PHOENIX - Public retirement plans are walking a tightrope with high-yield return strategies, Moody's Investors Service said.

In a report published Wednesday and authored by analysts Thomas Aaron and Timothy Blake, Moody's said the investment returns public pensions rely on are heavily-invested in volatile asset classes and that the risks of credit-significant losses are increasing as a result.

“After weak returns for the fiscal years ending June 2015 and 2016, U.S. public pension plans are reporting favorable investment returns as of June 2017,” Moody’s said. “These returns are welcome news for sponsoring governments, but attaining those returns required investment in assets that carry substantial risk of losses. The California Public Employees' Retirement System, which is the largest U.S. public pension system, has reported an 11.2% investment return for its fiscal year that ended June 30, 2017. Its better-than-assumed results were driven most significantly by 19.6% public equity returns, an asset class that comprises just under 50% of the system's entire investment portfolio.”

Equities carry a much higher risk than do fixed-income investments, which made up a smaller fraction of CalPERS’ investment returns. CalPERS projects that equities and real estate carry single-year volatility risk of 12% - 15%, compared with only 6% for fixed-income.

CalPERS’ risky investment strategy has plenty of company, Aaron and Blake said.

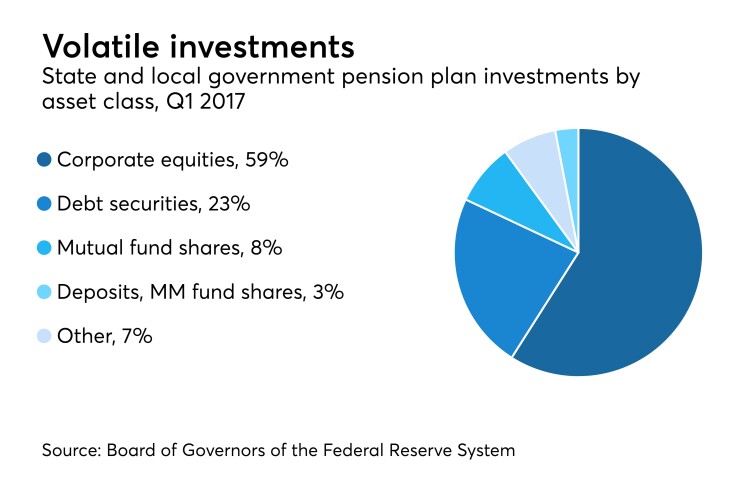

“According to the Federal Reserve's `Financial Accounts of the United States,' 59% of the $4 trillion in total state and local government defined benefit pension assets were allocated to corporate equities, as of March 2017. Some large US public pension systems have chosen to allocate even heavier portions of their investment portfolios to equities. For example, the Georgia Teachers Retirement System allocated 69% of its $64 billion investment portfolio to domestic (53%) and international (16%) equities as of June 2016.”

While many large public pension plans, including CalPERS have reduced their assumed rates of return over the past year, the rates are still higher than many observers would like to see. But reducing those rates requires more up-front contributions from either plan participants or their governments, which can be an unpleasant option or even a political third rail in some places. And the risk is not likely to abate anytime soon, Moody’s said.

“When plans choose to retain higher assumed rates of return, government pension costs may remain lower in the very near term under the actuarial funding approach, but the reach for yield is accompanied by high expected volatility and/or likelihood of consistently missing annual return targets,” the report concludes. “Many governments are exposed to large pension asset portfolios relative to revenues, with high concentrations in volatile assets, leading to material risk of a ‘budget shock’ from steep investment losses. As demonstrated by the past two decades of historical returns, governments face the risk of steeply rising pension costs from volatile investment performance, even if their investment return assumptions are met over longer periods of time.”