A small, fledgling minority-owned firm that opened its doors in 1971 with just a handful of clients is celebrating a half century on Wall Street, growing to 11 regional offices nationwide and serving as lead manager on $40 billion in the last decade.

Samuel A. Ramirez & Co. Inc., a once-modest boutique shop, is now a full-service investment bank, brokerage, and advisory firm that has evolved into a top senior and co-manager of public finance issues — not to mention oversees $4 billion in its asset management arm.

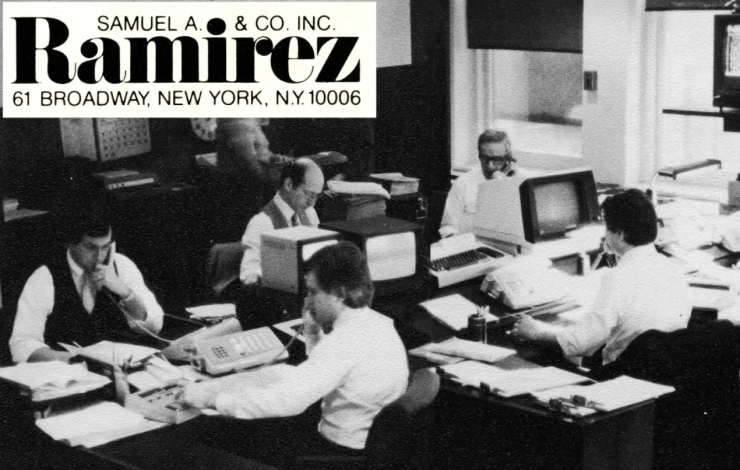

“My father started a firm in an industry where he broke in and really made a name for himself as the first Hispanic firm” in the financial industry selling municipal bonds, Sam Ramirez Jr., a senior managing director of the firm said in a recent interview at its 61 Broadway headquarters in New York City.

As it reaches its 50th year in business, Ramirez ranks 15th industry wide among all managers year to date in 2020, as of Dec. 21, participating in 782 deals with full credit to each manager, totaling $102.37 billion, according to Thomson Reuters data.

“We have grown our business, and hired people along the way who have helped it grow,” Sam Ramirez Sr., president and chief executive officer said in the interview.

Its underwriting business in 2020 alone is indicative of its growth, in spite of the COVID-19 pandemic.

The firm has senior-managed 47 issues totaling $6.1 billion and ranked 15th in 2020, according to Refinitiv data.

That’s up from the prior two decades when the firm senior-managed 51 issues totaling $2.98 billion, and ranked 22 back in 2010; and senior managed just one deal for $25.5 million and ranked 110th among senior managers back in 2000, according to figures provided by Thomson Reuters.

As the company prepares to celebrate its milestone year, it is no less committed to growing its capital, clients, and core business than it was a half-century ago, despite facing inherent challenges during its 50-year growth spurt.

While its product line is highly diversified between fixed-income and as well as equity products, its core foundation has always been and continues to be municipal bonds, the patriarch and founder of the family-owned firm said.

“We have our roots in the municipal market as a fixed income boutique,” Ramirez Jr. agreed.

Currently, about 70% of the firm’s core business consists of municipal product, with a full-service investment banking and capital markets group to help maintain a competitive edge among the largest banks regionally and nationally.

Meanwhile, 30% of the business represents capital markets and advisory, taxable sales and trading and institutional asset management.

Family Affair

Ramirez Jr. joined the firm almost 30 years ago in 1992, working as a managing director and fixed income specialist, responsible for the growth of the institutional and retail sales and trading, public finance, and corporate banking.

Long before that, a three-year-old Ramirez Jr. would sit at his dad’s desk and ask clients if they want to buy municipal bonds, Ramirez Sr. reminisced.

Today, he is president and chief executive officer of Ramirez Asset Management, which he established in 2002 and has $4 billion under management.

