Municipals were steady on Monday with some weakness around 10 years as the market awaits a small $5 billion calendar to close out April.

With the lower supply this week — only a handful of deals larger than $100 million — municipals should continue to hold onto current levels.

Last week's new-issue supply volume of $12.7 billion was the largest so far this year, said Patrick Luby, senior municipal strategist at CreditSights, but this week's anticipated $5.7 billion, $1.3 billion of which is taxable, is 39% below the one-year weekly average of $9.5 billion.

The dearth of supply will hold down rates lower and keep certain investors out of the muni market. Relative to U.S. Treasuries and corporates, "munis have performed well, but on a relative value basis, tax-exempts are out-of-the-money for corporate investors," Luby said. Munis, however, "still offer value for individual investors in high-tax states."

With both municipal bonds and Treasuries range-bound last week and ending with a constructive tone, strategists and analysts expect the trend to continue.

"This may be a pattern for municipals in the next few weeks, as nothing on the horizon suggests outsized inflation, which would cause bond prices to decline," said Nuveen's head of municipals, John Miller, in a weekly report. "In fact, when the Fed meets this week, policymakers will very likely say that inflation is not a concern to the U.S. economy. That should be further impetus for fixed-income in general to stay the course. Tailwinds for municipals should persist, as we are coming up on outsized coupon reinvestments for June 1 and July 1."

Luby also noted the summer redemption season is fast approaching; issuers will be paying out $116 billion of principal from maturing and callable bonds in June-August. The average amount of monthly redemptions for this year is $27 billion but for the first three months of summer, that figure rises to $39 billion, he noted. May redemptions will be $25.7 billion, below average, but 21% more than April, Luby said.

High-yield municipal bonds, still the most in-demand sector, tightened last week, Luby and Miller noted. "Muni credit spreads continue to tighten ... the spread for the High-Yield Muni Index is still 23 basis points wide of where it was at the end of 2019," Luby noted.

The largest deal of the week, $1.57 billion New Jersey Transportation Trust Fund Authority, selling on Wednesday in four pieces, is primed for high-yield investors and, with travel reopening, transportation issues have generally been well-received over the course of 2021.

"Demand for both new-issue and secondary market high-yield municipals remains firm, bolstered by existing cash balances," Miller said.

Triple-A benchmark scales were mostly steady Monday, with a one basis point cut on bonds in 2025-2030, according to Refinitiv MMD, while other triple-A benchmarks were little changed.

Municipal to UST ratios also held steady, closing at 60% in 10 years and 69% in 30 years on Monday, according to Refinitiv. MMD, and ICE Data Services had the 10-year at 59% and the 30 at 70%.

Trading showed a steady tone. Utah 5s of 2022 traded at 0.07%. New York Dorm PIT 5s of 2022 traded at 0.07%. Washington 5s of 2023 at 0.08%. Hawaii 5s of 2025 at 0.54%.

Wisconsin 5s of 2028 at 0.69%. California 5s of 2029 at 0.92%, the same as Wednesday. Denver City and County 5s of 2027 traded at 0.57%. Fairfax County, Virginia, 4s of 2029 traded at 0.85%.

Carrollton Farmers Ranch, Texas, 5s of 2030 traded at 0.93% versus 0.94% Thursday. Anne Arundel, Maryland, 5s of 2030 traded at 0.90% versus 0.90%-0.89% Friday. California 5s of 2031 traded at 1.05%, the same as Friday. Delaware 5s of 2031 at 0.93%.

New York Dorm PIT 5s of 2033 traded at 1.30%-1.28%. Delaware 3s of 2033 traded at 1.22% versus 1.18% Friday. New York City TFA 5s of 2036 traded at 1.46%.

Denver City and County 2.125s of 2047 at 2.16% versus 2.16%-2.13% Friday. Ohio water 5s of 2050 at 1.58%.

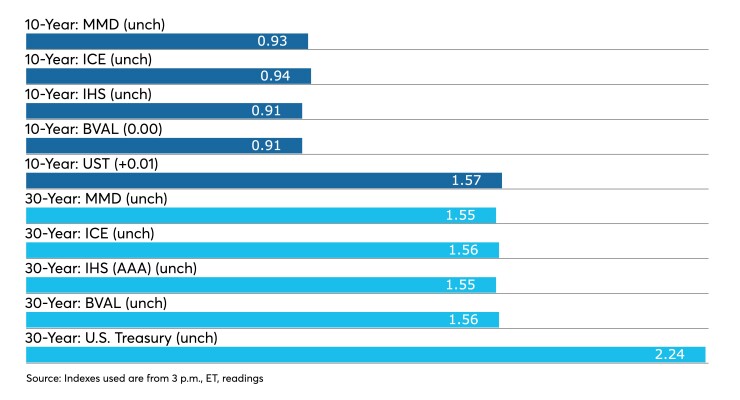

On Refinitiv MMD’s AAA benchmark scale, yields sat at 0.05% in 2022 and 0.08% in 2023. The yield on the 10-year was at 0.93% and the 30-year at 1.56%.

