Want unlimited access to top ideas and insights?

The employment report suggests the economy is slowing, though not to the point of recession.

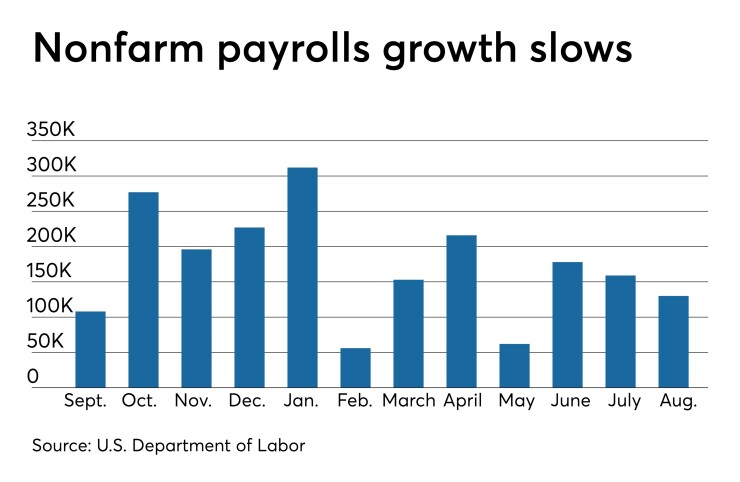

Nonfarm payrolls rose a less-than-expected but still robust 130,000 in August after a gaining 159,000 in July, the Labor Department reported Friday. The July gain was originally reported as 164,000.

“As expected, given the global slowdown in economic growth, and increasing signs of a slowing in the pace of U.S growth, we are seeing job gains cool down a bit," said Mike Fratantoni, Mortgage Bankers Association senior vice president and chief economist. "August’s 130,000 increase in jobs was somewhat supported by federal government hires for the decennial Census, with private growth of only 96,000 jobs. We expect that job growth will continue to wane, and that there will be some upward pressure on the unemployment rate over the next year.”

Economists expected 160,000 new jobs in the month. While the three-month average of just under 156,000 more than covers the number of incoming workers, it falls far short of the nearly 241,000 jobs added on average for the same three months a year ago.

“The average 155k increase in payrolls over the last 3 months is consistent with slowing US growth. In percentage terms, job growth is now down to around 1.4% from 1.7% a year ago," said Brian Coulton, chief economist at Fitch Ratings. "But it doesn’t look anything like impending recession territory. The labor market doesn’t seem to be dancing to the same tune as the bond market.”

While the report “confirms slowdown fears,” it “by no means is pointing to a recession anytime soon,” according to Edward Moya, senior market analyst, New York at OANDA. “The employment report pretty much cements only a 25-basis point rate cut for the Fed at the Sept. 18 meeting. The global growth outlook remains soft and it is unlikely we get a landmark moment in the trade war this month that will ease businesses’ concerns that is making them hesitate with capex and investments.”

"A weakish employment report fails to bolster the argument for a 50bps cut in and of itself, but the Fed appears on track for a second quarter-point reduction," said Stifel Chief Economist Lindsey Piegza.

Consumers hold the key to expansion.

“The U.S. economy will continue to expand as long as consumption growth remains strong enough to offset sluggish business fixed investment, the U.S. and global industrial slowdown and declining exports,” wrote Mickey Levy, Berenberg Capital Markets' chief economist for the U.S. Americas and Asia and U.S. Economist Roiana Reid. “Job growth has slowed from the ~200k pace of recent years, but it is still strong enough to keep the unemployment rate low and worker and consumer confidence high. Moreover, households’ optimism about labor markets and future income prospects have soared, increasing the likelihood of continued robust spending on discretionary goods and services.”

The report "was stronger than sub-par headline payroll growth suggests," Levy and Reid said. "The U.S. economy is in good shape."

The unemployment rate held at 3.7%.

The average workweek rose to 34.4 hours in August from 34.3 in July, while hours worked increased 0.4% after a 0.2% drop the month before.

Average hourly earnings posted a 0.4% gain in the month and a 3.2% year-over-year rise.

“The pickup in wage growth is in line with rising unit labor costs, which have ticked up to 2.6% y/y in Q2 from 1.0% y/y as recently as Q4 2018,” BNP Paribas Securities Chief U.S. Economist and Head of Markets360 Daniel Ahn, U.S. Economist Andy Schneider, and Macro Quant Strategist & Data Scientist Joel Alcedo wrote in a note. “While we expect this to factor into core CPI rising to 2.6% y/y by Q2 2020, we think the FOMC will arguably be more attuned to inflation expectations than spot inflation per se.”

Manufacturing employment was light: adding just 3,000 jobs in the month as the sector exhibits continued weakness, a situation not helped by the trade war with China, which impacts manufacturing more than other parts of the economy.