DALLAS – Texas voters will consider $4.8 billion of bonds Saturday, with no billion-dollar proposals on 68 local ballots.

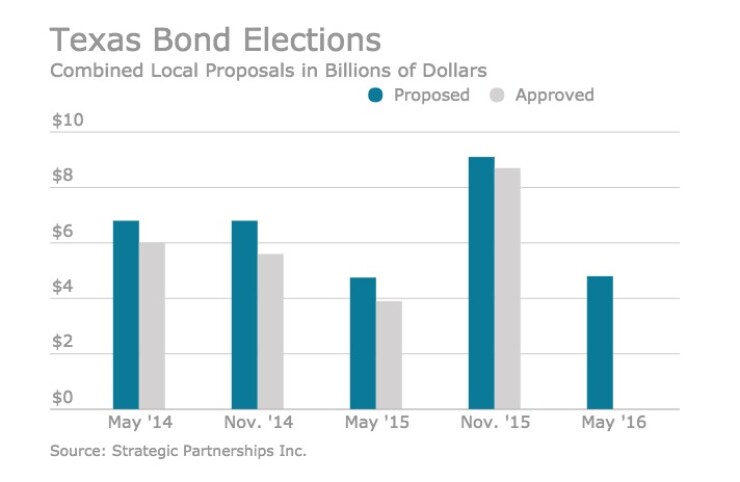

That amount roughly matches last May's bond elections, when local governments requested $4.75 billion, winning approval of $3.9 billion or better than 80%.

This May’s total is slightly more than half of the record $9.2 billion on the ballot last November, according to the Austin-based consulting firm Strategic Partnerships Inc. Voters approved 96% or about $8.7 billion of those proposals.

“I’m tracking the exact same number of elections as last November, but there were several very large bonds that pushed the November dollar total higher,” said Kurt Yoshida, director of information services at SPI.

Among the large issues approved last November were $1.6 billion for the Dallas Independent School District and $848 million for Harris County, the state’s most populous. The May 7 ballot will not include any county bond elections, Yoshida said.

Bond elections in May are typically smaller than those in November.

Voters will decide bond proposals in 49 school districts, five cities, one community college district and an improvement district.

One of the largest proposals comes from the fast-growing Plano Independent School District, where $481 million of school construction bonds are proposed to fund a fine arts center, an elementary school and specialized schools for special education and pre-kindergarten, along with other renovations and upgrades.

The district’s last bond election was in 2008 just as the global economic crisis was beginning. Then in 2011, Texas schools faced deep cuts from the state as funding was slashed. Plano ISD generally submits bond proposals every four years but managed to wait eight years for this one.

The district carries a rating of AA-plus from Standard & Poor’s but gets a triple-A wrap from the Texas Permanent School Fund, as do other districts in the state.

Plano ISD, in the affluent northern suburbs of Dallas, enrolls 54,818 students. The median household effective buying income in the district is 152% of the national average, according to S&P. As the new headquarters for Toyota USA, Plano is expecting continued growth in the coming years.

Neighboring Richardson ISD is also seeking a large bond approval of $437 million. The package is made up of $215.7 million in maintenance funds, $107.3 million for campus renovations and construction to address enrollment growth, and $114 million for technology and library improvements.

In nearby McKinney, the McKinney ISD is asking voters for $220 million of bond authority, including $50 million for a football stadium.

The 12,000-seat stadium, which drew some opposition at school board meetings, would use an additional $12.5 million remaining from a 2000 bond authorization for roads, water, sewer and other infrastructure.

A stadium was approved in the 2000 bond election, but rapid growth forced the district to shift the money to new schools. McKinney ISD’s stadium, built in 1962, seats 7,000. At the time, it had only one high school and four lower schools. Now the district northeast of Dallas has three high schools.

The nearby Allen ISD ran into problems in 2012 after it built a $60 million, 18,000-seat stadium that developed cracks that forced its temporary closure. After $10 million of structural improvements, the stadium reopened for graduation in spring of 2015.

Neighboring Frisco ISD is contributing $30 million for a new indoor stadium that includes a 57-foot-wide video screen and space to seat 12,000 as part of a development for the NFL Dallas Cowboys’ training headquarters.

The city of Allen is asking voters to approve bonds for $93.15 million in capital improvement projects, including a library expansion, new recreation center, new fire station, various street improvements and funding for public art.

Northwest of Dallas, the Coppell ISD is proposing $146 million of bonds to build a middle school, set aside funding for a new elementary school and remodel other facilities in the fast-growing district.

Near Houston, the Alvin Community College District is asking voters for $88.5 million for a new technical building, and campus facility improvements. The district has about $13.4 million of outstanding bonds, which Fitch Ratings affirmed March 3 at A-plus with a stable outlook.

Although the economy is showing signs of softening in the Houston area and the oil-producing regions of the state, there have been no indications that economic factors have deterred bond proposals.

“There has been some modest yet inconsistent enrollment growth,” Fitch said of the Alvin district. “This is balanced against overall trends that generally reflect an eroding base, which Fitch views with some concern.”

In the northern suburbs of San Antonio, Judson ISD, which includes parts of the city, will ask voters for $266 million of bonding authority.

Meanwhile, the school board for Southside Independent School District in San Antonio rescinded its plan to ask voters for $21 million, saying the district needed more time to plan proposed projects.

In the Lower Rio Grande Valley of far South Texas, the Weslaco ISD is proposing a $109 million bond issue that would provide an early college campus and repair damages sustained in the aftermath of the October 2015 floods.

The bond issue was recommended by the WISD bond committee during a Feb. 10 workshop, where plans for a smaller $70 million bond were scrapped in favor of addressing more needs, officials said.

Bonds would also finance “mini-gyms” at elementary schools to accommodate physical education and recess regardless of weather conditions.

With an estimated population of 71,504, Weslaco ISD is in Hidalgo County, about 17 miles east of McAllen. Standard & Poor’s rates the district’s underlying credit A-plus. The district issued $31 million of refunding bonds in 2015.