Pension obligation bonds may be on a list of options for Dallas officials as they tackle a persistent funding problem in the city's retirement system.

During a presentation to the city council last month on debt capacity for a 2024 general obligation bond referendum, Dallas Chief Financial Officer Jack Ireland said $400 million of available capacity was being set aside for the potential issuance of POBs.

"I'm not suggesting that $400 million will fix the problem," he said. "I think it's going to take a combination of perhaps some infusion of cash, as well as increased annual contributions from the city, possibly from the employee, I don't know."

The nation's ninth-largest city is struggling with unfunded liabilities of $3 billion in its police and fire fund and $1 billion in its employee fund.

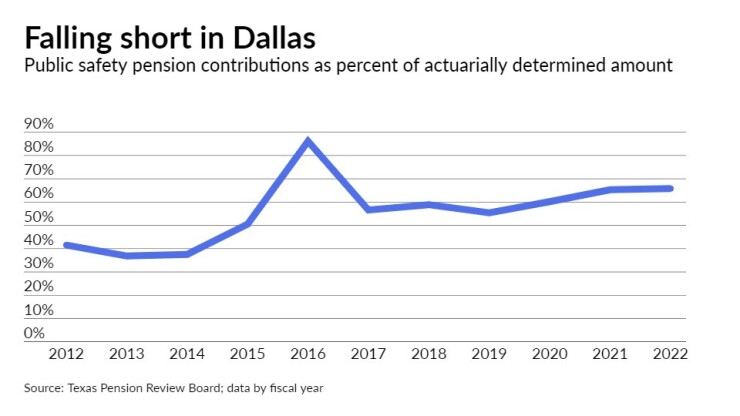

Ireland said the city is awaiting recommendations, which may or may not include POBs, from an independent actuary with preliminary information due to the city and its police and fire pension fund board later this year. With the city's pension contributions lagging actuarially required levels, an unknown level of increased funding is expected to be required at the same time tighter budgets are projected.

Dallas' latest five-year

The budget for the fiscal year that begins Oct. 1 includes 290 new police officers and 100 additional firefighters, which would boost the ranks of employees contributing to the public safety pension fund.

A final report on whether Dallas has a plan to fully fund pensions within 30 years must be issued by The Texas Pension Review Board in December 2024 ahead of the 2025 state legislative session.

Depending on the report's findings, lawmakers could mandate additional pension reforms, analysts said.

A 2017

The law was spurred by the city's projection its police and fire fund, which then had an unfunded liability of nearly $3.7 billion,

Stephen Doyle, a S&P Global Ratings analyst, said the main focus for Dallas' AA-minus rating is on pensions.

"The economy, the financial profile outside of underfunding of the pensions, are all trending well," he said. "So really what we're watching for in terms of the rating is future pension reforms — whether that be a number of things related to contributions, potentially a POB issuance, we don't know."

As for POBs in general, Doyle said S&P undertakes a case-by-case analysis that incorporates the reasons behind the issuance and how an issuer addresses risks associated with that kind of debt.

Moody's Investors Service, which rates Dallas A1 with a stable outlook, reported in May that the primary and continuing challenge to the city's credit profile is its unfunded pension liability.

"The city's pension contributions remain materially below a 'tread water' level that would prevent the liability from growing, while investment returns lag plan targets," the rating agency said, adding that a failure to address the growing liability "could lead to negative credit pressure."

It also noted that while hitting investment return targets is important for the "poorly funded" police and fire fund, "achieving targeted returns are challenged because the plan remains heavily invested in illiquid assets."

Fitch Ratings, which has the city at AA with a stable outlook, also has pensions on a list of factors that could lead to a downgrade.

"Some of the factors that we watch for would be failure to close the gap between annual pension contributions and the actuarially determined contributions amounts," analyst Omid Rahmani said.

The nation's ninth-largest city still has $95.315 million of debt outstanding from its previous POB sale in 2005, according to information provided by Dallas' cash and debt manager. That deal included $186.6 million of current interest bonds and $137.7 million of capital appreciation bonds with both series having final maturities in 2035. Another $75 million of step-up coupon bonds sold at that time were refunded in 2010 in a deal that was subsequently refunded in 2020.

Kroll Bond Rating Agency rated Dallas GOs AA-plus with a positive outlook.

Ireland acknowledged the market is currently "in a bad place" to be borrowing a significant amount for pensions, noting POBs would probably fetch a 6% rate.

The most recent peak for POB issuance was in 2021 when $10 billion of the taxable debt — the second highest amount on record — was sold, according to

"POB issuance has come to a halt as governments wait for a lower and less-volatile interest rate environment to develop," S&P Global Ratings said in a July report.

When that happens, there could be some pent-up demand, although it may take some time for POBs to hit the market due to the time-intensive government process of issuance, the rating agency added.

Citing "a considerable investment risk," the Government Finance Officers Association

In conjunction with another 2017 Texas reform law, Houston sold $1 billion of pension bonds to

The law put into place a 7% rate of return on investments for calculating actuarial assumptions and a requirement for the city to meet its annual contribution to eliminate the unfunded liability in 30 years. Since then, the unfunded liability for the city's three retirement systems, which had climbed as high as $8.2 billion, shrank to $1.5 billion.

This year Houston, Texas' largest city, addressed its growing unfunded liability for retiree benefits like health care by creating a trust.