Illinois' latest pension results tell two tales.

The actuarially based unfunded liability tally that smooths the impact of investment returns improved slightly to $139 billion from $139.9 billion last year, propped up by the

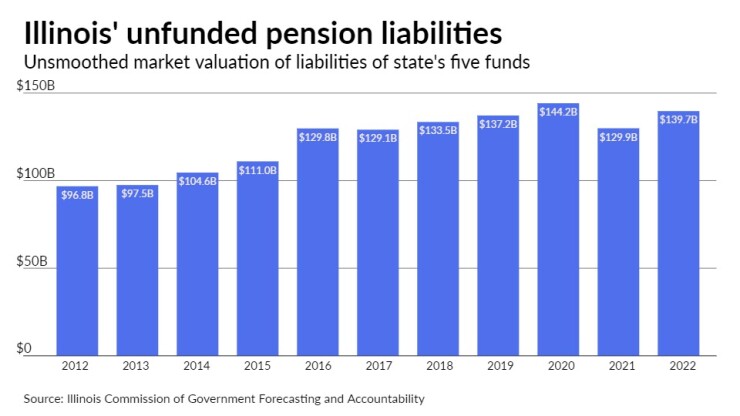

But the market valuation that provides an unsmoothed snapshot of the current health of the five state pension funds piled $10 billion onto the unfunded tab to hit $139.7 billion, compared to $129.9 billion in fiscal 2021.

The unfunded actuarial

"In fiscal year 2022, the unfunded liability based upon market value of assets increased by approximately $9.8 billion, a 7.5% growth from the previous year, due mainly to market value investment losses," COGFA said.

The funded ratio on an actuarial basis rose to 44.1% from 42.4% while on the market value basis it deteriorated to 43.8% from 46%.

All five systems assume investment returns at either 6.5%, 6.75% or 7%, with the largest fund, the Teachers' Retirement System, at 7%. The market's downturn sunk all five in fiscal 2022 to negative territory with losses between a negative 1.2% to a negative 6.4% following returns that topped 20% in 2021.

Smoothing the impact of investment results over five years — a strategy the state began in 2009 — allowed each fund to record for actuarial purposes a return in the 7% range.

"In effect, the systems are still reaping the positive benefits of the outsized FY 2021 investment returns because of the asset smoothing law," COGFA said.

The state launched buyout programs for the top three systems in 2018 that have been extended through 2024 funded with several billion dollars in authorized general obligation bond borrowing. The buyouts had a positive $256.3 million impact in lowering the liabilities for fiscal 2022.

"Overall, the aggregate unfunded liability has grown significantly over the past 15 years from $54.4 billion in FY 2008 to $139.7 billion in FY 2022," the report noted of the market value results. "The primary driver behind the growth in the combined unfunded liability has been actuarially insufficient state contributions determined by the current pension funding policy."

The state's contribution will total $10.9 billion in fiscal 2024 — down about $40 million from this year — based on the preliminary requests. About $9.8 billion comes from the state's roughly $46 billion general fund.

The total contribution falls $4.4 billion short of a $15.3 billion contribution required to meet an actuarially determined level based on sound accounting principles.

Rating agencies and civic groups have warned that the 2022 market tumble would impact both the unfunded tab and required contributions.

"We expect the uncertainty in projecting pension contributions will persist in fiscal 2023 for (U.S. public finance) issuers because market returns are built into funding models influencing a large part of pension plan inflows and funding amounts," S&P Global Ratings analyst Todd Kanaster said in a summer report.

Illinois doesn't face higher payments, which underscores the flaws of its pension funding methods.

Under the funding schedule, the state is required to make contributions as a level percent of payroll in fiscal years 2011 through 2045. The contributions are required to be sufficient, when added to employee contributions, investment income, and other income, to bring the total assets of the systems to 90% of the actuarial liabilities by fiscal year 2045.

The funds aren't projected to reach 50% until 2028 and don't hit 70% until 2040.

The state actuary's report typically recommends a change in the 90% funding target and higher contributions but state leaders have paid little heed to the suggestions.

The report highlights the weight of the state's pension burden on state finances, which has been overshadowed over the last year by fiscal progress as Gov. J.B. Pritzker directed surplus revenue to pay down a backlog of bills and rebuilt a depleted rainy day fund. Pritzker also directed $500 million in supplemental pension contributions.

The strides have raised the state's ratings that sat a one notch away from junk territory heading into the COVID-19 pandemic to the BBB-plus/Baa1 level.

TRS actuary Segal lays out a dim view

"The state funding has been inadequate, resulting in TRS being among the worst funded public employee retirement systems in the United States. We strongly recommend an actuarial funding method that targets 100% funding."

The change would keep liability growth in check by covering the normal cost, interest on the unfunded tab, and paying down the principal balance.

Last year, Budget Director Alexis Sturm said the 90% target remained reasonable given other pressures on the state budget, such as the backlog and pandemic-related borrowing, all of which now has been paid down.

The Teachers' Retirement System, which accounts for 58% of liabilities made up $80.6 billion of the actuarial tab and a funded ratio of 43.8%, followed by the State Employees Retirement System with $29.2 billion and a funded ratio of 44%, the State Universities Retirement system with $27.3 billion and a funded ratio of 45.3%, the judges' system with $1.6 billion and a funded ratio of 44.3%, and General Assembly fund at $283 million and a funded ratio of 22%.

Under state rules, the five funds must submit their contribution requests for the next fiscal year by Nov. 1 based on the actuarial reports for the previous fiscal year that closed June 30. COGFA compiles those reports and annually releases its "November Special Pension Briefing" in early December. The state actuary issues its own report certifying the state contributions early in the New Year.

In a statement late Thursday, Pritzker spokeswoman Jordan Abudayyeh said: "Today, Illinois is better prepared for these market fluctuations, and is still well below the height of the unfunded pension liability. On top of that, we've reached a point where pension contributions are no longer projected to grow faster than existing state revenue sources — which created tremendous stress and strife on the state budget. Additionally, the governor is the first leader in history to pre-pay the pensions and build up a Budget Stabilization Fund. We will continue the proven methods that responsibly reduce the long-term obligation while ensuring that retirees receive the benefits they were promised."