Selling pressure on the short end continued on Monday and triple-A benchmark yields were cut by as much as five basis points there while U.S. Treasuries pared back earlier gains and equities rebounded from a large selloff earlier in the day.

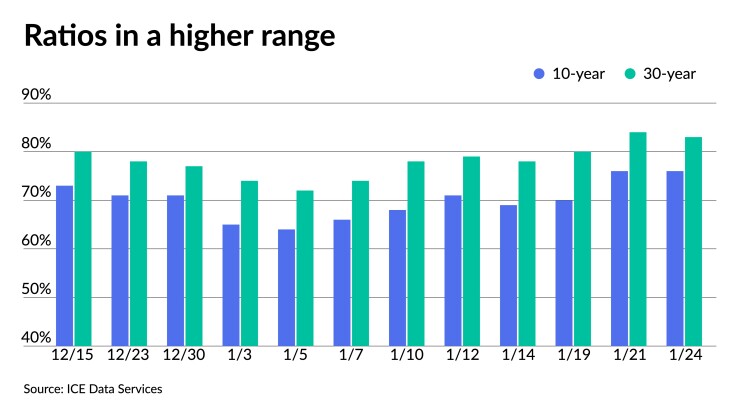

Ratios rose with the day's moves with the municipal to UST five-year at 64%, 75% in 10 and 83% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 61%, the 10 at 76% and the 30 at 83%.

Looking at how high ratios have risen, particularly on the short end, ratios started 2022 at 37% in two-years, 43% in five, 65% in 10 and 73% in 30.

The muni selloff is not a surprise, Nuveen said in a Monday market note. Tax-exempt rates have been rich relative to Treasury bonds and this decline puts tax-exempt rates closer to fair value.

Not only are rates rising, but volatility is also high — it's at its highest level since the first quarter of 2021 — making investors warier about the municipal market, according to Barclays strategists.

Higher rates have led a majority of U.S. fixed income asset classes to underperform on a total return basis this year, and munis have been no exception, with tax-exempt indices down 1.38% and taxable indices down 2.6% year-to-date.

The market also

“We are continuing to watch muni flows, with outflows typically correlated with large rate spikes,” they said. “Not only ratios have started moving higher, but spreads have also begun decompressing, with high-beta names — mainly triple-Bs and some single-As — underperforming.”

High-yield saw inflows last week and outperformed the rising rates of investment grades. High-yield municipal bond yields increased 6 basis points on average versus AAA-rated yields rising 8 to 10, Nuveen noted.

"Municipal-to-Treasury yield ratios increased as a result, and high-yield municipal credit spreads decreased," Nuveen said, adding that selling pressure "remains light and limited to specific market areas.

"Mutual funds remain cash rich, but appear patient and selective as yields have drifted higher," Nuveen said. "However, yields and credit spreads are wider than they have been for months. This has gone a long way to resolve the reinvestment risk for persistent cash balances, which bodes well for fund earnings going forward."

Barclays said that while taxables munis have been outperforming corporates, historically large corporate spread swings have been predecessors to taxable munis' widening, with the most recent instance being in October. Due to the recent aggressive widening of corporate spreads, muni taxables are anticipated to come under pressure in the near future, they said.

“We expect much more attractive yields and valuations compared with Treasuries, which in the long term should reward patient investors, in our view,” they said.

According to Ramirez & Co., tax-exempts generated negative total returns and underperformed Treasuries for the third week in a row due to market volatility, nascent muni fund outflows and increased secondary market activity.

Tax-exempts are cheaper on a one-year average and moving into the fairly valued range on a three-year basis, Ramirez said. Spreads remain tight, however, as base rates account for most of the yield widening of late. Tax-exempts underperformed last week, led by the two- and 10-year spots.

Munis are expected to underperform for another few weeks as markets remain fragile and investors reevaluate allocations, according to Ramirez. Moreover, U.S. Treasury and muni yields are certain to rise in 2022, although the firm expects flattening of Treasury curves, which together with continued good demand for tax-exempts should translate into outperformance on the long-end of triple-A yield curves.

This week, supply returns to a modest $6.1 billion, of which $4.8 billion, or 78.3% is tax-exempt, led by issues from the Brightline West Passenger Rail Project, the Airport Commission of the City and County of San Francisco and Black Belt Energy Gas District.

In the competitive market Monday, Worcester, Massachusetts, (Aa3/AA-/AA/) sold $208.01 million of general obligation municipal purpose loan of 2022 bonds to BofA Securities. Bonds in 2/2023 with a 5% coupon yield 0.42%, 5s of 2027 at 1.06%, 5s of 2032 at 1.48%, 3s of 2037 at 2.05%, 2s of 2042 at 2.66%, 2s of 2047 at 2.83% and 2.125s of 2050 at 2.90%, callable 2/1/2030.

Secondary trading

DASNY 5s of 2023 at 0.43% versus 0.50% Friday. Los Angeles Department of Water and Power 5s of 2024 at 0.66%. Minnesota 5s of 2023 at 0.50%. Minneapolis 4s of 2024 at 0.83%.

