September municipal bond issuance declined 43% year-over-year, with nearly every structure and sector seeing large drops, as issuers eschewed the market amid another Federal Reserve rate hike and severe global market volatility.

Third-quarter issuance was down 26% led by a steep drop in taxable and refunding volumes, according to Refinitiv data. Total issuance for the first three quarters of the year is down 14.8% from 2022, likely leading to 2022 falling short of 2021's and 2020's

For the first three quarters, total issuance sits at $308.440, down from $361.932 billion in 2021. Taxables are down 48.0% to $45.724 billion from $87.979 billion.

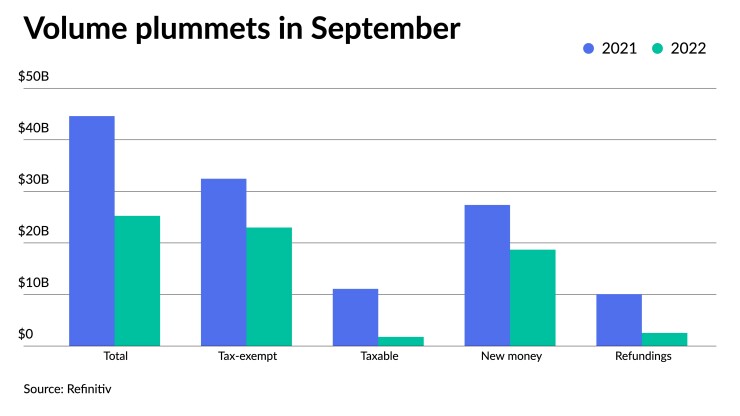

Total September volume was $25.253 billion in 511 deals versus $44.604 billion in 1,024 issues a year earlier, according to Refinitiv data. Taxable issuance totaled $1.778 billion in 44 issues, down 84.0% from $11.098 billion in 178 issues a year ago. Tax-exempt issuance was down 29.2% to $22.987 billion in 461 issues from $32.454 billion in 838 issues in 2021.

Reversing course from the past few months, new-money issuance was down 31.7% to $18.697 billion in 470 transactions from $27.370 billion a year prior.

Refunding volume decreased 74.8% to $2.544 billion from $10.082 billion in 2021 and alternative-minimum tax issuance dropped to $489.6 million, down 53.4% from $1.051 billion.

September felt like an inflection point for the market, noted CreditSights strategist Pat Luby.

"It's just been a really tough month all the way around. The volatility has increased, making it more difficult to hedge. Higher hedging costs means either less available liquidity in the secondary market or wider spreads," he said.

"The September results are going to make all market participants, whether the buy-side or sell-side, more conservative as we move through the last through the last months of the year," Luby said.

The muni selloff and resulting large losses in September led to the lower issuance levels, noted BofA strategists Yingchen Li and Ian Rogow.

"September is typically light anyway, only this year it is especially so," they said.

Compounding the lighter issuance, well below the 10-year average of $32.559 billion, was September Federal Open Market Committee meeting during the second to last week of the month in which the Fed implemented its third 75-basis-point rate hike.

Usually around weeks where the FOMC meets, issuance falls, said Eve Lando, a portfolio manager for Thornburg Investment Management.

"Everyone is waiting to see, but this time in September, [issuance] just plummeted," she said, as total volume went from $3.6 billion the week prior to $1.3 billion during the week of the FOMC meeting, according to Refinitiv. "It's understandable and logical. Issuers wanted to avoid being caught in the crossfire that week. We're facing a 75 basis point rate hike."

"Only a couple of issuers sold bonds that week," Luby said. "Even if issuers wanted to come that week, a lot of investors were rightfully reluctant to want to put money to work in advance of the Fed's latest rate hike."

He said it would have been "difficult for an investor to make a buy decision prior to the FOMC, unless bonds got priced so cheap, it would overcome that uncertainty."

"It was a combination of buyer reluctance and that greater uncertainty from the Fed earlier in that in the first half that week would have made it prohibitively expensive for issuers to borrow prior to when the Fed made their announcement," he said.

Some of the supply that would have been issued during the week of the FOMC meeting did come to market the following week — explaining the rebound in supply — but some of it was also deferred, he noted.

And while the reduced new-issue volume takes some pressure off the market by reducing supply, "it also reduces the energy level in the market," Luby said.

"There are many investors who rely on the new-issue market, and they're not necessarily going to shift their attention into the secondary market if the new-issue market is slow," he said. "So even though heavy supply can oppress prices, prices may not are necessarily going to benefit from the reduction of supply."

Looking ahead, October is historically a larger new-issue month, though next week's calendar sits at an estimated $3.8 billion, down from this week's $7.1 billion.

"The next one to five weeks or so would ordinarily be clear sailing for new issues to come into the market, but the volatility may affect some of those financings," Luby said.

Lando said she sees issuance in October rebounding from September, saying if several of those prepaid deals return to the calendar, then new issuance will spike.

BofA strategists said recent market conditions may "continue into October if Wednesday's Treasury market rally proves to be short-lived," but "if that rally has more follow through, munis should at least stage a tactical rally as well and produce a more normal October with large issuance and active two-way flows."

Li and Rogow estimate October total principal redemptions and coupon payments at $39 billion and new issuance of $41 billion.

Issuance details

Revenue bond issuance decreased 56.8% to $11.770 billion from $27.257 billion in September 2021, and general obligation bond sale totals dropped 22.3% to $13.484 billion from $17.346 billion in 2021.

Negotiated deal volume was down 48.8% to $17.944 billion from $35.017 billion a year prior. Competitive sales decreased to $7.057 billion, or 19.4%, from $8.755 billion in 2021.

Deals wrapped by bond insurance dropped 59.6%, with $1.280 billion in 86 deals from $3.170 billion in 200 deals a year prior.

Bank-qualified issuance dropped to $584.8 million in 163 deals from $1.174 billion in 299 deals in 2021, a 50.2% decrease.

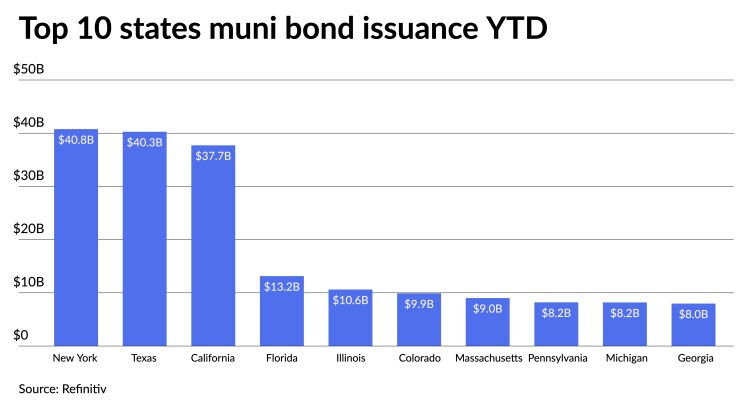

In the states, New York claimed the top spot year-to-date.

Issuers in the Big Apple accounted for $40.781 billion, up 6.4% year-over-year. Texas was second with $40.270 billion, down 0.1%. California was third with $37.721 billion, down 36.5%, followed by Florida in fourth with $13.152 billion, down 4.8%, and Illinois in fifth with $10.625 billion, a 14.0% increase from 2021.

Rounding out the top 10: Colorado with $9.903 billion, down 0.4%; Massachusetts with $9.022 billion, down 3.1%; Pennsylvania with $8.220 billion, down 44.6%; Michigan at $8.194 billion, up 8.0%; and Georgia with $7.983 billion, up 22.0%.