Growth and Expansion

The father-son duo at the helm pride themselves on being one of the longest family and minority-owned firms in the financial district still standing on its own.

Today, the company has 140 employees nationwide, 60% of its senior executives being minorities. in addition, of its 11 nationwide offices, 10 are headed by minorities or women, and the 11th headed by a veteran, according to Ramirez Jr.

Its public finance team is headed by Ted Sobel; underwriting led by Patty McGrorry, James Cortese, and John Young; municipal sales and trading led by Alan Greco; and municipal credit strategy led by Peter Block.

There are 11 traders, six of whom cover municipal bonds; 17 institutional salespeople, and two research specialists — all covering over 300 institutional accounts.

The firm has a team of 46 in its sales and trading divisions supporting the banking businesses for most of the U.S. fixed income sectors. That includes corporate investment-grade and high yield, mortgage-backed securities, agencies, and Treasuries and coverage of all the top institutional money managers in the country — from tier one to tier three institutional accounts, the father and son noted.

“That fills a niche for liquidity and also provides experienced coverage,” Ramirez Jr. said.

The investment banking team provides debt and equity capital markets and advisory services to more than 25% of the Fortune 500 corporations in the country, Ramirez Sr. pointed out.

To date, the company retains a large core of individual mom and pop retail and high net worth family and business accounts in its wealth management division, which happens to be its oldest division, Ramirez Jr. said.

Some of the accounts “are third and fourth generation clients,” and demonstrate the firm’s history and longevity, Ramirez Sr. was quick to point out.

The birth of the firm

Ramirez Sr. was a newbie on Wall Street, starting his career in 1963 as an order clerk at the former Kidder Peabody, where he worked with municipal syndicate manager and his mentor, the late Frank Devers.

Back then, he relied on the Standard & Poor’s Blue List, cold-calling clients hoping to sell municipal bonds to mom and pop individual investors.

“Years ago, when I cold-called investors, people would say, ‘I don’t need them,’ ” speaking of municipal bonds, which Ramirez said clients often confused with governments and corporates.

He learned the ropes of the municipal industry from Devers, and after graduating from college in 1965, became a municipal salesperson and trader with Frank Stoever, president of Stoever Glass & Co., then a one-man start-up specializing in municipals.

Ramirez honed his skills as a young salesman on the Street for nearly six years before deciding to start his own shop in 1971 in a small, two-room office at 19 Rector Street with just $50,000 and a shoe box of high net worth retail accounts.

The early years

After four years of struggling as a small, new minority-owned firm, it was in 1975 that Ramirez experienced its first pivotal growth in capital, catapulted by New York City’s fiscal crisis, the company’s founder said. The city’s operating deficit of more than $600 million and other fiscal shortfalls led to nearly defaulting on its notes and declaring bankruptcy until a Congressional bill extended $2.3 billion of federal loans to rescue the city.

As the city’s notes sold at deep discounts, there was no distinction between the 3%, 4%, and 5% notes, Ramirez Sr. recalled.

“Everything traded at a dollar price; the coupon was worthless,” he said.

That meant heavy business for the firm — and an expansion of staff, particularly municipal traders, he said.

“We were never busier,” Ramirez Sr. said, recalling that bonds from the Municipal Assistance Corporation —which was created in 1975 to provide financial assistance and fiscal oversight to fiscally-distressed cities — had 8% coupons due in 1986 with a 10% current return backed by the city sales and transfer tax.

“New York City dug itself out and did not flood away into the ocean as some people thought,” Ramirez recalled.

The following year, in 1976, the firm got its first credit for being a member of the syndicate groups on 48 deals totaling $1.87 billion, and ranking 20th among the top 50 underwriters, according to Thomson Reuters.

Years later, the firm saw further expansion and growth during the 1987 Stock Market Crash, after which it continued to be market makers on the buy- and sell-sides of the industry, underwriting and trading bonds until adding its own public finance component in the 1990s.

