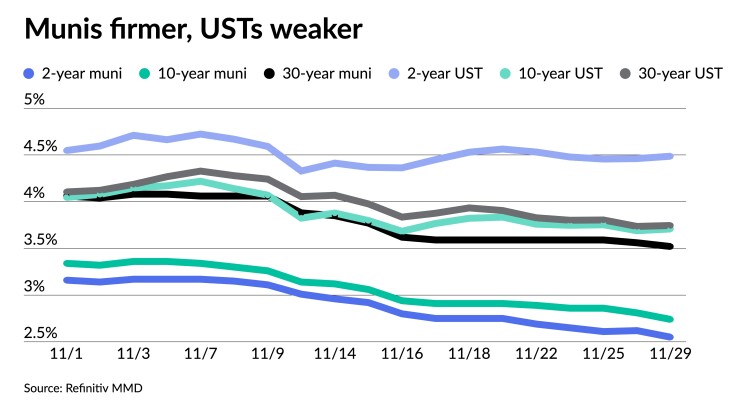

Municipals were firmer Tuesday in a constructive secondary market while two large new-issues from the New Jersey Transportation Trust Fund Authority and the Commonwealth of Massachusetts led the primary. U.S. Treasuries were weaker, and equities ended down.

Triple-A benchmark yields fell up to seven basis points on the short end, depending on the scale, while UST yields rose four on the short to eight on the long-end.

Short muni-UST ratios fell on the day's moves. The three-year muni-UST ratio Tuesday was at 61%, the five-year at 68%, the 10-year at 70% and the 30-year at 92%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the three at 61%, the five at 67%, the 10 at 76% and the 30 at 95% at a 4 p.m. read.

Tax-exempt munis have now regained late September levels, and November's rally has eclipsed October's selloff, noted Matt Fabian, a partner at Municipal Market Analytics

Despite continuing net outflows, he said that "mutual fund NAVS are trending positively and have now regained 21%-24% of year-to-date losses."

"At some point — and seasonal expectations would argue for December, assuming the Fed actually slows its hiking cycle — this is likely to translate into sustained mutual fund inflows," Fabian said. "Which would be very likely to propel tax-exempts to lower yields and, albeit at a lag, tighter spreads, almost regardless of USTs."

Current and expected tax-exempt scarcity remains a key factor in this expectation, he said. Through Oct. 31, tax-exempt issuance was $13.6 billion (4.2%) behind 2021 and $25 billion (7.5%) behind 2020.

Through Friday, year-to-date tax-exempt issuance was $33.3 billion (9.4%) behind 2021, and he said "the forward calendar is not encouraging into year-end."

Muni-UST ratios are, therefore "running near the lower end of recent ranges and, last week notwithstanding, are likely to show tax-exempts as relatively rich for an extended period," he said.

Worse off is the short-term market, "where the SIFMA 7-day index is 190 bps below SOFR and represents just 50% of that reference rate," he said.

"This is very likely about supply, with few VRDOs and stubsecurities being available for sale to the 2a7 funds, with mutual funds disinclined to finance new purchases via synthetic floaters, and with two straight quarters of massive growth in direct lending that, among other things, depletes public floating-rate supply," Fabian noted.

In the primary market Tuesday, BofA Securities priced for the New Jersey Transportation Trust Fund Authority (A3/BBB+/A-/A-/) $750 million of transportation program bonds, 2022 Series CC, with 5s of 6/2032 at 3.55%, 5s of 2037 at 4.24%, 5s of 2042 at 4.55%, 5s of 2048 at 4.72% and 5.5s of 2050 at 4.59%, callable 12/15/2032.

In the competitive market, Massachusetts (Aa1/AA/AA+/) sold $500 million of general obligation bonds consolidated loan of 2022, Series E, to BofA Securities, with 5s of 11/2042 at 3.59%, 5s of 2047 at 3.84% and 5s of 2052 at 3.91%, callable 11/1/2032.

The commonwealth also sold $200 million of GOs to Morgan Stanley & Co. LLC. Bonds in 11/2028 with a 5% coupon yield 2.65%, 5s of 2032 at 2.72% and 5s of 2033 at 2.77%, noncall.

Citigroup Global Markets Inc. priced for retail investors $888 million of general obligation bonds for Connecticut (Aa3/AA-//). Bonds in 11/2023 with a 5% coupon yield 2.63%, 5s of 2027 at 2.89%, 5s of 2032 at 3.01%, 5s of 2037 at 3.65% and 5s of 2042 at 3.83%, callable 11/1/2032.

