Municipal bond buyers got a taste of this week’s healthy new-issue slate from diverse issuers on Wednesday. Municipals remained steady, with yields little changed across the AAA scales.

ICI reported muni bond funds and exchange-traded funds saw combined inflows of $2.5 billion, the 23rd straight week of positive results.

CUSIP Global Services said requests for muni identifies surged 18% in September, an indicator that bond volume will increase in the last quarter of 2020.

President Donald Trump gave an address on the economy before the economic Club of New York on Wednesday morning. Speaking via webcam from the White House, Trump said infrastructure would be a top priority in his next term if he is re-elected next month.

“We actually have [an infrastructure] plan now, but we’re going to make it make it much bigger … We want to re-do our roads, our highways, our tunnels, our bridges — some are unsafe. It’s going to be an absolute priority.”

The president didn’t give any specific details of his new and bigger plan ahead of the Nov. 3 election.

The Volcker Alliance and the Penn Institute for Urban Research said the American Road & Transportation Builders Association estimates that at least $10.9 billion of state and local transportation projects have been delayed or cancelled so far this year and that $141 billion of funding initiatives or ballot measures have been vetoed, cancelled or postponed.

The organizations will be holding a

Kim Olsan, senior vice president at FHN Financial, said that ahead of the Presidential election, the market is moving into a defensive mode.

“Defensive demand is only getting stronger with election uncertainty playing a large role,” Olsan said. “Short-end credit spreads continue to tighten to AAAs, much like firmer levels being paid for optionality. Single-A revenues opened the year trading +11-13/AAAs and widened to +23/AAA during the Spring selloff. Current spreads have moved into the single digits in some cases,” she said.

The market will remain cautious as uncertainty looms over the Nov. 3 election; Trump and Democrat Joe Biden are scheduled to hold competing Town Hall meetings that will be televised on Thursday night at the same time.

Some weakness ahead of deals

“Munis have experienced some weakness due to the elevated expected supply, as issuers come to market prior to the election, along with continuing uncertainty over the economy and a potential stimulus package,” said Dan Urbanowicz, director and senior portfolio manager at Washington Crossing Advisors.

At the same time, the limited window of heavy volume should be beneficial given its timing ahead of seasonal supply and demand challenges, according to Urbanowicz.

“We're viewing this elevated supply as perhaps the last good buying opportunity before the end of the year as seasonal reinvestment picks up and issuance decreases,” he said.

Though there is caution in the market, as investors are gearing up for the rest of the week’s sizable deals — as well as those expected later in the month — as it continues to stabilize following some recent Treasury weakness.

“The market is still concerned about a stimulus package or lack thereof,” but is looking forward to the supply coming the next two to three days, he said.

While Treasuries were up the last few days, some recent deals were cleaning up “slowly but surely.”

“It feels OK, but nobody is rushing to bid it up,” he said of the secondary market overall. “Some of the supply in the Street is slowly starting to trade up a little bit — especially in New York,” he said, pointing to the Dormitory Authority of the State of New York’s personal income tax bonds, which priced last week.

“The market has a modestly better tone today, which is certainly not indicative of where Treasuries have been the last three days or so,” the trader said, pointing to the weakness on Friday, followed by an unchanged to little weaker on Tuesday.

While “it doesn’t feel like the Street wants to jump in yet,” the trader said “there seems to be more people paying attention” to the primary market this week.

Primary market

BofA Securities priced the Baptist Healthcare System Obligated Group’s (A2/NR/A/NR) $510 million of Series 2020B taxable corporate CUSIP bonds. The bonds were priced at par to yield 3.54%, 203 basis points above the comparable U.S. Treasury security, in 2050.

Citigroup priced the Louisiana Public Facilities Authority’s (A3/A/NR/NR) $385.12 million of revenue bonds for the Ochsner Clinic Foundation project, consisting of Series 2020A bonds and Series 2020B hard put bonds. The $279.745 million of Series 2020A bonds were priced to yield from 1.03% with a 5% coupon in 2026 to 2.34% with a 5% coupon in 2037; a 2047 maturity was priced as 3s to yield 3.10% and a 2049 maturity was priced as 4s to yield 2.92%. The $105.375 million Series 2020B hard put bonds were priced as 5s to yield 0.90% in 2050 with a mandatory tender date in 2025.

JPMorgan Securities priced Franklin County, Ohio’s (Aa2/NR/AA/NR) $148.95 million of taxable hospital facilities revenue improvement bonds for the Nationwide Children's Hospital project. The bonds were priced at par to yield 2.877% in 2050.

