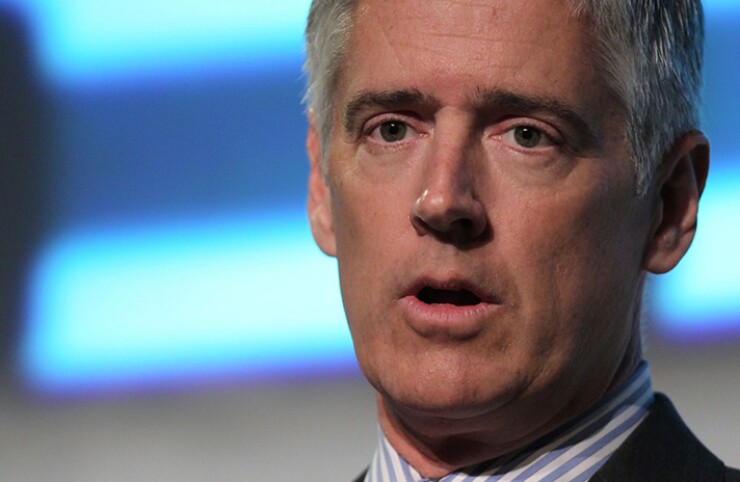

Peter Hayes, one of the most well-known and influential people in the municipal bond industry, plans to relax and enjoy life with his family and friends after he retires early next year.

"I'll be 65 next year — and I didn't think I'd still be working at 65, but it's all good, I don't mind it at all," Hayes, a managing director at Blackrock and head of its municipal group told The Bond Buyer on Friday.

He noted some of the things he found most satisfying about his more than 35 years in the municipal bond industry.

"The nature of the asset class itself is public purpose," Hayes said. "It's designed to help people in a number of ways, whether it's hospitals and healthcare, education, or other things. I really like that it's public purpose — the fact that it impacts everyone in some way, shape or form."

He remains impressed by the caliber of the people in the business and with those he has worked.

"The municipal bond industry has some very, very good people in it," he said. "It's just a community of terrific people. People who are very smart, but who also care about their community and others."

The industry was very rewarding and personally satisfying, Hayes said.

"Two of the aspects of the municipal market I really like are the client interaction — that's always been one of my favorites," he said. "And second, in the last 15 years, it's been building a team, developing talent, mentoring people and helping their careers. That's been one of the most rewarding things."

Hayes' career got started in the early 1980s, with his first taste of munis.

"I worked at a bond shop that was New Jersey-based from 1983 until 1985, when the firm went under, about a month before I married my wife, who I met there," he said. "But it gave me the foundation for bonds — they traded Treasuries and municipals primarily — and it introduced me to municipal bonds and fixed-income more broadly."

He said he always was drawn to the fixed-income sector.

"I was an economics major and therefore I like the macroeconomic environment," he said.

From New Jersey he moved to Massachusetts and went to work at a bank in Boston, where he again traded both municipal and government bonds for several years.

In 1987 an opportunity came up in New York at Merrill Lynch Asset Manager, later known as Merrill Lynch Investment Management (MLIM).

"I took that role primarily because I wanted to be on the buy-side. I liked the idea of a longer-term investment view," he said. "When you're trading on the sell-side, your view is basically five minutes — 'How can I buy a bond and sell it at a profit quickly.'

"And in asset management, it's building a portfolio though a lot of different economic cycles, having a longer-term view on interest rates, on credit sectors," he said. "So, I really wanted to get to the buy-side, which I was fortunate enough to be able to do."

In 2006, BlackRock bought MLIM, and Hayes — who was a managing director — would remain there the rest of his career, building up BlackRock's presence in the municipal bond industry in both portfolio management and research.

"I have seen the evolution of the business," he said. "When I started it was really clipping coupons, then paper delivery bonds to banks and ultimately DTC. And I've seen changes in how people bought bonds — the growth of closed-end funds and open-end funds, separately managed accounts and now exchange traded funds. It's the ever-changing nature of the business and it will continue to evolve."

He's looking forward to his retirement, which will be sometime in the first quarter of 2024.

"I've had a summer job since I was 10 years old and I've had one every year since then until I got out of college when I went full-time," he said. "And so, for a little while, I'd like to have nothing to do."

Hayes, who is married, has four children and three grandchildren.

"We never got an opportunity to travel a lot," he said. "So, we're going to go traveling together. We're going to be spending time with our grandkids. And hopefully I'll improve my golf game and get proficient at fishing."

His colleagues will miss him.

"Peter represents the best of BlackRock," Rich Kushel, senior managing director and head of the firm's portfolio management group, said in a memo announcing the news. "Clients know him for his performance. And while we surely don't underweight the significance of performance, we know Peter for so much more."

"He stands for excellence as an investor and a colleague. He has been a mentor and friend for so many. He built a great municipal bond team whose potential we're only beginning to realize," Kushel said. "It's a credit to Peter that his legacy will live on in the culture that is BlackRock today and in the people and processes he helped to identify and develop."

Patrick Haskell, deputy head of the muni group

Haskell stepped aside as Morgan Stanley's head of municipals in August 2022, a move that came ahead of several months of sweeping turnover at the firm. Haskell, who joined Morgan Stanley in 2009, had led muni securities since 2013.

Prior to joining Morgan Stanley in 2009, Haskell spent over a year as chairman and CEO of Ecosphere Technologies, a water technology company, and prior to that was managing director at HSBC and HSBC Americas. He began his municipal bond career at Credit Suisse, where he was managing director from 1994 to 2005.

Caitlin Devitt contributed to this story.