Rising in the ranks

The firm increased its public finance and investment banking presence with the creation of a capital markets group in the early 1990s.

“There were opportunities as a diverse investment firm trying to break into the business on an institutional level,” Ramirez Jr. said. “That’s when the expansion with institutional sales and trading happened.”

In 1991, those opportunities led to the firm being chosen as a diverse co-manager for New York City by former Mayor David Dinkins.

Nearly 30 years later the firm is among the rotating senior managers for the city’s transactions.

“We were growing our banking division and we saw more opportunities to pursue business and ramp up our teams in general,” Ramirez Sr. said.

The business has evolved dramatically over the years, Sobel pointed out. For instance, historically, the firm has acted as a manager on $1.5 trillion of transactions since the early 1990s, which includes $1.3 trillion of negotiated business, according to Sobel, citing data he obtained from Thomson Reuters.

At the same time, Ramirez has been lead manager on 354 transactions totaling $40.67 billion in the last decade alone, according to Thomson figures.

“That was an outgrowth of the two decades prior where the firm became actively involved and greatly expanded its banking efforts,” Sobel said.

But, despite the firm’s advancements to date, Ramirez Sr. is eyeing future expansion. “We are always looking for opportunities to break into areas we understand and add value,” he said.

For instance, Ramirez hopes to continue to grow its public finance and capital markets presence in higher education, according to Sobel.

The firm also focuses on housing, public power, transportation, water and sewer utilities, and taxable municipal debt, among others, he said.

It repeatedly serves as co- and senior manager to major issuers with complex structures and extensive financing plans, such as Dallas Fort Worth Airport, the Port Authority of New York and New Jersey, the Metropolitan Transportation Authority, and New York City, which Sobel said is a recognition of its longevity.

“When issuers ask ‘what is your commitment to the business?’ we look at the value of muni finance to the firm as a whole, and for Ramirez it is the driver of the firm,” Sobel said.

“The heart and foundation of the firm is sales and trading and banking,” he added.

Five decade legacy

During its long tenure, municipal growth and expansion has remained key for Ramirez, beyond the Big Apple and its New York headquarters, its managers said.

Historically, the firm has co-managed 11,660 issues totaling $164.8 billion, ranking 14th among co-managers nationally over the last decade, Thomson Reuters figures as of Dec. 7 show.

Sobel said the firm maintains its staying power with a clients-come-first philosophy.

“We hope clients appreciate the fact we are in it for the long haul with and for them and that Sam wants to grow the firm and serve the clients well,” he said.

Among their clients, the firm’s reinvestment in itself is a major advantage.

Marjorie E. Henning, Deputy Comptroller for Public Finance in the Office of New York City Comptroller Scott M. Stringer, said Ramirez executes transactions “as seamlessly as larger firms.”

“We like that we are able to get bulge bracket execution at a boutique firm,” Henning said. Ramirez has a staff of professionals “that generate value-adding ideas for the city’s core and related issuers,” she added.

In the summer of 2020, the firm was awarded a position in New York City’s general obligation and Transitional Finance Authority’s new money and refunding bracket rotations as a senior managing underwriter, Henning noted.

Ramirez first joined the city’s senior-managing pool as a special bracket member following the city’s 2006 underwriter request for proposal, and was promoted to a full-time senior manager for the New York City Municipal Water Finance Authority after the 2009 underwriter RFP, she noted.

“Since becoming a full-time senior manager, our relationship with Ramirez has continued to grow,” Henning said.

Ramirez has served as a sole senior manager for transactions for each of the city’s main credits — NYC GOs, TFA, and NYC MWFA, she added.

“We look forward to continuing our relationship with Ramirez as a co-manager on all of the city’s transactions,” Henning continued.

Meanwhile, the firm continues to break ground in new roles.

In September, Ramirez served as joint senior manager on a $2.63 billion California various purpose GO and refunding issue — its first time in that role for the state, according to Mark Desio, communication director for the California Treasurer's office.