Bright spots emerging

"The Fed's aggressive tightening campaign, coupled with record industry-wide retail outflows, has resulted in the worst downturn in 40 years," said Megan Poplowski, director of municipal research at MFS.

Calendar year returns for 2022, she said, may go down as "the worst annual return on record." Since 1980, she noted, there have only been five other calendar years with negative returns.

She expects the Fed to remain committed to hiking rates to bring down persistently elevated inflation.

"Hawkish policy, coupled with the market's efforts to divine the Fed's path, will likely keep rate volatility elevated in the near term," she said. "Given this rate environment, we believe outflow pressure and choppy performance is likely to persist for the asset class in the near term."

However, there are some bright spots.

"Investment-grade municipal bonds have never experienced back-to-back negative calendar years, and historically municipal bonds have delivered attractive returns after periods of outflows," Poplowski said.

Yields on investment-grade munis have reached their highest level in over a decade.

"Income has been the largest component of fixed income total return, and historically higher starting yields have been strongly correlated with higher subsequent five-year total returns," she said.

"Additionally, given higher yields from higher-quality assets, such as investment-grade municipal bonds, investors may not have to 'reach for yield,' or take on more credit risk to achieve their desired income needs, as they have in the past," she added.

Moreover, municipal issuers are generally in strong fundamental positions.

"Healthy tax collections and high property valuations should buffer state and local governments against economic softening," she said.

Tax receipts are up, while state rainy-day funds have reached all-time highs.

"Also, although property values have historically declined during periods of economic softness, assessments typically lag the peak of the downturn, thus providing a degree of tax revenue stability to localities," Poplowski said. "The normalization of economic activity supports revenue-backed sectors including airports, toll roads and higher education, while the health care sector should benefit from efforts to contain inflation."

She believes "upgrades will likely continue to outpace downgrades, and default rates should remain low."

And while the "economic outlook is uncertain, investment-grade municipal bonds have been relatively resilient during recessionary periods," she said.

AAA scales

Refinitiv MMD's scale was bumped four to seven basis points: the one-year at 2.51% (-7) and 2.55% (-7) in two years. The five-year at 2.66% (-7), the 10-year at 2.74% (-7) and the 30-year at 3.52% (-4).

The ICE AAA yield curve was bumped five to seven basis points: 2.52% (-7) in 2023 and 2.57% (-7) in 2024. The five-year at 2.64% (-6), the 10-year was at 2.78% (-6) and the 30-year yield was at 3.58% (-5) at a 4 p.m.

The IHS Markit municipal curve was bumped three basis points: 2.51% (-7) in 2023 and 2.57% (-7) in 2024. The five-year was at 2.64% (-7), the 10-year was at 2.75% (-7) and the 30-year yield was at 3.52% (-4) at a 4 p.m. read.

Bloomberg BVAL was bumped four to five basis points: 2.58% (-4) in 2023 and 2.61% (-4) in 2024. The five-year at 2.65% (-5), the 10-year at 2.75% (-5) and the 30-year at 3.51% (-3) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.478% (+4), the three-year was at 4.243% (+4), the five-year at 3.925% (+5), the seven-year 3.853% (+6), the 10-year yielding 3.747% (+7), the 20-year at 4.018% (+7) and the 30-year Treasury was yielding 3.801% (+8) at the close.

Primary to come:

The San Jose Financing Authority (/AAA/AAA/AAA) is set to price on Thursday $275.575 million of wastewater revenue green bonds Climate Bond Certified, serials 2023-2042; terms 2047, 2052. Wells Fargo Bank.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price on Thursday $190 million of single-family mortgage revenue bonds (non-AMT), serials 2024-2034; terms 2037, 2042, 2047, 2052, 2053 (PAC bonds). Barclays Capital.

School District No. 58, Illinois, (/AA//) is set to price Wednesday $130.92 million of general obligation school bonds, serials 2023-2041. Oppenheimer & Co.

The School Board of Sarasota County, Florida, (Aa2///) is set to price $123.465 million of certificates of participation on Tuesday. Raymond James & Associates.

The Aurora Highlands Community Authority Board, Colorado, (NR/NR/NR/NR) is set to price on Wednesday $103.788 million of special tax revenue capital appreciation bonds. Piper Sandler & Co.

Competitive:

Alexandria, Virginia, (/AAA//) is set to sell $144.175 million of unlimited tax general obligation bonds at 10:30 a.m. Wednesday.

Westchester County, New York, is set to sell $142.375 million of tax-exempt GOs at 11 a.m. Thursday. The issuer will also sell $71.662 million of taxable general obligations bonds at 11:30 a.m. Thursday.