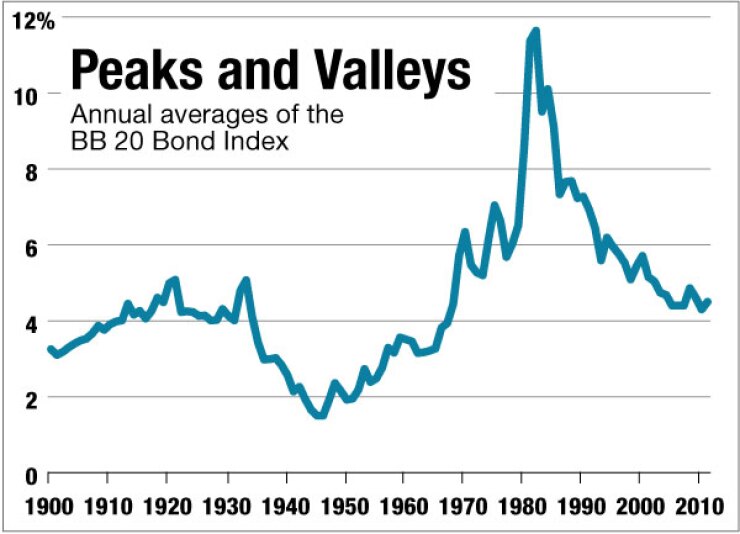

Investors may be wondering where municipal bond yields are headed after they reached 45-year lows last week.

Interest rates as reflected by The Bond Buyer 20-Bond Index have fallen nearly 10 percentage points since January 1982, when they reached record high levels. After such a steep decline, it may seem to some that yields could not possibly go lower.

However, a historical view of muni bond yields suggests the market has not hit an impenetrable floor (see story on page 6).

While the 20-bond index closed at 3.60% Friday, the all-time low yield was reached in February 1946, when the index hit just 1.29%.

The 20-bond index is based on a selection of general obligation bonds maturing in 20 years. The average rating of the 20 bonds is roughly equivalent to a double-A.

As of the end of Monday, Municipal Market Data’s generic 10-year triple-A bond was paying 1.87%, the 20-year was 2.96%, and the 30-year was 3.37%.

Are yields finally going to start rising? Or could they possibly fall further?

The Bond Buyer asked a selection of muni research analysts for their predictions.

Loop Capital Markets expects the 30-year triple-A to be 3.90% by the end of the year.

Yields will increase slightly by the end of the year, said Chris Mier, Loop’s managing director. Most of the increase should take place in the second half of 2012, Loop predicts.

The increase will mainly be due to the ebbing of the investor flight to quality that characterized 2011, according to Mier. The European debt problem will not improve soon, he said, adding that over time, U.S. investors will become less sensitive to Europe’s problems.

Currently, yields are unusually tight to the inflation rate, he noted. (See graph above.) Eventually, investors will demand a better premium.

Munis are also expensive relative to corporate bonds right now. While the average 10-year muni-to-corporate ratio going from the present back to October 2002 is 62.9%, on Jan. 20 it was 38.8%.

Munis are also expensive relative to Standard & Poor’s 500 stock dividends. While the average ratio between 20-year munis and S&P 500 stock dividends going back to June 1981 has been 246%, the current ratio is about 170%.

Both of these factors will also push yields up in the coming year, Mier said.

Bank of America Merrill Lynch expects that by the end of this year, the 10-year will rise to 2.30% and the 30-year will rise to 3.80%.

The Federal Reserve said that interest rates are on hold until 2013, noted John Hallacy, head of municipal research at Bank of America Merrill. That will eliminate one potential source of upward pressure on muni yields.

However, a modest U.S. economic recovery and increased supply in the second half should push yields up, Hallacy said.

Trident Municipal Research expects the 10-year to decline to 1.50% by mid-year and then remain about there for the rest of the year. It also expects the 30-year bond to decline to 2.75% by the end of the year.

Two major factors will push yields lower, said Bart Mosly, co-president of Trident. Europe and China’s economic problems are keeping inflation risks in check, while the credit picture for state governments is improving.

Evercore Wealth Management expects little change in the next few months, followed by a possible 50 to 75 basis point increase in yields by year-end.

In six to 12 months, there may be some improvements in the European debt situation and in euro zone growth, said Gary Gildersleeve, fixed-income manager at Evercore. In addition, the U.S. economy should improve.

These factors may lead to higher bond yields in the second half of the year.

If a Republican is elected president in November, investors will expect more economic growth and that may push bond yields higher, he said.

Envision Capital Management expects the 10-year to trade in a range between 1.85% and 2.60% for the rest of the year.

Envision expects 15% more new issuance in 2012 compared to 2011, said Marilyn Cohen, Envision’s chief executive officer. However, she said the market should be able to absorb such amounts.

Yields will rise only modestly this year, she said, unless there is some sort of external event. Examples of this could be a troubled bank, a development in the euro zone, or fiscally troubled Illinois having a hard time rolling over its debt.

Miller Tabak Asset Management expects 10-year and longer bonds in 2012 to trade in a range from 25 basis points lower to 50 basis points higher than the present.

Mike Pietronico, chief executive officer of Miller Tabak, pointed to three main factors that will keep yields at their current fairly low levels.

First, a strengthening U.S. dollar will keep the cost of imported goods low. In turn, this will keep inflation low.

Second, a weak European economy will mean limited global economic growth. This will contribute to the preservation of low U.S. interest rates.

Third, a weak U.S. housing market will encourage the Fed to keep interest rates low. Ultimately, this should affect both short- and long-term rates, Pietronico said.

McDonnell Investment Management says that depending on conditions, yields could increase by 50 basis points or remain where they are.

Richard Ciccarone, managing director at McDonnell, said there are a variety of fluid conditions that will affect bond yields this year.

Three factors led his firm to believe that interest rates would rise modestly — how low they are presently, an expected increase in muni bond supply, and a retreat from the flight to quality that has pushed muni yields down. If the federal government puts a cap on the federal tax-exemption for muni interest, that could also contribute to higher rates, Ciccarone said.

However, there are other factors that might keep yields roughly where they are now, he said. Chief among these would be unsettled conditions with the European debt crisis. Also, if the tax cuts enacted under former President George W. Bush are allowed to expire, that would encourage people to buy munis as tax havens.

Richard Sylla, an economist and economic historian offered thoughts about where muni yields are headed. He expects yields to decline for the next 12 months, but then increase somewhat in the following year.

There is a “decent chance” that yields will continue to decline in 2012, said Sylla, professor of economics at New York University’s Stern School of Business.

“The economy is still pretty sluggish and the Fed has promised to keep its target fed funds rate close to zero into 2013, if not longer,” he said. “And the Obama administration seems to want to raise marginal tax rates on 'the rich,’ however defined; that by itself would make munis more appealing to investors.”

Next year the rate decline should be halted by an improving economy.

“Long-term bond investors need to be very careful in the period ahead, lest they suffer once again the negative returns, nominal and real, that they experienced by holding bonds from 1965 to 1981,” Sylla said.