Delaware 5s of 2027 at 0.98%-0.96%. New York State Urban Development Corp. 5s of 2027 at 1.06%-1.04%. New York City Transitional Finance Authority 5s of 2028 at 1.21% versus 1.10%-1.08% Wednesday.

New York City TFA 5s of 2032 at 1.60%. California 5s of 2032 at 1.41%. Washington 5s of 2034 at 1.53%.

Washington 5s of 2038 at 1.66%. California 5s of 2041 at 1.76% versus 1.70% Friday. Los Angeles Department of Water and Power 5s of 2048 at 1.92%-1.91%. Triborough Bridge and Tunnel Authority 5s of 2051 at 2.06%.

AAA scales

Refinitiv MMD's scale saw one to five basis point cuts at the 3 p.m. read: the one-year steady at 0.39% and 0.63% (+5) in two years. The 10-year at 1.30% (+2) and the 30-year unchanged at 1.72%.

The ICE municipal yield curve was cut two to three basis points: 0.39% (+2) in 2023 and 0.64% (+3) in 2024. The 10-year was at 1.34% (+2) and the 30-year yield was at 1.75% (+2) in a 4 p.m. read.

The IHS Markit municipal analytics curve was cut one to two basis points: 0.41% (+1) in 2023 and 0.60% (+5) in 2024. The 10-year at 1.28% (+1) and the 30-year at 1.75% (+1) as of a 4 p.m. read.

Bloomberg BVAL was cut one to four basis points: 0.45% (+3) in 2023 and 0.61% (+4) in 2024. The 10-year at 1.32% (+2) and the 30-year at 1.73% (+1) at a 4 p.m. read.

Treasuries pared back earlier gains and equities rallied in the late afternoon.

The two-year UST was yielding 0.968%, the five-year was yielding 1.540%, the 10-year yielding 1.763%, the 20-year at 2.170% and the 30-year Treasury was yielding 2.110%, at the close. The Dow Jones Industrial Average gained 101 points or 0.30%, the S&P was up 0.29% while the Nasdaq gained 0.63% at the close.

Could Fed raise rates 50 bps in March?

While nearly all economists expect the Federal Open Market Committee to liftoff in March, some analysts believe a 50-basis-point move could be considered.

“Is there a real chance of a 50-basis point hike in March?” asked Christian Scherrmann, U.S. Economist at DWS. “Right now, we don’t think so. But inflation may force the Fed’s hand. If the January and February readings push the annual rate up even higher, the Fed might be under huge pressure to respond with more than a 25-basis point increase in rates.”

Should the Fed decide a larger hike will be needed in March, Greg McBride, Bankrate chief financial analyst, said, “this is the meeting where the Fed needs to begin prepping markets for that possibility.”

It would be reasonable for the Fed to end asset purchases now, he added. “That would better align the Fed with the hawkish inflation stance and better position them to actually let bonds begin rolling off their balance sheet as soon as March.”

But Ed Al-Hussainy, senior interest rate strategist at Columbia Threadneedle Investments, disagreed. “I don’t expect an immediate end to the Fed’s bond buying program as they don’t have much to gain from doing this,” he said. “In March, I expect they’ll extend the pace.”

While the Fed must feel pressure to react to high inflation, officials have pivoted from their position six months ago, he noted. “Is the situation extraordinary enough for them to act right now? No. Remember, the Fed can act at any time, not just at meetings.”

While a March rate increase is expected, followed by two or three more later this year, Al-Hussainy asked whether “100 or 150 basis points is going to slow the economy enough to take inflation out of the system. I don’t buy into the view that we have to sacrifice significant employment to take out inflation, and there’s no evidence that the Fed is trying to do this.”

And an announcement on the balance sheet is unlikely, since the Fed has “been explicit that their main tool is Fed funds, the balance sheet is a passive tool with minimal impact to the economy.”

Standing in the way of any definitive proclamations by the Fed is the Omicron variant, according to Gary Schlossberg, global market strategist at Wells Fargo Investment Institute. “The Fed likely will be taking a cautious view toward telegraphing the pace of rate increases beyond March in the face of Omicron’s threat to first-quarter growth,” he said.

While it appears the number of infections is nearing a peak, which will allow the economy to rebound in the spring, Schlossberg said, “the Fed will be inclined to move cautiously until the extent of the slowdown becomes clearer.”

Additionally, the complicated economic and financial situation makes the Fed “vulnerable to policy errors,” especially, he said, with “housing and financial assets boosted by years of low inflation and subdued interest rates.”

As a result, policymakers “will have to walk a fine line between reining in elevated inflation and moving cautiously enough not to upend the financial market in a way that produces the sort of ‘disorderly market conditions’ requiring an abrupt policy reversal,” Schlossberg added.

