Although municipal bond volume is expected to rise by almost $2 billion, it won’t be nearly enough to satisfy investors’ thirst for the asset class.

There is a clear theme to the expected issuance, as it is heavy on taxable corporate CUSIP healthcare bonds. IHS Ipreo is estimating supply will come in at $7.12 billion, up from a revised total of $5.47 billion. The calendar composed of $4.94 billion of negotiated deals and $2.18 billion of competitive sales. There are 20 deals scheduled $100 million or larger, with four being competitive deals. Ten of those deals are either taxable, partially taxable or corporate CUSIPs including the top five largest deals.

Brian Musielak, senior portfolio manager for Commerce Trust Co., expects very strong institutional demand for the deals.

“Large nonprofit hospitals are one of the few sectors investors can still pickup some additional yield for high-quality, generally stable credits,” he said. “An added boost may come from traditional tax-free muni buyers given the collapse of muni/UST ratio to start the year.”

He noted that at Commerce Trust Co., they are advising clients even in the upper tax brackets to focus on taxable munis for maturities inside eight years.

“While the corporate CUSIP may prevent some from participating, more and more buyers seem to be comfortable with the structure,” Musielak said. “Given the strong start to the year, no question in our minds the big institutional investors, both domestically and overseas, will show up for these deals.”

Primary market

JP Morgan is scheduled to price the Partners Healthcare System Inc.’s (Aa3/AA-/NR/NR) $1.004 billion of taxable corporate CUSIP for Mass General Brigham on Wednesday.

Morgan Stanley is expected to price Cottage Health Credit Group, Calif.’s ( / /AA-/ ) $500 million of taxable corporate CUSIP also on Wednesday.

Citi is slated to price JobsOhio Beverage System’s (Aa3/AA/ / ) $370.865 million of statewide senior lien liquor profits taxable revenue refunding bonds on Thursday. The deal is expected to mature serially from 2021 through 2034 and include a term bond in 2038.

Citi is also expected to price Hartford Healthcare’s (A2/A/A+/NR) $359.524 million of taxable corporate CUSIP on Thursday.

In the competitive arena, Delaware (Aaa/AAA/AAA) is selling $300 million of general obligation bonds on Wednesday.

Also, the University of Houston System Board of Regents (Aa2/AA/ ) is selling a total of $478.025 million of consolidated revenue refunding and taxable bonds in two separate sales on Wednesday.

Lipper sees inflows for 54th consecutive week

For the 54th week in a row, investors flushed the municipal market with cash to be put to work and continuing the streak as the money does not stop flowing into cash-exempt mutual funds.

In the week ended Jan. 15, weekly reporting tax-exempt mutual funds added $2.340 billion of inflows, after inflows of $2.888 billion in the previous week, according to data released by Refinitiv Lipper late on Thursday.

Exchange-traded muni funds reported inflows of $500.704 million, after inflows of $557.555 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.839 billion after inflows of $2.331 billion in the prior week.

The four-week moving average remained positive at $1.801 billion, after being in the green at $1.605 billion in the previous week.

Long-term muni bond funds had inflows of $1.824 billion in the latest week after inflows of $1.886 billion in the previous week. Intermediate-term funds had inflows of $376.446 million after inflows of $467.608 million in the prior week.

National funds had inflows of $2.608 billion after inflows of $2.608 billion while high-yield muni funds reported inflows of $685.574 million in the latest week, after inflows of $611.643 million the previous week.

Persisting issuers market

A favorable market for issuers of municipal debt continues to be a theme, as a confluence of factors have gathered to begin the New Year, according to Tom Kozlik, head of municipal strategy and credit at Hilltop Securities.

“These factors have already morphed into what can accurately be described as a market that clearly favors municipal entities who would like to sell debt,” Kozlik said. “The leading reason is demand based: 54 straight weeks of flows into municipal funds topped out at $2.89 billion last week, per Lipper data.”

He added that not only is 54 consecutive weeks a record, but $2.89 billion for an individual week is also a record based on data going back about three decades.

“Even though municipal-to-Treasury ratios are at, or near, all-time lows, the significant amount of investment dollars flowing into municipals is causing money managers to put money to work,” he said.

Kozlik continued to say that supply is just not keeping up: Average 10-year supply for January is $24 billion, which is tied for the lowest monthly average with February.

“While we expected some December 2019 issuance to spill over to this year, the supply of $14.6 billion ($6.5 and $8.1 billion) for the first two weeks of 2020 has still not satisfied the market’s appetite for bonds,” he said. “The supply picture is even less likely to meet demand from a big picture perspective.”

Kozlik noted that the total annual municipal market supply has averaged $382 billion over the last 10 years.

“Sure, supply jumped to $421 billion in 2019, but $70 billion was also taxable last year,” he said. “Even if supply comes in close to our $450 billion estimate for 2020, the issuer’s market could remain if a strong amount of demand for municipals endures.”

He also said that other influences contributing to this issuers’ market are mostly investor-demand related, unsurprisingly. Global fixed income alternatives are generally unattractive with many sovereigns still offering negative rates.