The ICE AAA municipal yield curve showed yields at 0.06% in 2022 and 0.09% in 2023. The 10-year maturity at 0.94% while the 30-year fell to 1.55%.

The IHS Markit municipal analytics AAA curve showed yields rose a basis point to 0.06% in 2022 and 0.09% in 2023, the 10-year at 0.94% and the 30-year at 1.55%.

The Bloomberg BVAL AAA curve showed yields at 0.04% in 2022 and 0.06% in 2023, with the 10-year at 0.91%, and the 30-year yield at 1.56%.

The three-month Treasury note was yielding 0.02%, the 10-year Treasury was yielding 1.57% and the 30-year Treasury was yielding 2.24% near the close. Equities were mixed with the Dow falling 14 points, the S&P 500 rose 0.31% and the Nasdaq gained 0.94% near the close.

Economic indicators

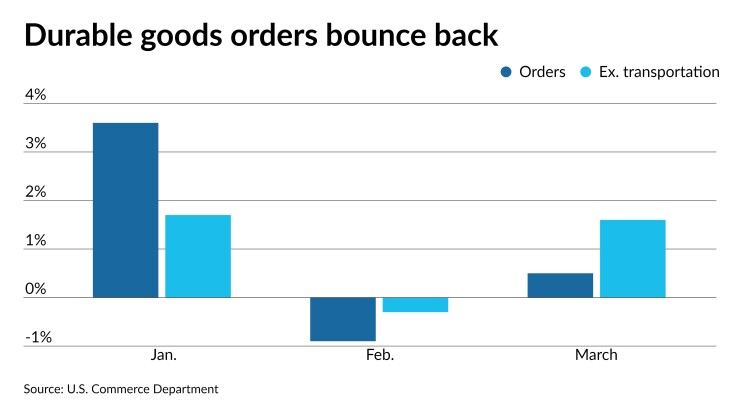

The economic recovery continues, as evidenced by the increase in durable goods orders in March, despite it being a smaller rise than economists expected.

Durable goods climbed 0.5% in March, after falling a revised 0.9% in February, first reported as a 1.2% decline.

Excluding transportation, new orders gained 1.6% after a 0.3% decrease a month earlier, and excluding defense, new orders rose 0.5% following a 0.4% February slide.

Economists surveyed by IFR Markets had expected a gain of 2.5% in March for the headline number, and a 1.6% rise excluding transportation.

“Orders came in at about half of what most were expecting, as the disappointment followed the first contraction in orders for big-ticket capital goods in nine months,” according to Diane Swonk, chief economist at Grant Thornton.

Supply chain bottlenecks were a major reason for the “less than stellar” report.

“That will not stop the economy from more fully healing as we move through the year,” she said. “A pivot in consumer demand from a focus on goods to services, added to catch-up on earlier shortfalls, suggests the bottlenecks will dissipate as we move into the second half of the year.”

“Aircraft orders were largely to blame, but supply chain issues are holding back activity as well,” noted Tim Quinlan and Sarah House, senior economists at Wells Fargo Securities. And consumer demand was spurred by stimulus checks.

February’s revision to a “smaller decline” takes “some but not all of the sting out of” the numbers.

“Despite crosscurrents affecting March data, this durable goods report is consistent with an advancing economy,” said Mickey Levy, Berenberg chief economist for the U.S., Americas and Asia. “Facing strong product demand, manufacturers’ demand for capital and durable goods used in production is strong and expected to rise further.”

Separately, manufacturing activity in the Dallas region “remains robust” and respondents’ outlooks are rosier, according to the Federal Reserve Bank of Dallas.

The company outlook index rose to 29.1 in April from 25.8 in March and general business activity climbed to 37.3 from 28.9.

The outlook uncertainty index dropped to zero from 5.5, suggesting “uncertainty is no longer on the rise.”

The production index fell to 34.0 from 48.0, new orders gained to 38.5 from 30.5.

