New issues were strong yesterday while secondary prices gained 1/4 point as the market continued to exhibit a robust tone, despite some recent signs that potent retail demand has faded off its highs.

Some market participants late last week said they saw signs of a slowing retail bid as relative yields dropped and stocks recovered. But even though retail investors may have stepped back from the market, participants say demand remains brisk, even at aggressive prices.

"We feel things have run a little too far, but people are still willing to pay these prices," a trader said. "It had slowed down last week but it has picked up again yesterday ."

The same trend is apparent in the primary, where some underwriters also say retail has tapered off from its peak, but continues to queue up for new issues even at strong prices.

"Our retail is down 15% to 20% from a month ago, because yields are down 35 to 40 basis points, but it's still above last year's average," one underwriter said. "Demand is still strong, mainly because the availability of supply is not there."

George D. Friedlander, portfolio strategist at Salomon Smith Barney Inc., said the strong bid still prevalent in both the primary and secondary markets is, in fact, due to light supply rather than stronger demand. Dominant retail investors, he said, have turned more reticent and may be harder to entice from the sidelines thanks to rate shock, a resurgent stock market, and a flatter yield curve.

"Our bottom line is that the market should do fine as long as supply remains light, and it will remain light," Friedlander said in his firm's new market report. "In the absence of a broad-based fixed-income rally, however, the best performance is probably already behind us."

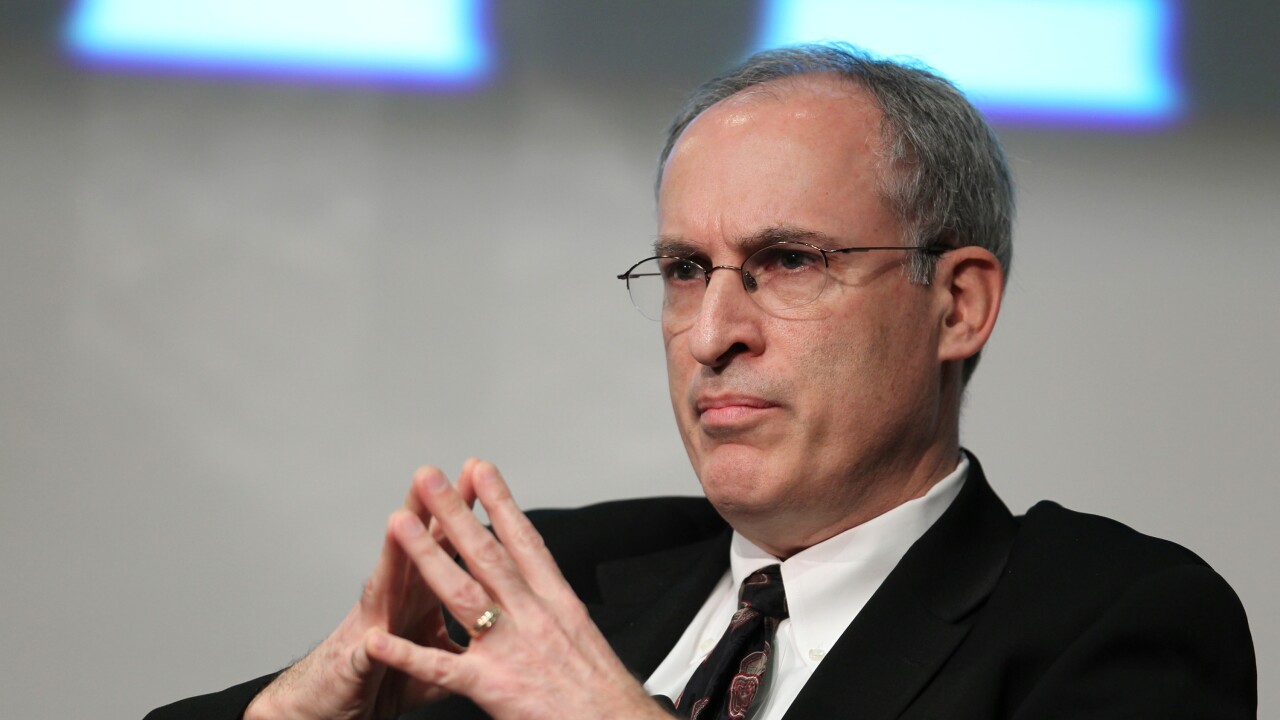

Philip J. Fischer, director of research at Merrill Lynch & Co., echoed the sentiment, noting that the firm's retail distribution has dropped approximately 25% from its May high. Fischer also stressed that the institutional bid remains tepid. Property and casualty insurance companies continue to operate under earnings pressure while tax-exempt bond funds continue to lose assets, he said. AMG Data Services Friday said funds lost $420 million, he added.

"As a consequence, we are moving from bullish to neutral on the market," Fischer said in the firm's latest market report.

Turning to yesterday's primary, one analyst said yields on high-grade new issues reflected a four- to five-basis-point improvement in the intermediate range while yields on the long end indicated 1/4 of a point gains.

Heading up the competitive action, Lehman Brothers won the $350 million California general obligation bonds with a true interest cost of 5.3372%. Merrill Lynch had the cover with a TIC of 5.3384%, followed by Salomon Smith Barney with a TIC of 5.3416%. Banc of America Securities rounded out the bidding with a TIC of 5.3802%.

Lehman said it received approximately $257 million of pre-sale orders for the loan and reported an unsold balance of $23 million.

"It seems like the market is pretty frothy, but we're still seeing the business and you've got to stay with it," said a member of the underwriting syndicate. "Everybody does double-takes everyday and it keeps on grinding higher."

Serial bonds were reoffered to investors at yields ranging from 4.30% in 2004 to 5.42% in 2017. A 2025 term containing $33 million of the loan, was reoffered as 5 1/2s to yield 5.62% and a 2028 term containing $33 million was reoffered as 5 1/2s to yield 5.65%. Serial bonds due from 2001 through 2003 and from 2018 through 2022 were not formally reoffered. A 2030 term containing $22 million was also not reoffered.

The issue is rated Aa3 by Moody's Investors Service, AA-minus by Standard & Poor's, and AA by Fitch.