And don’t expect any 50 basis point moves, he said. “First, Omicron has made the immediate growth outlook more fragile. Second, price pressures are expected to ease (albeit gradually) during the latter part of the year, lessening fears of runaway inflation. And third, outsized increases of 50 or more basis points often have had an unsettling effect on the financial markets, encouraging their use only when the Fed truly needs to shore up its inflation fighting credentials.”

But Grant Thornton Chief Economist Diane Swonk said, “Dissents pushing the Fed to act more aggressively on rate hikes cannot be ruled out, even as the Fed begins the process of raising rates.”

Federal Reserve Bank of St. Louis President James Bullard, who rotates in as a voter this year, “will be pushing to taper asset purchases even sooner than the Fed decided and could dissent as soon as his first meeting, arguing that the Fed should end asset purchases in February instead of March,” she said.

In less than two months. Swonk said, “the Fed has pivoted from being patient to panicked on inflation.” The voters rotating in “tend to be among the most outspoken on rate hikes,” she said. “Brace for dissents as debate about the pace of rate hikes intensifies.”

But Omicron may stunt economic growth, leaving first quarter GDP “with a 1-handle, but” keeps the Fed on track for a March liftoff, according to a Morgan Stanley research report. “The growth trajectory beyond this quarter will help to shape the path of policy tightening.”

Primary to come

Brightline West Passenger Rail Project (Aaa///) is set to price Thursday $894.3 million, Series 2020A, consisting of $774.3 million of Series 1 and $150 million of Series 2. Morgan Stanley & Co.

The Airport Commission of the City and County of San Francisco at the San Francisco International Airport (A1//A+/) is set to price Tuesday $749.155 million of second series revenue bonds, consisting of $308.73 million of alternative minimum tax bonds, Series 2022A, serials 2024-2032 and 2052; $239.23 million of non-alternative minimum tax bonds, Series 2022B, serials 2026-2030 and 2052; and $201.195 million of federally taxable bonds, Series 2022C, serials 2030-2032 and 2034-2037. Citigroup Global Markets.

The Black Belt Energy Gas District (Baa1//A-/) is on the day-to-day calendar with $498.92 million of gas project revenue bonds (Project No. 8), 2022 SERIES A. Goldman Sachs & Co.

The Connecticut Health And Educational Facilities Authority (Aaa/AAA///) is set to price Tuesday $400 million of Yale University Issue revenue bonds, consisting of $125 million of Series U-1, $125 million of Series U-2 and $150 million of Series A-4. J.P. Morgan Securities.

Austin Independent School District, Texas (Aaa///) is set to price Wednesday $221.985 million, consisting of $92.87 million of unlimited tax school building bonds, Series 2022A, serials 2022-2041, insured by Permanent School Fund Guarantee Program; $100.395 million of unlimited tax refunding bonds, Series 2022B, serials 2027-2036, insured by Permanent School Fund Guarantee Program; and $28.72 million of unlimited tax refunding bonds, Series 2022C, serials 2028-2033. Ramirez & Co.

Austin Independent School District, Texas (Aaa///) is also set to price Tuesday $129.815 million of taxable unlimited tax refunding bonds, consisting of $50.27 million, Series 2022D, serials 2026-2035, insured by Permanent School Fund Guarantee Program and $79.545 million, Series 2022E, serials 2025-2031. Ramirez & Co.

The Ohio Housing Finance Agency (Aaa////) is set to price Thursday $175 million of social non-alternative minimum tax residential mortgage revenue bonds, 2022 Series A, serials 2022-2033, terms 2037, 2042, 2047, 2052 and 2052. Citigroup Global Markets.

Forney Independent School District, Texas Thursday (/AAA//) is set to price $152.585 million of unlimited tax school building bonds, Series 2022A, insured by Permanent School Fund Guarantee Program. FHN Financial Capital Markets.

Alvin Independent School District, Texas (Aaa//AAA/) is set to price Wednesday $117.39 million of unlimited tax schoolhouse bonds, Series 2022, insured by Permanent School Fund Guarantee Program. Piper Sandler & Co.

Palacios Independent School District, Texas (Aaa///) is set to price Tuesday $116.5 million of unlimited tax school building bonds, Series 2022, serials 2023-2042, terms 2045, 2047, 2049 and 2051, insured by Permanent School Fund Guarantee Program. HilltopSecurities.

The Charlotte-Mecklenburg Hospital Authority, North Carolina (Aa3/AA-///) is set to price Wednesday $115.335 million of health care refunding revenue bonds, Series 2022A, serials 2023-2043, Citigroup Global Markets.

The California Statewide Communities Development Authority Community Improvement Authority is set to price Tuesday $113.965 million of essential housing revenue bonds, consisting of $11 million of Series A-1, serial 2043; $73.99 million of Series A-2, serial 2058; and $28.975 million of Series B, serial 2058. Stifel, Nicolaus & Co.

Competitive:

Spartanbury County School District #5, South Carolina, (Aa2/AA-//) is set to sell $100 million of general obligation bonds, Series 2022 at Thursday 11 a.m. eastern.