WASHINGTON – Sens. Cory Booker and James Lankford have introduced a bipartisan bill that would prohibit the use of tax-exempt bonds to finance professional sports stadiums.

Their bill mirrors a House version introduced in March by Rep. Steve Russell, R-Okla.

“Using billions of federal taxpayer dollars for the subsidization of private stadiums when we have real infrastructure needs in our country is not a good way to prioritize a limited amount of funds,’’ Lankford, R-Okla., said in a press release.

“Professional sports teams generate billions of dollars in revenue,’’ Booker, D-N.J. said in the release. “There’s no reason why we should give these multi-million-dollar businesses a federal tax break to build new stadiums. It’s not fair to finance these expensive projects on the backs of taxpayers, especially when wealthy teams end up reaping most of the benefits.”

Like the Russell legislation, the Booker/Lankford bill says that any bonds used to finance professional sports stadiums "shall be treated as meeting the private security or payment test of the tax law on private activity bonds."

Under the tax law, bonds are PABs if more than 10% of the bond proceeds are used by private parties and if debt service on more than more than 10% of the bond proceeds is secured by, or derived from, private parties. Once the two-part test has been met, PABs are only tax-exempt if they fall within one of several specified categories, none of which cover professional sports facilities.

But typically sports stadiums have been financed with tax-exempt governmental bonds because, while the bonds meet the 10% private use test, they fail the 10% private payments test when the debt is repaid from generally applicable taxes rather than private parties. If the private payments test is removed, sports stadium bonds would become PABs and would then be taxable because there is no tax-exempt PAB category for sports stadiums.

Booker and Lankford said their bill would not prevent localities and states from bidding and offering economic incentives to teams.

Their release said the bill “unties the hands of local governments to finance their stadium subsidies with taxes on tickets and in-stadium purchases—in other words, allowing states to target taxes on the people who actually use and benefit from the subsidy.’'

Current tax law does not allow local governments to finance federal stadium subsidies by levying taxes on stadium purchases, they said

The bill could grab the attention of the Trump administration and Republican lawmakers who are working on a tax reform plan to broaden the tax base by eliminating many exemptions and deductions. Those revenues would be used to lower overall corporate and individual tax rates.

State and municipalities have been lobbying to keep the tax exemption for municipal bonds used to finance transportation and other infrastructure, but the exemption for sports stadiums might be put on the chopping block.

However, the Municipal Bonds for America coalition does not support any changes to current laws covering tax exempt bonds.

"The overwhelming majority of borrowings for projects are voter approved via referendum. It is of paramount importance to preserve this local decision making power since it’s the voters themselves who truly understand the needs of the communities they live in,'' the coalition said. "Therefore, we would caution against any approach to limit the use of tax-exempt municipal bonds, particularly where state and local governments have determined to use their own tax dollars and other revenues to support the related project.''

A Brookings Institution report issued last September estimated $3.2 billion in federal tax revenue has been lost since 2000 through the use of tax-exempt bonds to finance construction or renovations of 36 sports stadiums. Another $500 million in revenue was lost through the tax avoidance by people who purchased those tax-exempt bonds, the report estimated.

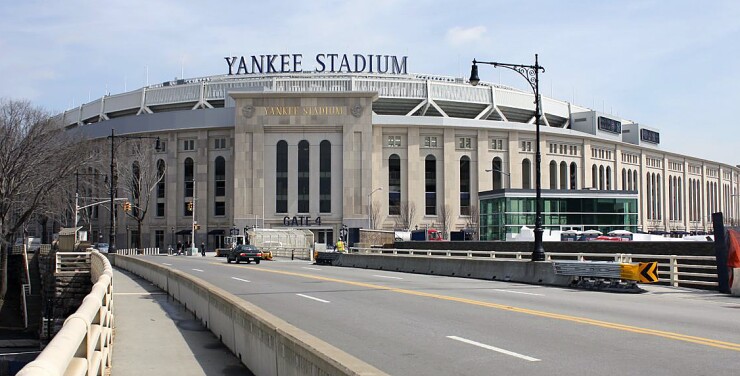

The new Yankee Stadium in the Bronx that opened in 2009 topped that list of sports stadium projects with the biggest tax cost. Brookings estimates the federal government lost $431 million in possible tax revenue because of the $1.7 billion in municipal bonds that helped finance the $2.5 billion cost of construction. Brookings estimates the buyers of those bonds received an additional $61 million in tax exemptions.

“Decades of academic studies consistently find no discernible positive relationship between sports facilities and local economic development, income growth, or job creation,’’ the Brookings report said. “And local benefits aside, there is clearly no economic justification for federal subsidies for sports stadiums.’’