The Bond Buyer took the pulse of professionals in various sectors of the municipal bond market to see what they are doing and advising in the midst of the market turmoil driven by President Trump's erratic tariff policies.

Alice Cheng, director of municipal credit and investor strategy at Janney, said she'd advise both investors and borrowers to play it safe. Players in equities and fixed income markets are "reacting to everything that the administration has to say," Cheng said. "To mitigate that, perhaps wait-and-see is a better option."

"Investors are looking, investors are paying attention, but they're not ready to jump into putting money to where they think it will work at the moment," Cheng said.

"[For] issuers, the window of going to market in a more certain and favorable market has closed since the tariff news has been coming out," Cheng said. "So a lot of our issuer clients are looking into much later days for accessing the market. And I know that some of the institutions, market players, are expecting issuance to go up even further for this year, they're revising their numbers. I think that's probably something I wouldn't do right now … because costs of construction and projects will tend to go up."

Is it a good time for an issuer to bring a deal? "Right now, I feel like, may not be the right time when you have a project that is highly dependent on imported materials and labor."

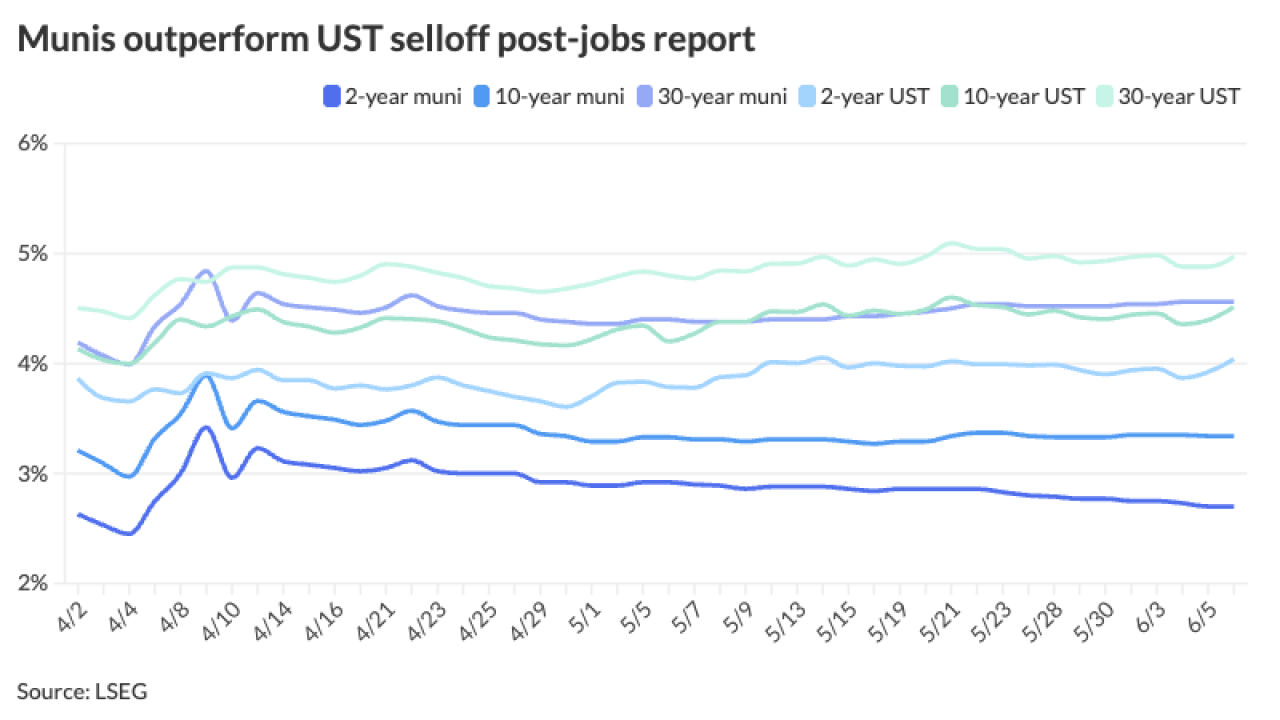

"Volatility certainly has been elevated given the uncertainty around tariffs," said Daniel Kelly, head of municipal underwriting at Huntington Capital Markets.

Does the 90-day pause on many tariffs help the market? "Even with the announcement this afternoon, heightened volatility is likely to stay with us for the foreseeable future and we may continue to see select Issuers choose to wait to issue debt until markets are more stable," Kelly said. "We have been supporting our efforts and clients in municipals by participating in the competitive market and keeping our Issuer clients fully informed on the developing market dynamics."

"The volatility in the markets over the past few days has underscored the importance of preparedness and agility for municipal issuers," said Jennifer Fredericks, a director at Baker Tilly. "The increased uncertainty around inflation and the start-stop tariff policy approach has led to choppier market conditions, further complicating timing and execution for public sector borrowers."

"The focus right now is helping clients navigate this environment with clarity and discipline," Fredericks said. "That means revisiting capital plans, reassessing debt structures, and ensuring that credit narratives are current and compelling. Additionally, reinforcing with issuers the importance of flexibility — whether through authorizations, shelf-ready transactions, or alternative financing mechanisms — so they can move quickly when market windows open."

"Despite the turbulence, there are still opportunities for well-positioned issuers, particularly those who are proactive and transparent in their approach."

"Just days after announcing arbitrary worldwide tariffs, Trump's reversal is yet another example of the constant chaos he is imposing on all of us," New York City Comptroller Brad Lander said in a statement.

"New York City's pension systems are invested broadly, for the long term, and on solid ground to meet all our obligations to our city's retired teachers, cops, firefighters, and all municipal workers," Lander said. "Still, despite our prudence, this level of uncertainty is bad for markets, bad for the economy, bad for investors, and bad for New York City."

"Many economists have increased the likelihood of a recession occurring in 2025, with some even suggesting the chances are greater than a coin flip. This is largely due to the potential negative impact of President Trump's new trade and tariff policies," Tom Kozlik, head of public policy and municipal strategy at HilltopSecurities, wrote in a commentary published Tuesday, the day before the president's at least temporary flip-flop on most tariffs.

"The risk-off stance many investors gravitated toward means they are beginning to avoid investments with risk," Kozlik said. "Many are turning to more stable choices or increasing levels of cash to protect themselves from market volatility, global trade policy and macro uncertainty. However, this is now setting up to be what could be the best municipal opportunity we have seen in the last 18 months, or perhaps since the end of 2023."

"Yes, it's 100 basis points away from last week," Brendan Troy, managing director at BofA Securities, said Wednesday at The Bond Buyer Texas Public Finance conference. "But look, we've seen this before, and we typically see it at this time of year, we are incredibly weak on the technical side. We are going into tax season. We are at the very low end of the redemption cycle, not just in Texas, but across the country."

"One point I would make is that, you know, the bank market is open, remains open," Robert Dailey, head of PNC's public finance group, said Wednesday at The Bond Buyer conference. "And so things that can't get done in the bond market can and are getting done in the bank market. And so there's going to be a little bit of, you know, invisible supply that's out there that may not show up."