Goldman Sachs priced the Michigan Finance Authority’s (Aa3/NR/NR/NR) $244.605 million of second lien distributable state aid revenue and revenue refunding bonds for the Charter County of Wayne. The bonds are priced to yield from 0.47% with a 5% coupon in 2022 to 2.56% with a 4% coupon in 2040 and as 4s to yield 2.70% in 2045, 2.81% in 2050 and 2.96% and 2.84% in a split 2055 maturity. The $50 million second half of the 2055 maturity is insured by Build America Mutual and also rated AA BY S&P Global Ratings.

BofA priced the Michigan State Housing Development Authority’s (NR/AA/NR/NR) $149.89 million of Series 2020 A-1 non-AMT tax-exempt and Series 2020B taxable rental housing revenue bonds. The $126.815 million of Series A-1 bonds were all priced at par to yield from 0.45% and 0.50% in a split 2023 maturity to 2% and 2.05% in a split 2031 maturity, 2.25% in 2035, 2.45% in 2040, 2.65% in 2045, 2.70% in 2050, 2.85% in 2055 and 3% in 2063.

JPMorgan Securities priced the Oklahoma Turnpike Authority’s (Aa3/AA-/AA-/NR) $188.455 million of Series 2020A second senior revenue refunding bonds. The bonds were priced as 5s to yield from 0.19% in 2022 to 1.44% in 2033.

Wells Fargo Securities priced the Metro Wastewater Reclamation District, Colo.’s (Aa1/AAA/NR/NR) $146.5 million of Series 2020A sewer improvement bonds. The bonds were priced to yield from 1.01% with a 5% coupon in 2030 to 2.32% with a 2.125% coupon in 2041; a 2045 maturity was priced as 2.5s to yield 2.51% in 2045.

BofA priced the Board of Regents of the University Of Hawaii’s (Aa3/NR/AA/NR) $212.855 million of university revenue bonds. The deal consisted of Series 2020A taxables, Series 2020B refunding bonds, Series 2020C taxable refunding bonds, Series 2020D refunding bonds and Series 2020E taxable refunding bonds.

In the competitive arena Wednesday, the New York City Transitional Finance Authority (Aa3/AA/AA/NR) sold 200 million of Fiscal 2021 Series S-1 building aid revenue bonds. Wells Fargo Securities won the deal with a true interest cost of 2.787%. The bonds were priced to yield from 0.25% with a 5% coupon in 2022 to 2.78% with a 3% coupon in 2050.

Frasca & Associates and Public Resources Advisory Group are the financial advisors. Norton Rose and Bryant Rabbino are the bond counsel.

On Thursday, Barclays Capital is set to price the City and County of Denver, Colo.’s $705.5 million of taxable and $219.4 million of tax-exempt airport system revenue bonds being issued on behalf of Denver’s Department of Aviation.

Wells Fargo Securities is expected to price the North Carolina Turnpike Authority’s (/BBB/BBB/) $499.46 million of senior lien turnpike revenue bonds anticipation notes for the Triangle Expressway System.

JPMorgan Securities is set to price the Oklahoma Turnpike Authority’s (Aa3/AA-/AA-/NR) $370.385 million of Series 2020A tax-exempt and Series 2020B taxable second senior revenue refunding bonds.

In the higher-yielding sector, PNC Capital Markets is expected to price the Philadelphia Industrial Development Authority’s (Baa3///) $195 million of refunding bonds for the Russell Byers charter school.

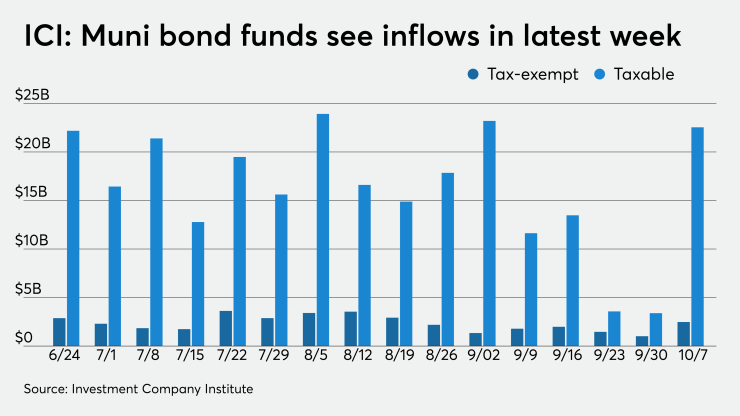

ICI: Muni bond funds see $2.5B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.479 billion in the week ended Nov. 7, the Investment Company Institute reported Wednesday.

It marked the 23rd straight week that the funds saw inflows. In the previous week, muni funds saw a revised inflow of $1.015 billion, originally reported as a $966 million inflow, ICI said.

Long-term muni funds alone had an inflow of $2.086 billion in the latest reporting week after a revised inflow of $996 million originally reported as a $947 million inflow in the prior week.

ETF muni funds alone saw an inflow of $393 million after an inflow of $164 million in the prior week.