“The 2017 Tax Cut was, and remains, a driver of municipal bond demand for individuals,” Kozlik said. “The state and local tax deduction cap put into place at the end of 2017 is fueling investor demand because higher-income investors are searching for tax deductions. Nothing leads us to believe the influence from these factors will decline in the near term.”

He added that there is a limited number of municipal investment opportunities for a large and rising pool of investment dollars.

“The supply and demand dynamic is often the driving force in the U.S. municipal bond market,” he said. “It is for now, and investor demand is a leading reason.”

Secondary market

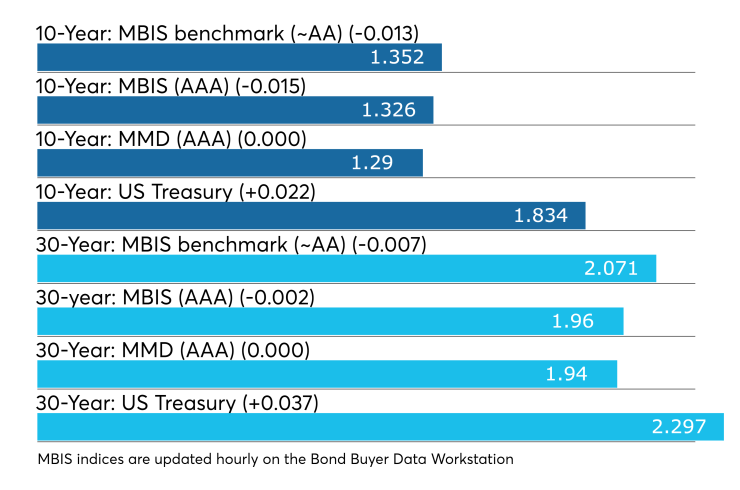

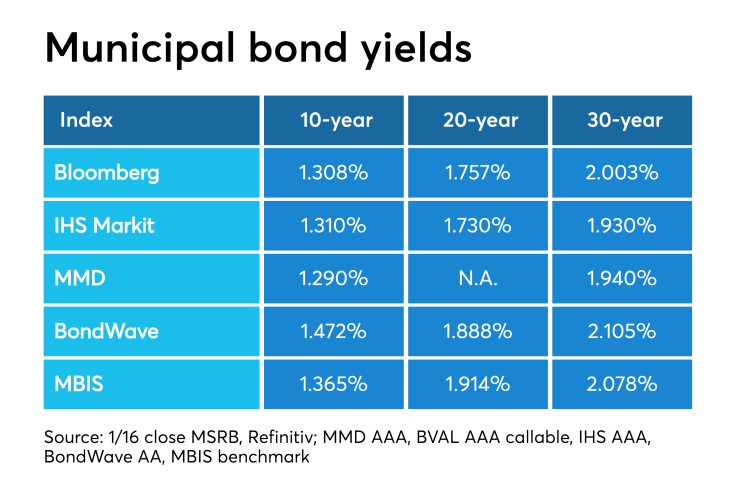

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year maturity and by less than a basis point in the 30-year maturity. High-grades were also stronger with yields on MBIS AAA scale decreasing one basis point in the 10-year maturity and by no more than one basis point in the 30-year maturity.

On the MMD benchmark scale, the yield on both the 10-year and 30-year were unchanged from 1.29% and 1.94%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 70.1% while the 30-year muni-to-Treasury ratio stood at 84.3%, according to MMD.

Stocks continued to roll on to record highs, while Treasury yields mostly moved higher. As of press time, all three major indexes were on pace for record closes.

The Dow Jones Industrial Average was up about 0.11%, the S&P 500 Index gained around 0.20% and the Nasdaq rose about 0.11%.

The Treasury three-month was yielding 1.564%, the two-year was yielding 1.567%, the five-year was yielding 1.633%, the 10-year was yielding 1.834% and the 30-year was yielding 2.297%.

Week’s actively traded issues

Some of the most actively traded munis by type in the week were from New York, New Hampshire and Texas issuers, according to

In the GO bond sector, the City of New York zeros of 2036 traded 27 times. In the revenue bond sector, the New Hampshire Health and Education Facilities Authority 5s of 2059 traded 67 times. In the taxable bond sector, the Texas Private Activity Bond Surface Transportation Corp. 3.922s of 2049 traded 41 times.

Week’s actively quoted issues

Puerto Rico, New York and California bonds were among the most actively quoted in the week ended Jan. 10, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 27 unique dealers. On the ask side, the City of New York GO 3s of 2044 were quoted by 196 dealers. Among two-sided quotes, the State of California taxable 7.35s of 2039 were quoted by 18 dealers.

Previous session's activity

The MSRB reported 35,204 trades Thursday on volume of $15.94 billion. The 30-day average trade summary showed on a par amount basis of $11.25 million that customers bought $5.84 million, customers sold $3.49 million and interdealer trades totaled $1.92 million.

Texas, New York and California were most traded, with the Lone Star State taking 13.327% of the market, the Empire State taking 13.02% and the Golden State taking 12.789%.

The most actively traded security was the Red River Educational Financing Corp. taxable revenue 3.397s of 2045, which traded 38 times on volume of $126.86 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.