Public Finance Authority, the Wisconsin based conduit, won a BBB rating with a stable outlook from Kroll Bond Rating Agency for its $165 million of Series 2017 taxable revenue bonds, payable solely from New York's Albert Einstein College of Medicine promissory notes and guaranteed by Montefiore Medical Center.

Morgan Stanley is lead manager on the bond sale, which is expected to be priced this week, and Ballard Spahr is bond counsel.

The bonds are being issued by PFA, which is a political subdivision of the state of Wisconsin created for the purpose of issuing tax-exempt and taxable conduit bonds for public and private entities across the United States.

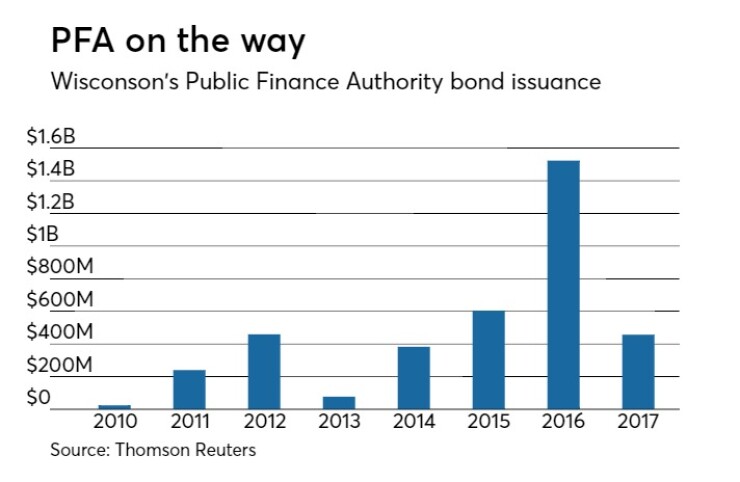

Since 2010, the PFA has issued about $3.7 billion of debt with the most issuance occurring in 2016 when it sold $1.5 billion. It sold the least amount of debt in 2010 when it issued $24 million.

The issuer, created with the support of the National Association of Counties, the National League of Cities, the Wisconsin Counties Association and the League of Wisconsin Municipalities, has taken fire from local politicians and finance authorities who don't like the PFA doing financings far from its own home base. The PFA's leaders insist that the agency exists merely to fill a void for issuers who might not otherwise have a way to get a financing done and that the PFA takes no part in local politics.

“In connection with the issuance of the bonds, U.S. Bank National Association, acting as the trustee, will receive a full security interest in the notes and guaranty,” Kroll said in its rating report. “The notes are payable first by AECOM resources and further supported by the unconditional and irrevocable guaranty by MMC of debt service and other debt-related amounts due on the notes.

Kroll said it can’t “conclusively determine” whether the college’s operations can support repayment of the notes so the agency said it is evaluating Montefiore’s credit position as the source of repayment. The BBB rating and stable outlook reflects the credit profile of Montefiore as guarantor of the notes.

Montefiore is a New York not-for-profit corporation.

“As the flagship academic medical center of the Montefiore Health System, MMC is one of the largest healthcare providers in New York City,” Kroll said. “The Medical Center’s structure, policies, and procedures provide a strong framework for managing its financial operations, enterprise risk management, and debt issuance.”