Taxable bond funds saw combined inflows of $22.542 billion in the latest reporting week after a revised inflow of $3.390 billion in the prior week originally reported as a $3.391 billion inflow.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $7.568 billion after a revised outflow of $9.327 billion in the previous week, originally reported as a $9.396 billion outflow.

CUSIP: Muni requests surge in Sept.

Municipal CUSIP request volume surged in September, according to CUSIP Global Services. Issuance of new security identifiers can be an early indicator of debt activity over the next quarter.

The aggregate total of all municipal securities — including municipal bonds, long-term and short-term notes and commercial paper — rose 18% to 1,647 in September from 1,396 in August.

On an annualized basis, total municipal CUSIP identifier request volumes are up 12.6% to 11,970 through September compared to 10,633 in the same period in 2019.

For municipal bonds alone, CUSIP requests in September rose 18.5% to 1,393 from 1,179 in August; they are up 15.7% to 9,828 on an annualized basis from 8,497 in the same period last year.

“Record low interest rates and lingering fears of a possible liquidity crunch throughout most of this year have not materially slowed the pace of new capital creation in the major fixed-income and equity asset classes,” said Gerard Faulkner, Director of Operations for CGS. “While we continue to see month-to-month volatility in CUSIP request volume, the overall direction in U.S. corporate and municipal securities continues to trend positive so far this year.”

Among top state issuers, Texas, New York and California were the most active in September.

Secondary market

Some notable trade on Wednesday:

Montgomery County, Maryland GOs, 5s of 2022, traded at 0.22%. Georgia GOs 5s of 2022 at 0.27%-0.22%. Texas trans, 5s of 2024, traded at 0.29%. Arlington County, Virginia 5s of 2026 at 0.44%-0.30%. Georgia GOs 5s of 2027 at 0.57%-0.53%. New York City TFA 5s of 2029 traded at 1.23%.

In the 10-year, Arlington County GOs 5s of 2030 traded at 0.95%-0.94% after originally pricing at 0.98%.

Charleston, South Carolina GOs 3s of 2033 at 1.36%-1.24%. New York City TFA 4s of 2034 traded at 1.98%-1.93%.

NYC TFA subs 4s of 2045 traded at 2.46%-2.30%.

Conroe, Texas, ISD 2.25s of 2046 traded at 2.32%, yesterday 2.34% and originally at 2.41%.

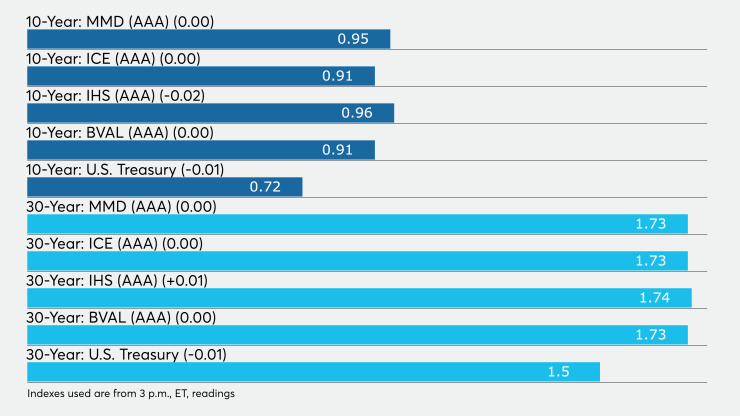

On Wednesday, high-grade municipals were unchanged, according to final readings on Refinitiv MMD’s AAA benchmark scale.

Yields in 2021 and 2022 were unchanged at 0.14% and 0.15%, respectively. The yield on the 10-year muni was steady at 0.95% while the 30-year yield was flat at 1.73%.

The 10-year muni-to-Treasury ratio was calculated at 131.6% while the 30-year muni-to-Treasury ratio stood at 115.3%, according to MMD

The ICE AAA municipal yield curve showed short maturities unchanged at 0.14% in 2021 and to 0.15% in 2022. The 10-year maturity was unchanged at 0.91% and the 30-year remained at 1.73%.

The 10-year muni-to-Treasury ratio was calculated at 128% while the 30-year muni-to-Treasury ratio stood at 114%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields at 0.13% in 2021 and 0.14% in 2022 as the 10-year muni declined two basis points to 0.96% and the 30-year remained at 1.74%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity unchanged at 0.13%, the 10-year flat at 0.91% and the 30-year steady at 1.71%.

Treasuries were stronger as stock prices traded down.

The three-month Treasury note was yielding 0.12%, the 10-year Treasury was yielding 0.72% and the 30-year Treasury was yielding 1.50%.

The Dow dropped 0.50%, the S&P 500 decreased 0.60% and the Nasdaq declined 0.80%.