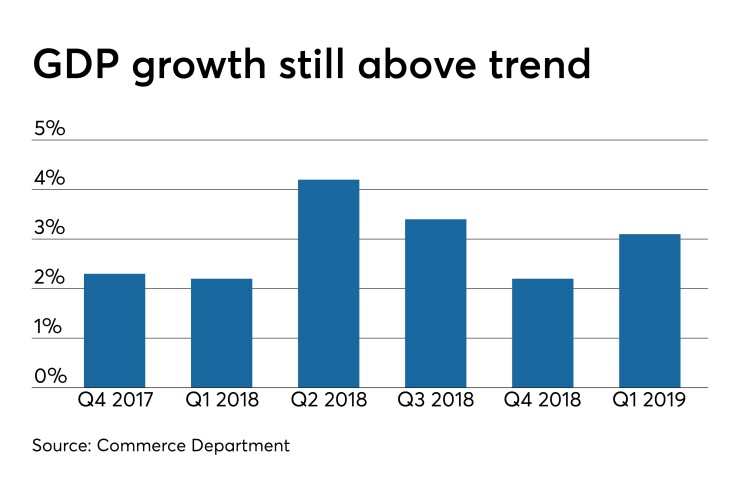

While real gross domestic product continues to surprise to the upside, a decline in pending home sales and a widening trade deficit suggest growth will be slower later in the year.

The Commerce Department said Thursday that economic growth in the first quarter was above trend, with the advance reading of real gross domestic product growth revised to a 3.1% pace from the 3.2% reported in the prior estimate. The consensus estimate was a revision to 3.0% growth.

GDP grew at a 2.2% pace in the fourth quarter of 2018.

“The increase in real GDP reflected increases in consumer spending, inventory investment, exports, state and local government spending, and business investment,” the department said in a release. “Imports, which are a subtraction in the calculation of GDP, decreased.”

Final sales to domestic purchasers rose a revised 1.5% — the slowest in four years. That compared with a 1.4% rise in the prior estimate, after a 2.1% gain last quarter. This suggests underlying demand is weakening.

For the second quarter, Scott Anderson, Chief Economist at Bank of the West Economics, said in an analysis he sees second quarter GDP gaining 1.4%, compared with his prior estimate of 1.7%. “The escalating trade war with China also puts growth in the second half of 2019 at risk. Our baseline forecast is now that second-half 2019 GDP growth remains in the 1.0 to 1.5% range.”

Pending home sales

Pending home sales dropped 1.5% in April to 104.3 from a 105.9 reading in March, the National Association of Realtors reported, as only the Midwest rose.

Year-over-year, sales fell 2.0%, the 16th straight month sales declined on an annual basis.

“The decline occurred despite lower mortgage rates,” Anderson pointed out. “The 30-year fixed rate has decreased from close to 5.0% in November 2018 to around 4.1% in April.”

“Though the latest monthly figure shows a mild decline in contract signings, mortgage applications and consumer confidence have been steadily rising,” Lawrence Yun, NAR chief economist said. “It’s inevitable for sales to turn higher in a few months.”

Before adjustment, the numbers improved in all regions except the West, said Mike Fratantoni, Mortgage Bankers Association chief economist. "The pending and existing-home sales data continues to paint a different picture of the housing market, compared to the recent strength we have seen in new home sales and purchase application data. Purchase applications have increased 15 straight weeks on an annual basis, and it's likely this positive momentum will lead to increased sales activity as we enter the summer."

Jobless claims

Initial jobless claims rose 3,000 to 215,000 in the week ended May 25, the Labor Department reported.

Continuing claims declined 26,000 to 1.657 million in the week ended May 18.

Fedspeak

Monetary policy should rely mainly on the expectations for employment and inflation, not on "the state of financial vulnerabilities,” Federal Reserve Board Vice Chair for Supervision Randal Quarles said at a research conference, according to prepared text released by the Fed. “Financial system resilience, supported by strong through-the-cycle regulatory and supervisory policies, remains a key defense against financial system and macroeconomic shocks.”

Meanwhile, Vice Chairman Richard Clarida, speaking in New York, said, "The U.S. economy is in a very good place, with the unemployment rate near a 50-year low, inflationary pressures muted, expected inflation stable, and GDP growth solid and projected to remain so.''

But, if incoming data showed “a persistent shortfall in inflation below our 2% objective or were it to indicate that global economic and financial developments present a material downside risk to our baseline outlook, then these are developments that the Committee would take into account in assessing the appropriate stance for monetary policy,” he said, according to prepared text.