Wisconsin voters signed off on $1.7 billion of local school bond and revenue requests in their April elections.

They signed off on 52 of 60 referendums, permitting $1.7 billion in property tax hikes. That’s an approval rate of 87%, according to a review conducted by the Wisconsin Policy Forum, which has long tracked voter sentiment on school requests.

The figure included a $1 billion, 30-year question sought by Racine public schools.

The April 7 elections came in the midst of an economic shock caused by COVID-19 and social distancing measures to combat the coronavirus that causes it.

“Wisconsin voters again approved the vast majority of school district referenda to increase local property taxes, despite the economic uncertainty linked to the COVID-19 pandemic,” the Forum wrote.

Of the 52 referendums approved, 25 asked for borrowing authority totaling $485 million and 27 were for operations, including 21 that sought non-recurring power to raise revenue totaling $1.16 billion. Six won recurring revenue authority totaling $97 million. Milwaukee Public Schools accounted for $87 million of the $97 million of recurring authority requests.

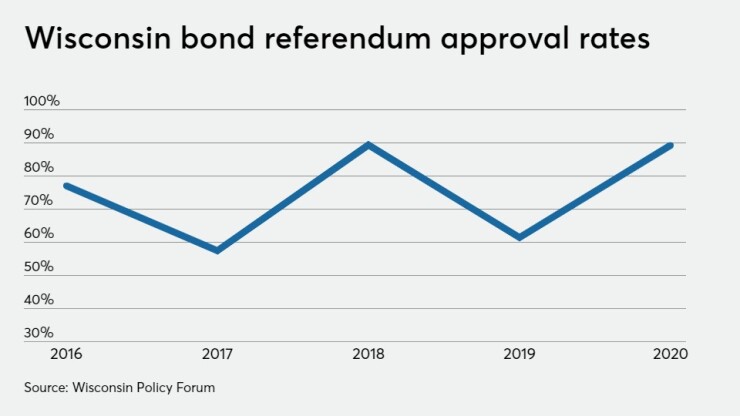

Just three borrowing requests failed, resulting in an 89.3% approval rate. That compares to a 61.5% rate in 2019 and 89.4% rate in 2018, 57.5% in 2017, and 77.1% in 2016. Only one of 22 referendums seeking a non-recurring revenue hike failed, for a 95.5% approval rate, the highest level tracked by the Forum. Recurring revenue hikes that allow districts to exceed state caps didn’t fare as positively with six of ten passing for an approval rate of 60%.

Since 2016, 267 of the state’s 422 school districts have won voter approval to raise property taxes by more than $7 billion, including $4.8 billion of borrowing requests, $2.1 billion in non-recurring revenue referendums, and $192.6 million in recurring revenue. Approval of 412 of the 514 referendums represents an 80% approval rate. That compares to a 52.5% approval rate for 912 of 1,736 referendum agreed to between 2000 and 2015.

Drawing conclusions is complicated because the vote took place “amid unprecedented circumstances created by the COVID-19 crisis.”

More voters cast early ballots as the spread of COVID-19 amplified concerns about the safety of in-person voting.

The Democratic presidential primary and a high-profile state Supreme Court race won by a Democrat may have drawn a voter pool more likely to support public school funding. The election drew attention when Gov. Tony Evers took 11th-hour steps to try to halt it over COVID-19 concerns.

The Economic Forum noted that the high approval rates came after a decade during which inflation outpaced per-pupil revenue growth for Wisconsin school districts.

Between 2009 and 2019, inflation rose 17% while the statewide average revenue limit per pupil for districts increased by $570, or 6%, to $10,677, covering all general state aid and property tax revenues.

In past elections, the forum's reviews have linked approval rates to rosier economic times when voters appear to be more willing to loosen the purse strings, but the pandemic was also in an earlier stage and recession projections and since worsened.

