The index tracking yields on seven-day variable-rate demand obligations rose 31 basis points last week, Patrick Luby, senior municipal strategist with CreditSights, pointed out in a Monday market comment, a move that signals increased volatility.

In contrast, the SIFMA index rose 50 basis points on April 17 and fell 53 basis points on May 8. In absolute terms, Luby said the movements in the index have been more volatile this year than in recent years, but adds that this latest move should not be overly concerning.

“We believe that the increased volatility in the SIFMA index (and VRDO yields) is a consequence of the money market funds regulatory reform that became effective in October 2016, which established three classes of money market funds and required institutional funds to have floating NAVs (rather than a stable $1 NAV). Since then, assets in the institutional tax-exempt money market funds have dwindled and we believe that direct investment in VRDOs has increased as a result,” Luby wrote. “In 2016, Institutional tax-exempt money market funds held an average of $49.8 billion in assets in the weeks prior to the effective date of reform and $4.9 billion a year. So far this year, they have held an average of $9.6 billion.”

The year-to-date average weekly change has been 14 basis points, up from 11 basis points through June 13 of last year; for all of 2018 the average was nine basis points; in 2017 and 2016 it was four basis points and three basis points, respectively. Since the beginning of 2008, the weekly absolute change has averaged seven basis points.

Luby speculated that last week's increase in the index was probably due to VRDO liquidations to pay second-quarter estimated Federal income taxes (which were due Monday) and to the increased availability of short-term fixed-rate municipals. So far this year, short-term muni issuance has averaged $624 million; but the last three weeks have seen averages of $1.6 billion and this week's calendar has $1.1 billion of short-term sales on it.

At the close on Friday, the amount of VRDOs offered on the Bloomberg Money Market Offerings system was $7.4 billion, above the year-to-date daily average of $3.9 billion, but in line with the $7.5 billion offered as of the previous Friday, he noted.

Looking at performance, Luby said that last week the return on the ICE BofAML Municipal Bond Index was negative for the first time since the week ended April 19 and lagged the Treasury and corporate bond indices.

In the taxable sector, muni performance has been in line with corporates so far this year, BofA Merrill Lynch said in a research report released Monday.

“On a duration-adjusted basis, the ICE BofAML Muni Master index performed in line with corporates. We continue our strategy of ‘the longer the better,’ as we are bullish on muni rates, but neutral on the flattening/steepening question,” Yingchen Li, municipal research strategist at BofA wrote. “BBB- and A-rated indexes continue to outperform the muni high-grade and high-yield indexes. Sector performances can all be explained by their duration and composite ratings. Sectors with A composite ratings are the best performers, second only to Leasing & Rentals Index due to its shorter duration.”

“Our argument of munis' equal performance against corporates year to date can be made clearer if we look at the taxable muni index (TXMB) and the BAB's index (BABS), which have durations of 8.61 and 8.41, respectively. Both are higher than Corporate Master index's (C0A0) 7.12 duration. TXMB returned 7.40% year to date and BABS 7.10%,” Li wrote.

FOMC: What’s the deal in D.C. this week?

The Federal Open Market Committee

The FOMC will be looking at a strong labor market even as manufacturing has been showing weakness. Meanwhile, the yield curve is inverted in spots, consumer sentiment is weakening, although still high, and inflation has been below 2%.

The Empire State Manufacturing Survey showed contraction in June, dropping 26 points, its largest-ever one-month decline. Not to mention trade issues with China that will hit growth in the short-term.

The markets are pricing in multiple rate cuts this year, but the Fed has to date offered no more than saying it will do what’s appropriate to keep the expansion going.

That could change with a new Summary of Economic Projections, or dot plot, a post-meeting statement and, perhaps most importantly, Fed Chair Jerome Powell’s press conference.

It will be difficult for the Fed to reiterate its recent statements suggesting the economy is in a good place and it will need to address the issues the market sees which have it pricing in rate cuts this year.

Monday’s muni menu

Investors are devouring new issues and showing little appetite for the secondary market as the summer reinvestment season progressed on Monday. Last week’s mammoth $10 billion slate, was well received by investors — and that demand continued as Monday’s activity was equally strong, traders said.

Primary deals are seeing strong demand and getting done — at historically consistent prices — but otherwise the market is lackluster, a Florida trader said.

“You would think some activity would spill over into the secondary — especially because of the municipal to Treasury ratios — but you’re not seeing it,” the trader said. “Buyers are buying in the primary and the secondary is languishing,” and not moving at the primary market levels due to the low rate environment, he said.

“Secondary traders, dealers, and hedge fund accounts who rely on activity and flow are frustrated — they are not seeing the volume and turnover they believe they should be seeing because of the positive fundamentals,” he added.