Prices paid for raw materials rose to 71.4 from 66.0 and prices received for finished goods climbed to 39.1 from 32.2.

The employment index jumped up to 31.3 from 18.8.

The future company outlook index gained to 36.6 from 26.2 and the future business activity index climbed to 36.6 from 33.7.

The future production index climbed to 47.2 from 38.3, new orders gained to 43.2 from 34.0.

Business owners head to exit

“Burned out” business owners are losing confidence and retiring, according to Wilmington Trust’s

The survey found “owners are less sure about the future direction of the U.S. economy and more uncertain about their ability to reach their long-term goals.”

More than twice as many respondents as last year plan an earlier than expected retirement.

Should they leave the workforce, it would be a positive for the economy, said Stuart Smith, national director of business value strategies at Wilmington Trust. “A generational transfer of businesses should mean liquidity for retiring owners and opportunity for a rising generation of leaders to bring new energy and ideas.”

If the owner planned for retirement, having set up “ true management teams, developed strong customer relationships, and created documented, repeatable systems and processes,” they should be able to sell their business, while those who didn’t, he said, “face a greater likelihood of simply closing the doors.”

“It is one thing to say you will retire in a survey but it's another thing to walk away,” said John Rosen, assistant professor and coordinator of political science at the University of New Haven. “I am curious to see if they” follow through.

If many business owners retire, Rosen said, “the impact would be deflationary,” but he added, “I hope we don't have anything like the 1970s.”

The survey also suggested the pandemic led to a rise in technology spending, as companies turned to virtual meetings and work from home models.

This could lead to additional hiring, he suggested. “History has always shown that technology does not replace or take away jobs,” said Rosen. “Productivity-enhancing technology leads to greater overall employment.”

Now that businesses have invested in the latest technology, he said, in the short-term, spending might die down a little but will then ramp back up, as technology evolves.

Noting that many businesses shut during the pandemic, Rosen said, “I expect it's going to be quite a while before storefronts are filled with business’ again.” The pandemic changed behaviors, and, as a result, “retail and commercial office space will be bleak.”

Since opportunities for new employees to learn from more experienced ones, “working from home will make it harder,” Rosen said. “I do think, if you're not in an office environment with older people, institutional and process knowledge walks out the door.”

Primary market

The New Jersey Transportation Trust Fund Authority is set to sell $1.57 billion of bonds on Wednesday in four deals — all priced by Citigroup.

The $589.7 million of Series A refunding bonds (Baa1/BBB/BBB+/NR) consists of serial bonds from 2025-2036. Another $584.2 million consists of forward delivery transportation program bonds (Baa1/BBB/BBB+/A-) in Series AA, which is a refunding structured from 2023 to 2038, while Series 2022 A is also a forward delivery that consists of $281.7 million of Transportation system refunding bonds (Baa1/BBB/BBB+/NR) that mature from 2038 to 2042.

The authority will also sell $116.2 million of fixed-rate program notes (Baa1/BBB/BBB+/A-) in a 2014 Series BB-2 remarketing structure from 2030 to 2040.

The Massachusetts Clean Water Trust is set to offer $354.7 million on Thursday in two series — $142.8 million of state revolving fund bonds in Series 23 A green bonds and $211.8 million of Series 23B sustainability bonds (Aaa/AAA/AAA/NR). Morgan Stanley is the lead manager.

Oregon is set to issue $234.2 million of taxable general obligation bonds (Aa1/AA+/AA+/NR) for higher education on Thursday. Series 2021 G is $129.9 million, while Series 2021 I is $104.3 million — both to be priced by BofA Securities.

The Lamar Consolidated Independent School District, Texas, is set to sell $233.8 million of unlimited tax schoolhouse bonds (Aaa/AAA) on Tuesday. The bonds are insured by the Texas Permanent School Fund Guarantee Program and mature serially 2023 to 2041 with terms in 2046, 2051, and 2061. Raymond James & Associates is the lead bookrunner.

The Northside Independent School District, Texas, is planning to sell $128.2 million of unlimited tax refunding bonds (Aaa/ /AAA/ ) in taxable series 2021 on Tuesday. Insured by the Texas PSF, the deal is structured serially from 2022 to 2041 and is being senior managed by Ramirez & Co.

The Board of the Trustees of Northern Illinois University is set to sell $106 million of auxiliary facilities system revenue refunding bonds ( /AA/ / ) on Tuesday. The bonds are insured by Build America Mutual Assurance Co. and are being priced by bookrunner Piper Sandler.