As June reinvestment season officially gets under way this week, a handful of sizable new issues -- highlighted by a nearly $2 billion deal in the Northeast -- will pique investors' interest across a variety of sectors, from plain-vanilla general obligation bonds to hotel and airport credits.

A $1.8 billion New York Metropolitan Transportation Authority state service contract revenue offering will obviously dominate the calendar. Lehman Brothers will kick off a retail order period today followed by an official pricing tomorrow, and the bonds will carry ratings of AA-minus from Standard & Poor's and AA from Fitch Ratings. A rating from Moody's Investors Service was not sought.

Market watchers are expecting retail investors to continue to be major buyers of this New York deal, as they have in recent weeks, especially when New York City sold $1.5 billion of GO debt two weeks ago.

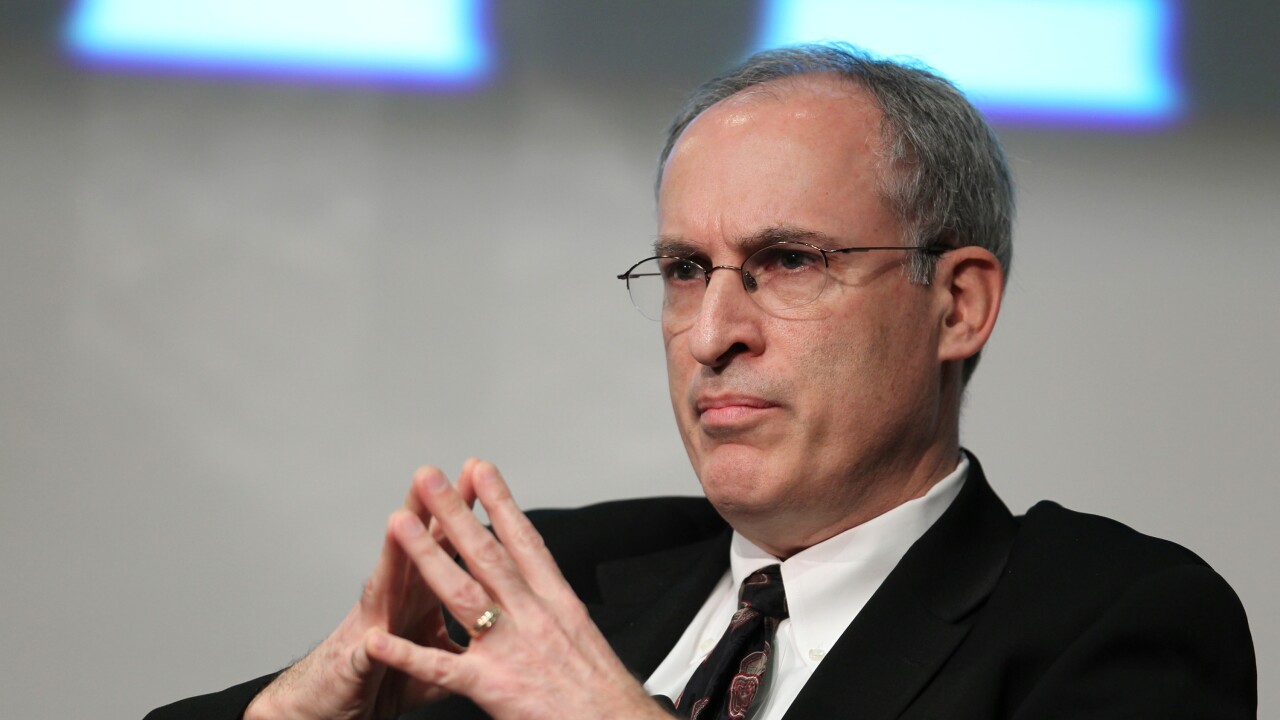

"The June and July rollover dates in New York are a formidable source of demand historically," said Joseph P. Darcy, a senior portfolio manager at Dreyfus Corp. in New York City.

With retail investors having provided the "deepest pool of liquidity" at the market's disposal on a consistent basis lately, Darcy added, "I expect retail to be a significant factor in the placement of this deal."

Bonds are scheduled to mature serially from 2004 to 2022 with term bonds in 2027 and 2031.

Whether or not he will purchase some of the bonds for the $1.4 billion Dreyfus New York Tax-Exempt Fund that he manages depends on pricing.

