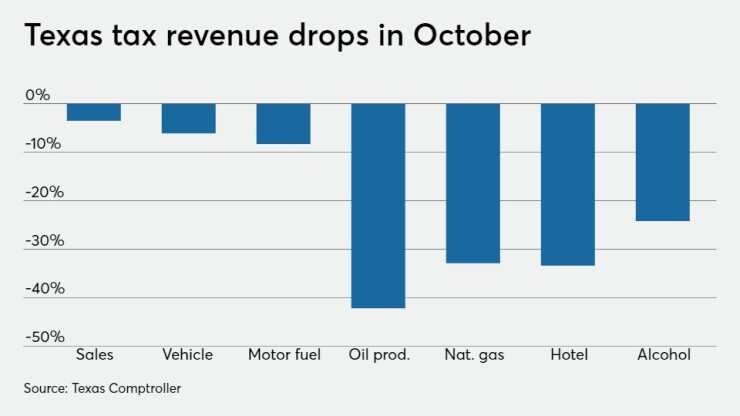

Texas collected $2.72 billion in sales tax in October, 3.5% less than in October 2019, State Comptroller Glenn Hegar reported.

The majority of October sales tax revenue is based on sales made in September, which are remitted to the agency in October.

“October sales tax collections from all major economic sectors declined significantly from year-ago levels, with the exception of collections from retail trade,” Hegar said. “The steepest declines were in receipts from oil- and gas-related sectors, with the rate of well drilling activity depressed almost 75% from the previous year.”

Sales tax revenue has been down in six of the 10 months of the calendar year. Sales tax accounts for 59% of revenue in Texas, which has no income tax. Since an emergency declaration in March due to the pandemic, revenue has exceeded that of 2019 only once: in July.

The Texas Legislature, which meets only in odd-numbered years, convenes in January and may have a House of Representatives controlled by Democrats, depending on Tuesday’s election outcome. Republicans gained control of the House in 2002 and have dominated state politics since then.

Hegar’s annual cash report Tuesday showed the Consolidated General Revenue Fund ended the year with a cash balance in the state treasury of $7.8 billion, a decrease of $600 million, or 7.7%, from fiscal 2019. The change in the balance is largely due to a decrease in tax collections, Hegar wrote in a letter accompanying the report.

Balances in Special Revenue Funds grew from $23.1 billion in fiscal 2019 to $28.6 billion in fiscal 2020. The Economic Stabilization Fund, commonly known as the rainy day fund, ended fiscal 2020 with a balance of $10 billion, a decrease of $100,000 compared to fiscal 2019.

The ESF ending balance included $5.9 billion of cash and investments having a fair market value of $4.1 billion. Net revenues for all funds excluding trust funds increased by $13.7 billion, or 10.7%, from fiscal 2019, to a total of $141.6 billion in fiscal 2020.

Federal income of $58.1 billion was an increase of $16.2 billion, or 38.7% from fiscal 2019.

Tax collections, the second largest revenue category, totaled $57.4 billion, a decrease of $2 billion, or 3.4%, from fiscal 2019.

Total sales tax revenue for the three months ending in October 2020 was down 5.1% compared to the same period a year ago.

“Receipts from the information sector were down, principally due to the federally mandated exemption of internet access charges from taxation,” Hegar said. “Receipts from retail trade increased, as adaptation to pandemic circumstances has spurred increased spending on building materials, home furnishings, sporting goods and alcohol for off-premise consumption, while spending at bars and entertainment venues has languished.”