The municipal bond market will see under $4 billion of new paper to close out the month and market participants remain hopeful volume will spike in September and stay strong into the fall.

“The summer is slowly crawling to an end and the light calendar this week should be digested quickly and easily,” said one New York trader. “From what I am seeing, the deals will start stacking up come September, once everyone is back, and hopefully it’s a strong end to the year.”

Weekly bond volume estimates says issuance will inch up to $3.9 billion this week from a revised total of $3.7 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $2.8 billion of negotiated deals and $1.1 million of competitive sales.

Secondary market

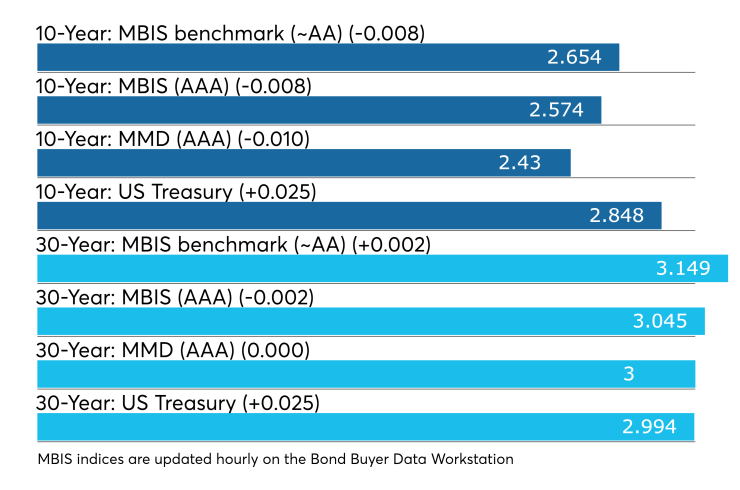

Municipal bonds were mostly stronger on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in 22 maturities. The four-, five-, eleven- and twelve-year maturities were the only ones that were weaker, rising by less than one basis point, and the remaining four maturities were unchanged.

High-grade munis were mostly stronger, with yields calculated on MBIS’ AAA scale falling less than one basis point in 22 maturities. The other maturities were weaker by no more than one basis point or flat.

Municipals were unchanged on Municipal Market Data’s AAA benchmark scale, which showed both the yield on the 10-year muni general obligation and 30-year muni maturity flat.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 86.2% while the 30-year muni-to-Treasury ratio stood at 101.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary market

Muni bond buyers will get another chance in the upcoming week to get hold of some Massachusetts and Texas paper, as both issuers will be in the market as the unofficial summer season winds down in the last week before Labor Day.

Morgan Stanley is set to price Massachusetts’ $727.145 million of general obligation and GO refunding bonds on Wednesday after holding a one-day retail order period. The issue is tentatively structured as $500 million of Series E consolidated loan of 2018 GOs and $227.145 million of Series 2018C refunding GOs.

Also in the Bay State, Citigroup is expected to price the Massachusetts Clean Water Trust’s $162 million of Series 21 state revolving fund green bonds on Tuesday.

Piper Jaffray is set to price the Texas Public Finance Authority’s $300 million of Series 2018 taxable GO and refunding bonds on Tuesday. The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

JPMorgan Securities is set to price the West Virginia Hospital Finance Authority’s $260 million of hospital refunding and improvement revenue bonds for the Cabell Huntington Hospital Obligated Group on Tuesday. The issue consists of Series 2018A bonds and Series 2018B taxable bonds. The deal is rated Baa1 by Moody’s and BBB-plus by S&P.

Previous session's activity

The Municipal Securities Rulemaking Board reported 30,354 trades on Friday on volume of $9.034 billion.

Texas, California, and New York were the municipalities with the most trades, with the Lone Star State taking 16.313% of the market, the Golden State taking 14.099% and the Empire State taking 9.306%.

Prior week's actively traded issues

Revenue bonds comprised 56.53% of new issuance in the week ended Aug. 24, according to

Some of the most actively traded munis in the week were from Puerto Rico, Texas and New York and New Jersey issuers.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 34 times. In the revenue bond sector, the Texas 4s of 2019 traded 204 times. And in the taxable bond sector, the Port Authority of N.Y. & N.J. 4.031s of 2048 traded 55 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 2.080% high rate, up from 2.035% the prior week, and the six-months incurred a 2.210% high rate, up from 2.185% the week before.

Coupon equivalents were 2.120% and 2.266%, respectively. The price for the 91s was 99.474222 and that for the 182s was 98.882722.

The median bid on the 91s was 2.060%. The low bid was 2.030%.

Tenders at the high rate were allotted 21.00%. The bid-to-cover ratio was 2.90.

The median bid for the 182s was 2.190%. The low bid was 2.170%.

Tenders at the high rate were allotted 33.00%. The bid-to-cover ratio was 3.06.

Treasury to sell $65B 4-week bills

The Treasury Department said it will sell $65 billion of four-week discount bills Tuesday. There are currently $92.997 billion of four-week bills outstanding.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.