Overall, Ramirez has served as a selling group member, co-manager, co-senior manager, and joint senior manager on more than 130 State of California bond issues since 1992-1993, when the Treasurer’s office established its underwriter pool for the first time, Desio noted.

Growing pains and memorable moments

But, the growth and advancements have not been without challenges, the CEO said.

He experienced struggles not only as a new firm, but also a minority firm, trying to break into the industry, according to Ramirez.

“The big struggle was being shut out of deals when you knew you could sell the bonds,” the firm’s patriarch recalled. “You weren’t a co-manager; I was in business, but not a major underwriter.”

With hard work, and affirmative action at the time his business was up and coming, the firm began seeing new opportunities, he said.

“All of a sudden doors were opening,” Ramirez Sr. said, citing a $200 million Battery Park City deal as one of his first financings back in 1972.

Among the biggest obstacles since then has been constantly trying to grow the business, no matter what market, political, social, financial, economic, or global events were occurring in the backdrop.

For example, after periods of heavy consolidation in the 1980s and 1990s, “things got a little more difficult” again, and the industry shrunk significantly as firms merged or were acquired, or closed altogether, Ramirez Sr. said.

“Firms were getting bigger and we had to compete on a bigger level,” he said. “But, we stayed who we are, and focused on servicing our clients.”

Over the years, Ramirez Sr. said some of the most memorable moments include being named as one of the rotating senior managers for New York City tax-exempt deals, while his son said senior-managing a $1.37 billion Los Angeles tax and revenue anticipation note deal in 2014, the firm’s first senior-managed deal over $1 billion, was a milestone.

Pandemic posture

Besides the early challenges of being a minority-owned firm, and ongoing market hurdles, such as consolidation and competition, Ramirez, like other firms, faced one of the biggest challenges to date when the country shut down due to the COVID-19 pandemic.

“We saw some severe hits in March due to the virus, but everyone stepped up and we survived,” thanks to the strong backbone of its IT department, Ramirez Jr. said.

He compared the experience to the struggle, and teamwork, facing the financial industry after the 9/11 terrorist attacks.

Greco, head of institutional sales and trading, said the firm made strides in underwriting in 2020, in spite of the difficulties surrounding the pandemic.

Despite being quarantined and relying on Zoom and other technology, Ramirez Sr. classified 2020 as “one of our best years.”

The firm conducted business without interruption during the pandemic, and by September, up to 30% of the staff was back in a safe work environment, he said.

The firm’s role as lead manager on a Port Authority of New York and New Jersey airport deal sized at over $1 billion exemplified its market strength during a crucial time, according to McGrorry, a managing director of underwriting. She said it was the first largest airport deal to be priced in July during the pandemic.

The future ahead for Team Ramirez

The father and son duo is relying on past performance as an indicator of future success as the time-tested, diversified firm prepares for the next 50 years.

Ramirez Sr., an avid baseball fan, said the firm is keeping its “eye on the ball” on the municipal “field” and using its inherent capabilities to increase staff and enhance its product line.

In addition, teamwork is the key to the firm’s past, present, and future success, he noted.

“We will continue to focus on areas that we have gained and built a foundation in,” namely municipals, as well as fixed income and equity products, Ramirez Jr. said.

The firm will continue to grow and expand its business, despite any market challenges from the COVID-19 pandemic, the future political landscape, and changing investor behaviors, the CEO added.

“We are always trying to come up with different concepts” to stay competitive and ahead of market impacts, he said.

“I don’t look behind me, I look forward,” Ramirez Sr. continued. “You do the best you can and hopefully you are rewarded — and we have been rewarded.”

“Sixty-six years later, I still enjoy being involved in the municipal bond market,” Ramirez Sr. added. “We will continue to grow our capital to take on larger goals, and look at risk and grow the firm responsibly.”