While he said the new-issue market is fundamentally “sound and doing well,” the price gains and volume are less robust than expected.

“We all came into June with expectations for net-negative supply, solid demand, and continuous flow — that means constant buying and selling which continues to create price gains and high volumes — but we are not getting any of that impact on pricing and volume,” the trader said.

A giant Florida transportation deal joined two sizable airport offerings, and a handful of other large financings in the market last week prior to the FOMC meeting. Morgan Stanley priced last week’s Florida Development Finance Corp.’s (Aaa-VMIG1) $950 million of Series 2019B surface transportation facility revenue bonds. The bonds are subject to the alternative minimum tax for the Virgin Trains USA Passenger Rail project.

The Florida trader said there was demand for the transportation deal, especially given the timing amid reinvestment demand and yield potential in the low-rate environment.

In other activity, bonds in the Los Angeles Department of Airport’s (Aa3/AA-/AA-) deal on behalf of Los Angeles International Airport had a varied impact on pricing when compared to the MMD scale, others noted.

“LAX comes 10 to 12 through the scale on the short end and 10 to 20 over the scale on the long end,” John Mousseau, president and chief executive officer of Cumberland Advisors, observed on Thursday of the Goldman Sachs-managed deal. “This has become a pattern in high-tax state issues.”

Mousseau predicted that a fair amount of airport money in high-tax states has piled into the front end of the curve at levels that are barely break even — if that — versus Treasuries

Primary market

Even with $8.5 billion on the new-issue calendar for this week, the 30-day net supply (issuance minus redemptions) stands at negative $36.4 billion, CreditSights’ Luby said.

But bond buyers will see lots of supply head their way this week, starting on Tuesday.

The University of Alabama’s Board of Trustees (NR/AA/NR) is competitively selling $171.525 million of general revenue bonds in two offerings consisting of $144.285 million of Series 2019B and $27.24 million of Series 2019A bonds.

Proceeds are being issue to finance the cost of certain capital improvements. The financial advisor is Protective Securities, a division of ProEquities. The bond counsel is Maynard Cooper.

Morgan Stanley is expected to price the Metropolitan Water District of Southern California’s (NR/AA+/AA+) $281.065 million of state revolving fund general revenue bonds consisting of Series 2019A green bonds and Series 2019B refunding bonds.

Citigroup is set to price the Indiana Finance Authority’s (Aa2/AA/AA) $291 million of hospital revenue bonds for the Indiana University Health Obligated Group as a remarketing.

On Wednesday, Georgia is selling $950.905 million of unlimited tax general obligation bonds in four sales. The deals consist of $351.185 million of Series 2019A Tranche 1 GOs and Series 2019C refunding GOs, $321.17 million of Series 2019A Tranche 2 GOs, $141.07 million of Series 2019B taxable GOs and $137.48 million of Series 2019B taxable GOs.

In the negotiated sector, Citigroup is expected to price the Pennsylvania Turnpike Commission’s (A3/NR/A-/A+) $706.335 million of Series 2019A turnpike subordinate revenue bonds on Wednesday.

