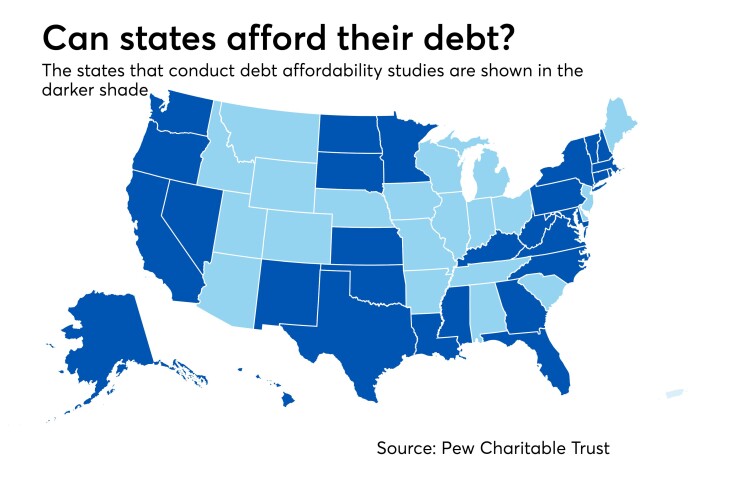

WASHINGTON – Twenty one states – including the high-debt states of Illinois, Michigan and New Jersey -- don’t conduct debt affordability studies prior to issuing new debt, according a new

Oklahoma and Hawaii, meanwhile, recently joined the 27 other states that do use these studies to evaluate the impact of new debt on self-imposed debt caps.

The Pew report, which looked at debt documents issued between January 2010 and October 2015, said it was too early to evaluate these two additions.

Oklahoma Gov. Mary Fallin signed legislation last month making it a legal requirement in her state. Hawaii released its first debt affordability study in December under a resolution passed by the state legislature in June 2015.

Among the 27 states with debt affordability studies evaluated by Pew, nine of them – Florida, Georgia, Maryland, Massachusetts, New Hampshire, North Carolina, Oregon, Texas and Virginia – received special recognition. Pew said those nine state led the way with “careful projections, smart benchmarking comparisons, multiple descriptive metrics and analysis.’’

Mary Murphy, Pew’s project director for state and local fiscal health who oversaw the report, said her team evaluated each state’s methodology. “In some cases, states have a document they title a ‘debt affordability study’ and not all those documents actually met our criteria,’’ she said. “In other states their capital plan or other debt reports may also include all these criteria.’’

She described a debt affordability study as “a flexible tool that can be beneficial to policymakers regardless of debt levels in their state.’’

“That said, for states that do issue a lot of debt and have to manage very complex structures, a debt affordability analysis may be particularly valuable,’’ Murphy said.

The release of the Pew report comes at a time when economic growth has slowed in many states. The National Association of State Budget Officers estimates 33 states face revenue shortfalls in fiscal 2017.

Last month Moody's Investors Service listed “rising debt levels’’ among the factors it took into account in downgrading the state of Connecticut's general obligation debt to A1 from Aa3. Moody’s also downgraded to A1 from Aa3 outstanding ratings on special tax obligation senior and subordinate lien bonds. “The downgrades reflect continuing erosion of Connecticut's finances, evidenced by the pending elimination of its rainy day fund, growing budget gaps and rising debt levels,’’ Moody’s said.

Here is a shortened summary of the criteria Pew recommends for a debt affordability study to be considered high quality. Pew said a state should:

- Enact a law or other requirement mandating the study, “making clear its purpose and use, who will prepare it, the timetable for ensuring regular publication and requiring the study to include a statement on how much more the state could afford to borrow. The study’s release should coincide with the state capital planning and budgeting process;’’

- “Use metrics to put in context what the state has borrowed and its capacity to issue additional debt. These metrics should compare the state’s debt loan to that of peer states;’’

- “Project the outstanding debt and the cost to service it,’’ including the state’s debt capacity over multiple year;

- Include written analysis of the data and “clear recommendations for future borrowing and debt management;’’

- “Consider the breadth of publicly supported debt and which obligations to model against state resources,’’ including independent authorities, state agencies and local governments;

- Include other long-term liabilities such as public pensions and retiree health care;

- “Ensure the study originates from an office or body with a commitment to objective analysis;’’

Although debt affordability studies are an important tool for policymakers, each state must independently decide whether to issue more debt or use pay-go financing, Murphy stressed.