While the impending signing of the phase one trade deal with China should help the manufacturing sector rebound, Boeing’s decision to halt manufacturing of its 737 MAX will be a short-term negative for the Institute for Supply Management’s index.

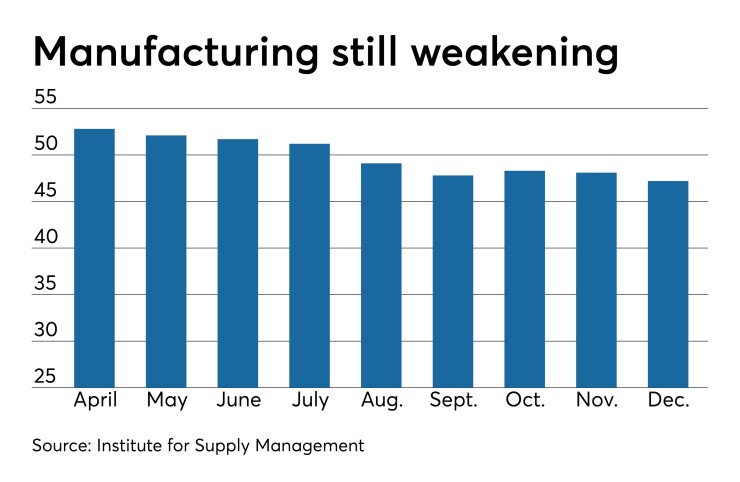

Indeed, Friday’s ISM PMI index fell to 47.2, its lowest level since June 2009. “The headline ISM index can ebb and flow with market movements, which makes the December reading all the more puzzling (or it could be that first half weakness dominated a second half recovery),” according to Morgan Stanley researchers. The team was expecting the index to bottom out “around a level of 48, but the bottom is not yet clear now.”

This report was issued too soon after the announcement that a phase one trade deal with China would be signed this month to show any related improvement.

“We believe December's ISM is evidence that it will take more than just positive trade news and market sentiment to lift manufacturing activity in the U.S.,” the researchers wrote in a note. “Purchasing managers may be sticking strictly to the spirit of the survey, and indeed production and new orders were weaker in December. Moreover, on Dec. 23 staff at the Federal Reserve released a paper estimating the impact of tariffs on U.S. manufacturing. The conclusion of the study found clear impacts on U.S. manufacturing from tariffs suggesting that removal of tariffs is what is needed to lift manufacturing, not just an end to escalation.”

The weaker-than-expected read suggests the manufacturing slowdown continued in December and any “rebound is still months away and likely to be unspectacular,” Mickey Levy, Berenberg Capital Markets' chief economist for the U.S. Americas and Asia, and U.S. Economist Roiana Reid, wrote in a note.

“The published comments of survey respondents were mostly downbeat, reflecting sluggish sales, falling orders, and weak foreign demand.”

Separately, Iran’s threat to retaliate for the airstrike that killed Iranian General Qassem Soleimani, and the geopolitical risks from the situation, have not yet changed Wells Fargo Investment Institute’s outlook for equity earnings growth or oil price targets.

“That said, if tensions escalate, defense stocks may see a new bid higher, and emerging market equities may come under pressure,” Paul Christopher, WFII’s head of global market strategy, and Darrell Cronk, its president, wrote in a note.

With the Federal Reserve injecting liquidity into the repo market, its balance sheet will reach its highest-ever level, according to a report from Hercules Investments. “While it is always undesirable for the Fed to have to step in to relieve inter-bank lending troubles, we should note that its liquidity insertion this time has the goal of calibrating an appropriate level of cash reserves that banks need, as opposed to the 2008 financial crisis when the goal was to buy distressed and otherwise illiquid assets,” the firm said in a note.