"There is a fair amount of MTA paper coming, so it will be a function of pricing with respect to the last MTA deal and whether they exact some of the same type of premiums for the bonds," Darcy said.

The MTA offering is the second sale in the agency's massive $14 billion refunding that it is selling as part of a consolidation of its 13 previous credits into four principal credits. The first sale was a $2.9 billion transportation refunding last month. The other two credits the MTA has are a Triborough Bridge and Tunnel Authority general revenue and subordinate revenue credit and a dedicated tax fund credit.

Darcy described his activity in the New York fund as "spotty" lately, noting that he took a pass on the New York City GO deal two weeks ago based on his own funds' limitations.

"We are not overly concerned with the city as a credit, but we feel our level of exposure is adequate," he said.

In general, the mammoth city deal was indeed well received, especially the 2032 final maturity that was reoffered with a 5.375% coupon priced to yield 5.54%. At the time of the pricing, that maturity was priced 21 basis points cheaper than the generic insured triple-A GO scale tracked by Municipal Market Data.

Meanwhile, cash-laden retail investors looking to replace called or maturing bonds this week will find significantly smaller, yet still appealing, deals elsewhere around the country.

The Clark County, Nev., School District will sell $475 million of GO building bonds competitively on Wednesday in a structure that includes bonds maturing from 2005 to 2022, while the Bellevue School District No. 405 in Washington is planning to sell $130.3 million of its GO credit tomorrow maturing from 2004 to 2021.

"Retail is a major participant in this market," said John Penney, director of retail trading at Salomon Smith Barney Inc. in Seattle.

With the new-issue calendar building and rollover season in full swing, the Bellevue deal in his neck of the woods should see demand unabated, he noted.

"We haven't seen that name for quite some time and the area is quite a wealthy area," which makes for a two-pronged selling point for individual investors and trust departments, he said.

Currently, retail investors are favoring par bonds through 10 years, the first 5% coupon bond that is available, and premium bonds with 5% coupons or better maturing between eight and 18 years, according to Penney.

Elsewhere, a pair of deals will offer sophisticated investors higher-yielding paper, including bonds subject to the alternative minimum tax and some of the non-AMT variety.

The week's first lower investment-grade deal to test the waters is a two-pronged industrial development revenue refunding tomorrow being issued by the Delta Economic Development Corp. in Michigan on behalf of Mead Westvaco, a local paper company.

The corporation will sell $93.5 million of non-AMT refunding bonds in one 2027 term maturity, and $6.7 million of AMT paper maturing in one 2023 maturity.

The bonds will carry ratings of Baa2 from Moody's and BBB from Standard & Poor's. Banc of America Securities is the lead underwriter.

Municipal issues with a corporate theme have done well lately, especially the kind that satisfies the current institutional appetite for more yield than the plain-vanilla market offers, noted John Irwin, managing director and a senior underwriter at Banc of America.

In the Southeast, meanwhile, another tax-exempt deal for a corporate obligor will be on the runway when the Memphis-Shelby Counties Airport Authority launches its $95.7 million special facilities revenue refunding for the Federal Express Corp. at Memphis Airport.

Morgan Keegan & Co. will price the deal on Wednesday, after a two-day retail order period beginning today.

The deal will consist of just one, non-AMT maturity in 2012. The credit has an existing rating of Baa2 from Moody's, and a confirmed rating on the new issue of BBB from Standard & Poor's.

"There have been a lot of Tennessee deals of late, but none of this size and that maturity," said Jerry Chapman, managing director of underwriting at Morgan Keegan.

"Fed Ex is an excellent name in Tennessee ... Memphis is its home and has a lot of interest in the state," he noted, adding that he expects strong retail and institutional demand.

Other deals of sizable nature and particular interest this week include a $242 million hotel tax and subordinate-lien revenue refunding from Harris County, Tex., and a $200 million Missouri Highway & Transportation Authority revenue offering.

The Texas hotel deal consists of a series of insured capital appreciation bonds maturing from 2013 to 2019, 2023 to 2025, and in 2028, as well as an uninsured series of current-interest bonds maturing from 2006 to 2012, 2022 to 2022, and in 2027 and 2032. The current-interest bonds carry ratings of Aa1 from Moody's, and AA-plus from Standard & Poor's and Fitch.

Lehman is expected to price the hotel deal today.

Missouri's double-A rated transportation deal is expected to be priced by Salomon on Thursday in a structure that includes serial bonds maturing from 2004 to 2022.