Texas plans to pump $500 million of top-rated debt into the taxable bond market Tuesday as it confronts fallout from the coronavirus pandemic.

While the primary tax-exempt muni market remains largely frozen, the corporate bond business appears to enjoy greater liquidity, said Lee Deviney, executive director of the Texas Public Finance Authority.

The bonds, pricing through book-runner Citigroup and co-senior manager BofA Securities, are taking out commercial paper for the Cancer Prevention Research Institute of Texas, a state agency that grants funding to research and treatment programs, including some that are private enterprises.

Rated triple-A by Moody’s Investors Service and S&P Global Ratings, the bonds mature serially through 2039.

“I’m confident about the sale,” Deviney said. “But if the market goes away, it’s not something we can’t put back on the shelf.”

The preliminary official statement for the bonds includes cautionary statements for several nations, indicating the global appeal of taxable debt.

"What I like about taxable municipals is that they have an expanded audience, especially in the current rate environment," said muni bond analyst Joseph Krist. "For a name with good brand name recognition there can literally be a global audience."

TPFA is one of the major issuers of general obligation debt for Texas, but Deviney said planning for future tax-exempt deals is on hold while the market undergoes unprecedented upheaval.

“There are a couple of refunding opportunities we may pursue,” he said. “We’re kind of in a sit and wait mode.”

The preliminary official statement comes with a lengthy supplement about the outbreak of coronavirus disease, or COVID-19. The statement explains that the impact of the disease cannot be quantified until more data is obtained.

“Stock values and crude oil prices, in the U.S. and globally, have seen significant declines attributed to COVID-19 concerns,” the statement said. “Texas may be particularly at risk from any global slowdown, given the prevalence of international trade in the state and the risk of contraction in the oil and gas industry and spillover effects into other industries, including manufacturing.”

So far, the stable outlooks on Texas’s triple-A ratings are secure.

“The uncertainty regarding the trajectory of dual challenges — an oil rout and COVID-19 outbreak — will undoubtedly test both the state and local governments,” S&P analyst Oscar Padilla wrote in a March 17 report. "Ultimately, the magnitude of the effects of both challenges will depend on their depth and duration but at present, given the state's strong financial position combined with its strong financial management and oversight, will, in our view, afford it a degree of flexibility to manage challenges as they arise.”

After years of preparing for a slump based on long experience with the boom-bust oil and gas markets, Texas enters this downturn with reserves at 8% of its biennial appropriations and an $11.48 billion rainy day fund. S&P estimates the state’s borrowing capacity at $12.58 billion.

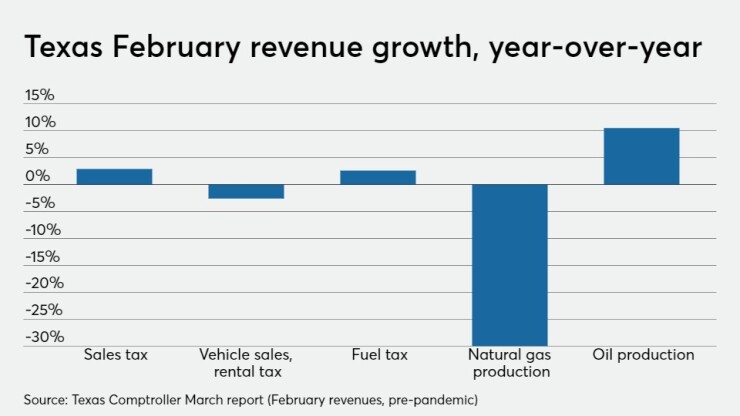

In what is almost certain to be the last monthly report of record revenues, Texas saw sales tax increase 2.9% to $2.69 billion for March. The revenues were mostly collected in February before widespread closures of offices and stores.

Texas Comptroller Glenn Hegar also said he expects projected revenues to fall by several billion dollars when he revises the state’s budget estimate in July.

Hegar also said the state may need additional revenue or spending cuts.

Hegar told The Texas Standard radio program that unemployment was probably already at 9% and soon to move into double digits.

After the last oil price slump that began in mid-2014, Texas has enjoyed 31 consecutive months of record revenue, peaking at $3.18 billion last November.

A projected 30% drop in global oil demand in April dwarfs the decline of 2% in the global financial crisis of 2008. Some analysts are comparing the current crisis to the oil price collapse of 1986 that wiped out Texas-based banks.

"It's probably the most challenged economic environment the state has seen since the '80s," Krist said. "In the long run Texas will be fine, but the current conditions of economic downturn and the potential additions to the State's expense budget."

Texas economist Ray Perryman anticipates losses of a million jobs and $101 billion in gross state product from the combined oil shock and COVID-19 economic freeze.

“The numbers will likely be terrible, but temporary,” Perryman wrote in a March report. “Once the worst of the virus subsides and social distancing is relaxed, venues will reopen and tens of millions of jobs will quickly be restored.”

A Brookings Institute

“In a huge nation made up of diverse places and varied local economies, a look at the geography of highly exposed industries makes clear that the economic toll of any coming recession will hit different regions in disparate, uneven ways,” S&P analysts wrote.

Houston, the world’s energy capital, is bracing for a severe hit after a wave of bankruptcies in 2019 when oil prices were above $50 per barrel.

Houston Mayor Sylvester Turner told an April 1 City Council meeting that lower revenue would mean budget cuts for months.

"We're taking into account that we are going to see a reduction in our sales tax March, April, May, June," Turner said. "All of that is being factored in."

Houston was among 10 U.S. cities facing the most fiscal stress in the COVID-19 crisis, according to an April 16 report from S&P. The others were New York, Los Angeles, Chicago, Phoenix, Boston, Miami, Philadelphia, San Francisco and Seattle.

“Given that the greater region has generally been on a growth trend in population, development, and market value, the depth and breadth of the risk would depend on how long the current challenging environment persists,” the S&P analysts said of Houston, which is rated AA with a stable outlook.

The CARES Act, the $2 trillion federal coronavirus relief bill, awarded Houston $5 million for the City of Houston Health Department to fund COVID-19 preparedness and response activities. The city will be creating a grant fund called the "COVID-19 Disaster Fund" and requesting City Council authorization to transfer up to $5 million into that fund from the budget stabilization fund as seed money for expenditures related to the public health emergency response efforts. The expectation is that up to 75% of the amount will be reimbursed by federal grants.

Houston’s diversification features a healthcare industry that includes cancer research that has made the city a world leader.

CPRIT bond funding is a contributor to the cancer research that takes place in places like Houston’s M.D. Anderson Cancer Center.

“Despite the continued diversification in the local economy, with sectors other than the energy sector strengthening, the city and its local economy are still very closely tied to the oil and gas industry and prolonged weak oil prices will add to Houston's challenges,” S&P said.

CPRIT has awarded $2.49 billion in grants to Texas research institutions and organizations through its academic research, prevention and product development programs. CPRIT was created in 2009 after Texas voters approved a constitutional amendment to commit $3 billion in the fight against cancer over 10 years. In 2019, Texas voters approved a constitutional amendment to provide an additional $3 billion to CPRIT.