As interest rates hover at historic lows, pension bond volume in 2021 is likely to match last year’s, which was the highest since the 2008 financial crisis, experts say.

“As long as rates stay near their current levels, we expect pension bond issuance in 2021 to be similar to 2020,” Hilltop Securities Managing Director Mike Newman and Director Brian Whitworth told The Bond Buyer via email.

“Market timing of investments is notoriously difficult, but borrowing costs are low by historic standards,” they said. “To evaluate the risk of market timing, we usually calculate the size of investment loss required to eliminate savings of a POB.”

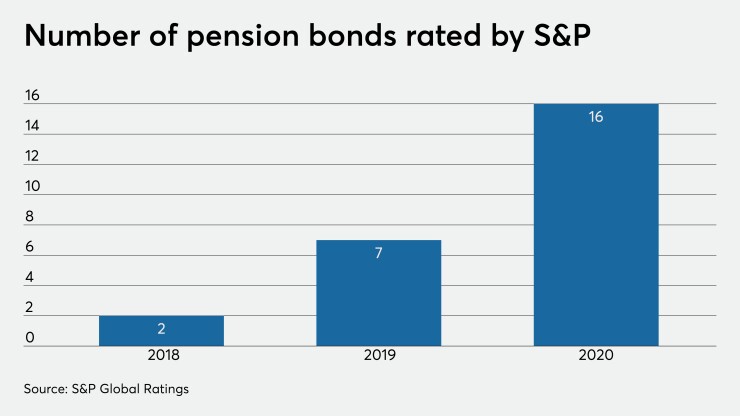

Todd Kanaster, director for municipal pensions at S&P Global Ratings said, S&P-rated pension bond volume more than doubled in 2020, “and we see no signs of slowing down in 2021.”

In a Jan. 25 report, Kanaster and co-author Timothy Little cited four key trends related to pension and OPEB liabilities this year: contribution deferrals, reductions in government employee payrolls, a period of low interest rates, and pension and OPEB benefit reforms.

“U.S. public pension and other post-employment benefit plans face new challenges as the country recovers from the sudden-stop recession and mitigates health and safety risks associated with the pandemic,” Kanaster and Little wrote.

“However, some of the challenges facing these plans are not unlike those that occurred following the Great Recession.”

State and local governments issued $6 billion of pension bonds in 2020, according to Municipal Market Analytics.

“Increasingly, issuers are looking at ‘refinancing’ their unfunded pension liability as a tool for near-in budgetary savings to cope with the fiscal strains caused by the pandemic,” MMA said. “Although the states of Illinois and California local governments accounted for the lion’s share of pension obligation bond activity (37% and 62%, respectively), issuers in other states are considering the strategy in 2021.”

Local governments in Arizona are following the lead of those in California, using certificates of participation to cover some of their unfunded obligations.

Lease appropriations are often easier to use, S&P's Kanaster points out, citing the Los Angeles County cities of Torrance and West Covina, which used their streets to secure the pension debt.

“However, S&P Global Ratings views lease appropriations as weaker than a GO or legally available funds pledges, and begin our rating analysis at least one notch below that of an issuer's GO rating,” he wrote in a separate report.

Arizona cities and counties are targeting unfunded pension obligations in the state Public Safety Personnel Retirement System, created in 1968 for public security employees. The PSPRS has been one of the most underfunded pension plans in the nation at 48%.

The city of Tucson is pricing about $660 million of certificates this week, backing the lease-revenue debt with city properties.

Tucson Chief Financial Officer Joyce Garland said she would have taken the deal to market three months ago if she could have.

Pinal County, also in Arizona, funded its $89 million public safety pension debt through certificates, a move financial consultants said could save taxpayers up to $69 million over the next 20 years.

Fitch Ratings rated the tax-supported revenue bonds AA with a stable outlook.

“While the current issuance will have minimal net effect on the county's total long-term liability burden, as the new issuance will substitute one liability (pension) for another (direct debt), it is expected to have a beneficial impact on the county's long-term PSPRS liability burden,” Fitch analyst Emmanuelle Lawrence wrote.

S&P rated the bonds AA-minus and noted annual savings of $2.9 million per year over 23 years.

“If poor investment performance or other experience changes generate new liabilities that are greater than previously projected — particularly if it occurs earlier in the amortization period — then the county risks having to pay both the debt service costs on the bonds and higher-than-expected pension contributions, which would result in eliminating potential payment savings from the transaction,” analysts added.

Pinal County secured a 2.61% true interest cost on the debt over a 20-year period. Net present value savings were $47.6 million.

“Discount rates at retirement systems are typically around 7%, and borrowing costs are often about 2.75-4.25% in the current market depending on the issuer’s rating, the POB term, and other factors,” according to Hilltop’s Newman and Whitworth. “The lower borrowing costs result in lower expected annual costs if POBs are issued.”

Phoenix is studying pension bonds to ease its $3.2 billion unfunded liability for the PSPRS but has no immediate plans to issue them, according to Chief Financial Officer Denise Olson.

“I acknowledge interest rates for issuing bonds are very attractive in terms of an alternative in funding our pension funds,” she told The Bond Buyer. “However, proceeds would be invested in equity markets that are currently very strong and rate of return in fixed income investments are relatively low. Timing on issuing debt should be balanced with success in investing the proceeds.”

Any pension bond issued by Phoenix would dwarf the others in the state and might not cover the full unfunded obligation.

Olson said the key factors under consideration are how much to issue, impact on the percent funded of pension liability, maximum rate acceptable on taxable bonds, and strategy in managing proceeds with focus on initial investments.

“Our analysis has shown the time value of money on investing the proceeds is significant,” she said. “If you invest $3.2 billion in bond proceeds and the equity market decreases in early years, it is hard to overcome the initial loss. This is especially true when considering significant bond issuances.”

Flagstaff in northern Arizona used lease-revenue debt to fully fund its public safety pension in July, covering $112 million of unfunded obligation.

The city said the deal was 3.7 times oversubscribed.

That gave Flagstaff a strong negotiating position and resulted in a plan that will save taxpayers more money than anticipated, according to the city. It also allowed it to obtain an interest rate of 2.7% instead of the expected 4%.

In May, the city staff expected to save taxpayers about $55 million over 20 years, but because of the lower interest rate, the city boosted its savings to as much as $76 million.

“After years of managing annual increases to the city’s unfunded pension liability, the city has developed a path forward to pay level debt, have 100% funded pension plans for our police and fire personnel, and set forth a reserve policy that will mitigate future changes in the plan,” said Rick Tadder, its management services director.

In December, Yuma County issued $35 million of pledged revenue obligations to bring its public safety pension obligation to fully funded. The debt was rated AA by Fitch.

The revenue obligations are secured by a first lien pledge on county general excise tax revenues, state shared revenues, vehicle license tax revenues and payment in lieu of taxes revenues.

Even sparsely populated Gila County approved a $12.5 million issue of taxable debt to fully fund its share of PSPRS obligations.

As issuers consider the variables, the prospect of higher interest rates is considered unlikely. Rates began falling during the 2008 crisis and have lingered near the bottom of the scale since then, briefly rising before the COVID-19 crisis caused the Federal Reserve to cut rates to the zero lower bound again.

"As interest rates remain low, so do bond yields, making safer investment options less attractive for pension funds needing to meet targeted returns," S&P said. "During this time of more difficult budgeting decisions, we expect governments and plan sponsors will be less likely to further lower plan discount rates and absorb higher costs."

Keeley Webster and Yvette Shields contributed to this article.