Secondary market

Munis were little changed on the

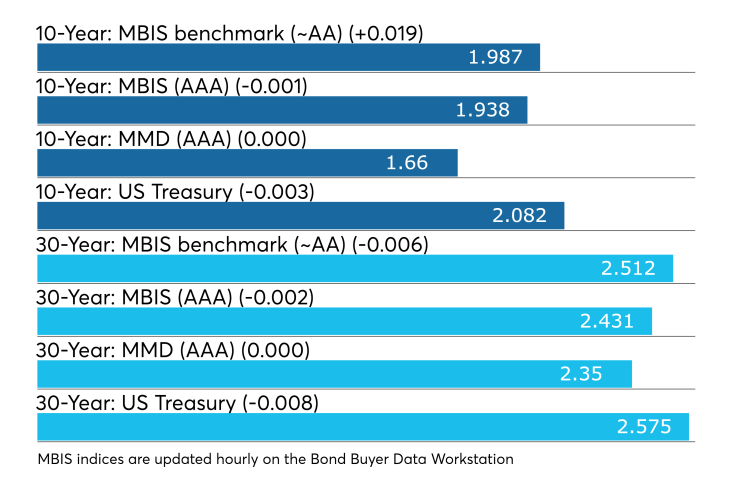

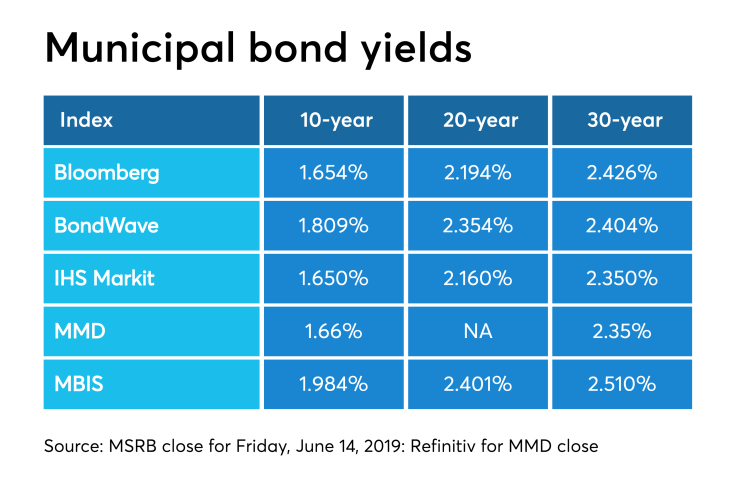

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni GO and the 30-year muni yield remained unchanged at 1.66% and 2.35%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 79.7% while the 30-year muni-to-Treasury ratio stood at 91.2%, according to MMD.

“The ICE Muni Yield Curve is within one basis point of the previous session’s levels as the market waits for the FOMC meeting,” ICE Data Services said in a Monday market comment. ”The tobacco and high-yield sectors are mixed today and taxable yields are unchanged except for the two-year and shorter maturities which are up, led by the one-year up 4.7 basis points.”

Treasuries were mixed as stocks traded mixed. The Treasury three-month was yielding 2.194%, the two-year was yielding 1.854%, the five-year was yielding 1.846%, the 10-year was yielding 2.082% and the 30-year was yielding 2.575%.

Previous session's activity

The MSRB reported 27,574 trades Thursday on volume of $9.61 billion. The 30-day average trade summary showed on a par amount basis of $12.49 million that customers bought $6.18 million, customers sold $4.20 million and interdealer trades totaled $2.11 million.

California, New York and Texas were most traded, with the Golden State taking 15.495% of the market, the Empire State taking 11.817% and the Lone Star State taking 10.506% of the market, the Golden State taking 15.495%.

The most actively traded security was the Amsterdam CSD, N.Y., BAN 2.25s of 2036, which traded 52 times on volume of $32.98 million.

Last week's actively traded issues

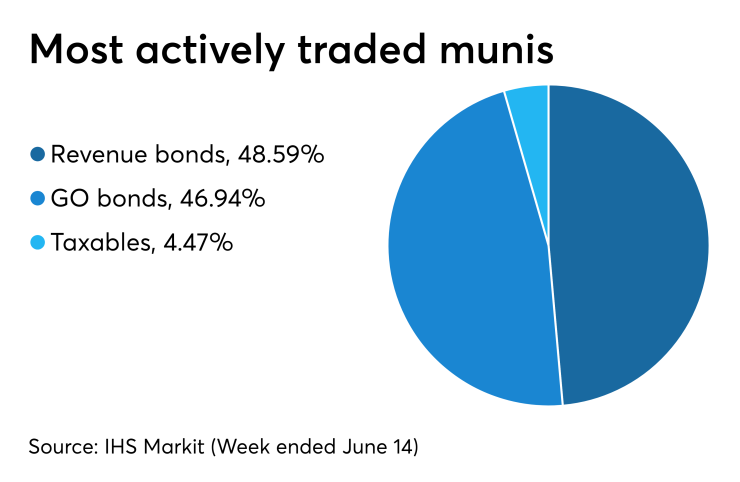

Revenue bonds made up 48.59% of total new issuance in the week ended June 14, down from 49.07% in the prior week, according to

Some of the most actively traded munis by type in the week were from Puerto Rico, Missouri and Puerto Rico issuers.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 28 times. In the revenue bond sector, the Kansas City Industrial Development Authority 5s of 2046 traded 44 times. In the taxable bond sector, the Puerto Rico Sales Tax Finance Corp. 4.55s of 2040 traded 20 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $36 billion of three-months incurred a 2.170% high rate, down from 2.240% the prior week, and the $36 billion of six-months incurred a 2.130% high rate, off from 2.140% the week before.

Coupon equivalents were 2.218% and 2.189%, respectively. The price for the 91s was 99.451472 and that for the 182s was 98.923167.

The median bid on the 91s was 2.140%. The low bid was 2.100%. Tenders at the high rate were allotted 72.03%. The bid-to-cover ratio was 2.84.

The median bid for the 182s was 2.105%. The low bid was 2.065%. Tenders at the high rate were allotted 38.21%. The bid-to-cover ratio was 2.88.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.