“The results from the April election are difficult to evaluate in this framework. The period since the Great Recession has seen steady economic growth, but that has abruptly ended amid the fallout from the COVID-19 crisis,” the forum wrote.

Additional ballot measures are planned for the November general election. Economic prospects could then weigh more heavily on voters.

“Amid the COVID-19 crisis, the state and world are entering an economic downturn of unknown length and severity. For voters whose appetites for property tax increases might be dampened by this, the implications of the crisis are likely to become more evident as the year unfolds,” the Forum wrote.

The forum suggests that lawmakers should consider the recent referendum trends as they wrestle with measures needed to manage budget strains from the pandemic.

While funding in the federal Coronavirus Aid, Relief, and Economic Security package signed March 27 will help districts cover virtual learning costs, districts across the state have expressed concern in recent weeks that state budget woes due to dwindling tax revenue will fall partially on their backs.

The Racine referendum allows the Racine Unified School District between the Illinois border and Milwaukee to exceed revenue caps and raise funding for capital projects all totaling $1 billion in revenue over 30 years.

The Racine referendum is non-recurring but runs 30 years.

The measure allows the district to exceed its state imposed revenue limit by $18 million annually through 2025, then by $22.5 million through 2029 and by $42.5 million through 2050 for building modernization, land acquisition, enhancements for student career pathway programs, safety improvements, furnishings and equipment, technology, and debt service for new building and other capital improvement projects.

The projects carry a price tag of $600 million but the additional revenue is needed to cover borrowing costs.

The measure passed on the April 7 ballot by just five votes and a recount cut the favorable number to four out of 33,500 votes were cast. A court appeal is being pursued by critics of the measure and watchdog groups who argued the vote was compromised by poor counting practices and flaws in counting absentee ballots.

Milwaukee

In Milwaukee's local election, Aycha Sawa beat Jason Fields to win a four-year term as city comptroller. The position is considered the city’s chief financial officer and the office manages city debt issuance. Incumbent Martin Matson retired.

Sawa began working in the comptroller’s office as an auditor in 2010, being promoted to audit manager and then accounting director. In 2017, she became deputy comptroller. She previously worked for Baker Tilly auditing governments and worked as an auditor for the Wisconsin Department of Transportation.

The city was recently handed two new negative outlooks on its AA-minus general obligation ratings from Fitch Ratings and S&P Global Ratings. The city’s budget relies heavily on property tax and state revenue sharing funds that are more resilient in a recession but they are not immune.

The negative outlooks were driven by ongoing draws on reserves and weaker 2019 results. The city is facing rating hits if it continues to draw down reserves and doesn’t structurally balance its books.

The city expects its share from federal relief packages that includes $103 million from CARES along with federal disaster funds to cover the costs being incurred due to the pandemic, according to

Evers extended a Safer-At-Home order from April 24 to May 26 and the state Supreme Court recently heard arguments challenging it. Most virus cases in the state are concentrated in the Milwaukee, Green Bay, Kenosha, and Madison areas and if the court rules against the statewide extension the city’s Commissioner of Health could extend it to keep non-essential businesses closed.

Through April, the city estimates revenue losses of $6.73 million, not covered by any relief package. “If conditions remain the same, with some adjustment for seasonality, losses are anticipated to be an additional $19.72 million through August, 2020 for a total of $26.45 million,” the disclosure says.

The losses stem from permits, court fines and fees, parking citations and fees, and water and sewer late fees. The city has furloughed some employees to save $3.3 million and is exploring other savings options. While liquidity is expected to be managed from its recent cash flow borrowing and CARES funds, the city has access to the Federal Reserve’s Municipal Liquidity Facility, the disclosure reads.

The city is preparing a 2021 budget and warns it could face state aid cuts, a significant revenue stream for city operations, but it’s too early “to provide any information on the amount of the potential reduction, what services may be reduced, what expenditures may be cut, and possible revenue enhancements, in order to balance the city’s 2021 budget,” the disclosure says.