Tim Schaefer, who served the California public finance market for decades as a trader, a banker, a financial advisor and until last year as deputy state treasurer, has died. He was 75.

Schaefer's career "is one that would be hard to replicate, not only in tenure, but he covered so many aspects of this industry," said Raul Amezcua, a senior managing director with Ramirez & Co.

Schaefer was California's deputy treasurer for public finance in two administrations. He was

He died Tuesday.

During more than five decades in the industry, Schaefer worked as a salesman on a trading desk, a banker at Chemical Bank and Bank of America, and as president of Fieldman Rolapp & Associates, a leading California financial advisory firm, before forming his own financial advisory firm, Magis Advisors.

Schaefer first joined Chiang when he was state controller as a fiscal policy advisor, then followed him to the State Treasurer's Office.

"Tim had a deep well of knowledge about public finance," Chiang said. "He had earned incredible respect not only from those who worked in state government; external parties held him in high regard. He was my first and only choice for deputy treasurer of public finance and an easy choice."

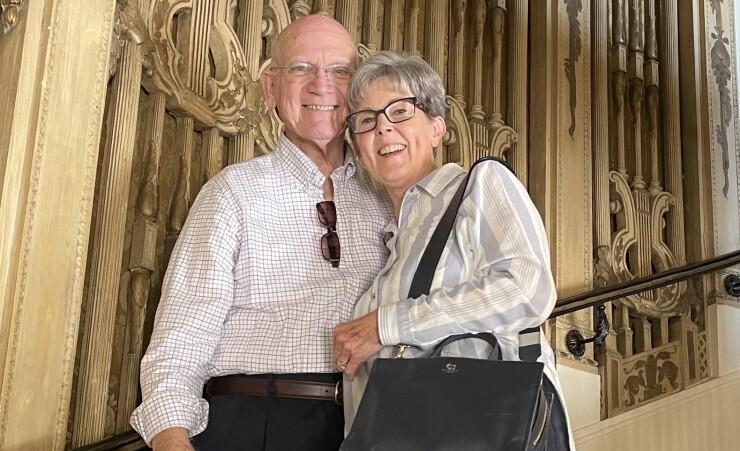

Schaefer was a registered Democrat who resided in Sacramento. He moved there with his wife, Kathryn, who also works in finance, when he took the job as fiscal policy advisor in the controller's office in 2014. Prior to that, he had lived in Los Angeles for 27 years.

Chiang said his policy about choosing staff was pick brilliant people and let them do their jobs.

"Sometimes you luck out in meeting caring, high quality people," said Chiang, who now serves on several corporate boards. "One of my mom's most important messages to me when I was growing up was pick great friends. If you do you will have a great life. I look for that in my co-workers and in the people in my life. Tim was one of those stellar stars who fit that model my mom wanted me to identify in my life."

Schaefer also spoke fondly of his time working for Chiang in both the controller and treasurer's office in an interview after he retired as deputy treasurer in October.

Schaefer was involved in some of the State Treasurer's Office's biggest public policy programs related to bonds.

They include California's

But working with The California Debt and Investment Advisory Commission, the treasurer's agency that provides education about public finance, was near and dear to his heart. Nicknamed the professor by many in the industry, Schaefer always made the time to explain to people be it colleagues, issuer clients or government officials how bonds worked.

Schaefer was involved with CDIAC when it was still the California Debt Advisory Commission, said Steve Juarez, who was the commission's executive director 1991 when Kathleen Brown was state treasurer.

Juarez appointed Schaefer to chair the technical advisory committee. Juarez later hired Schaefer to be the financial advisor for the Getty Trust when Juarez left the treasurer's office in 1995 to work there.

"His knowledge as a financial and industry advisor were always indispensable," Juarez said. "I think Tim has a way about him that creates trust. In the financial services industry, trust isn't always a given thing, but I always knew he was going to give me sage advice that wasn't tainted in any way. That is why we became far more than financial colleagues."

Schaefer, in his October interview, said a coming 10-part series of webcasts that will educate newly elected officials about working with bonds is among his greatest achievements. The webcasts, expected to formally launch in June, will ensure that newly elected officials understand what is in that 300-page bond document in their council package, Schaefer told The Bond Buyer.

Mentor, and a friend

Schaefer mentored many people over the course of his busy career.

"People have been texting me to talk about what Tim did to help them, and how he mentored them along the way," said Kathryn Schaefer.

One text said, "I am so thankful for Tim and the compassion he has shown me the past year. He was always a great mentor and friend, the best friend anyone could ask for," she said.

"Tim was my first boss in the muni business," said Robert Larkins, managing director at Loop Capital Markets. "He hired me as a wet-behind-the-ears analyst in February 1985, and thus began a 37-year friendship and mentorship, with Tim as teacher, and I as student.

"He was consistent with his often-invoked Jesuit education and innate resolute moral compass," Larkins said.

"Tim Schaefer always did the right thing. He set the standard for professionalism, ethics, integrity and decency in his personal and professional life," he said.

"He was wise, kind, modest, loyal, incredibly smart, and wickedly funny, but never at others' expense," Larkins said.

Katie Selenski, executive director of the California Secure Choice Retirement Savings Investment Board which operates CalSavers, the state's pioneering retirement savings program, praised Schaefer.

"I never even officially reported into his chain of command but from my first days at the State Treasurer's Office six years ago, he went above and beyond to be a mentor to me and was incredibly generous with his time," Selenski said.

"He always made himself available to me to offer insights and advice and helped me see new facets of the challenges I faced," Selenski said. "Every time I sat with him, I felt so lucky. I learned so much from him. Even more important than his tremendous career, he was a wonderful, generous human being and I am so grateful I had the chance to know him."

Adam Bauer, president and chief executive officer of Fieldman, Rolapp & Associates, also considered Schaefer a mentor.

Schaefer hired Bauer for his first job at Fieldman, Rolapp in 2004.

Schaefer set the firm on its current trajectory, Bauer said.

When Schaefer started at Fieldman & Rolapp, the firm primarily focused on water agencies and community facilities districts, Bauer said. At the helm, Schaefer expanded the work done by the firm, and it now focuses on school and local government financings.

"Tim was a great F.A.," Bauer said. "He knew how to break down an issue, explain it to clients and help them move forward. He was very thorough and many people sought him out for counsel."

Bauer remembers seeking out Schaefer's advice on deals he was working on.

"It was difficult to get on his calendar, because so many people sought him out, but once you did, he would wrestle that issue to the ground with you. It was important to him, not to handle an issue at the surface level, but to get all of the details right."

David Brodsly, a managing director at KNN Public Finance, said he first worked with Schaefer in 1984.

"He was the definition of a mensch, and he gave so much to our industry and the people in it," Brodsly said. "I am heartbroken. There is a Jewish expression one says when remembering the dead, 'May his memory be a blessing.' Tim is pretty safe on that one."

Schaefer contracted pneumonia, and it would ultimately take his life, according to his wife Kathryn.

"The timing was just stunning, coming so soon after his official retirement," Kathryn Schaefer said.

Schaefer is survived by his wife, two daughters and five grandchildren. Details on services have yet to be finalized.