For only the second time in a year, Oklahoma’s gross receipts to the Treasury surpassed those of the same month in 2020, State Treasurer Randy McDaniel reported Tuesday.

Receipts in March of $1.1 billion rose 3.2%, lifted by rising oil and gas revenue, McDaniel said.

The last time monthly receipts exceeded prior year collections was in July, but that increase was due to a three-month delay in income tax filings.

“This positive economic report is encouraging news,” McDaniel said. “Among the more favorable signs is the upward trend in oil and natural gas activity.”

Gross production taxes on oil and gas grew more than $90 million for the month, up by more than 15% from March of last year. That marks the first positive month for gross production in a year-and-a-half.

Gross production receipts are expected to continue to rise for at least the next few months, McDaniel said. March remittances are based on oil field production in January, when West Texas Intermediate Crude Oil averaged $52 per barrel. The price in February averaged above $58 per barrel, and the average price in March hit $62.

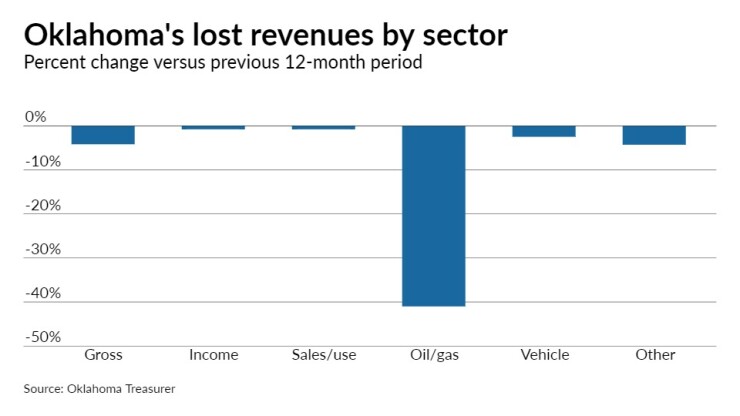

Combined gross receipts from the past 12 months of $13.15 billion are below collections from the previous 12 months by $572.9 million, or 4.2%. All major revenue sources show reductions during the period, but the bottom-line contraction was reduced by 0.2% compared to last month’s report.

The Oklahoma Business Conditions Index in March remained above growth neutral for a fourth month. The March index was set at 63, compared to 67.1 in February. Numbers above 50 indicate economic expansion is expected during the next three to six months.

The February unemployment rate in Oklahoma was reported as 4.4%, according to the U.S. Bureau of Labor Statistics. The state’s jobless rate was unchanged from January, but up from 3.1% in February 2020. The U.S. unemployment rate was set at 6.2 % in February.

Gross income tax collections, a combination of individual and corporate income taxes, generated $412 million in March, up by $29.3 million, or 7.7%. Individual income tax collections are $365.6 million, an increase of $37.2 million, or 11.3%.

Corporate collections are $46.4 million, down by $7.8 million, or 14.5%, McDaniel said.

Combined sales and use tax collections, including remittances on behalf of cities and counties, totaled $423 million, an increase of $1 million, or 0.2%. Motor vehicle taxes produced $79.7 million, up by $7.2 million, or 9.9%.