Pennsylvania’s state pension system for public school employees spent too much on investment fees last year, according to a

The $416 million of fees typifies a pattern of overspending on to Wall Street by the Public School Employee Retirement System, DePasquale told reporters Thursday in Harrisburg.

“One of my most significant concerns from this audit is that PSERS doesn’t seem to think spending more than $416 million on investment management fees in 2016 is a big deal,” said DePasquale, a Democrat.

“It is mind-numbing that they want a pat on the back for reducing the fees from $441 million in 2015. It’s a baby step at best.

"While my audit confirmed that the investment management fees PSERS pays may be consistent with industry standards, the fees are woefully unfair to taxpayers and PSERS members," said DePasquale.

DePasquale is also auditing the State Employees’ Retirement System. PSERS and SERS manage a combined $78 billion of assets.

In addition, DePasquale called out PSERS for insufficient vetting of trustees and not documenting manager fee negotiations.

Unfunded pension liability at both the state and local levels has been at the forefront in Pennsylvania, recipient of several bond-rating downgrades the past three years. Moody’s Investors Service, Fitch Ratings and S&P Global Ratings have all cited pension underfunding and budget imbalance.

Moody’s rates Pennsylvania’s general obligation bonds Aa3 with a stable outlook. Fitch and S&P each assign AA-minus ratings with outlooks of stable and negative, respectively.

Pennsylvania is hardly alone. "Rising pension expense is an issue for many states," said Alan Schankel, managing director at Janney Capital Markets in Philadelphia.

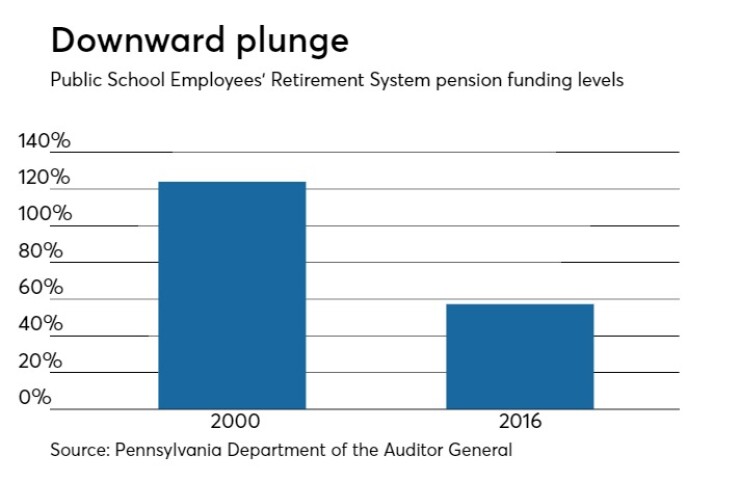

PSERS, according to DePasquale, was 24% overfunded in 2000 and remained above 100% until 2003. As of June 30, 2016, however, PSERS was down to 57.3% funded with an unfunded liability of $43 billion and assets of $49.2 billion.

“Pension reform has been discussed in Harrisburg for decades,” said DePasquale.

The 151-page report, which covers July 1, 2013 to March 31, 2017, includes 17 findings on six issues and makes 37 recommendations – 26 directed at PSERS, 10 at the General assembly and one for the governor’s Office of Administration.

“PSERS is pleased to report the auditor general performance audit issued no findings of violations of law, regulations, by-laws and other policies in the areas covered by the audit,” PSERS executive director Glen Grell said in a

Grell, however,

“Sadly, the post-exit conference addition of this politically motivated invective places a stain on an otherwise professional performance audit and the hard and capable work of the audit team,” said Grell, a former Republican state representative from Hampden Township, outside Harrisburg.

DePasquale also wants to broaden the Public School Employees’ Retirement Code and the Public Employee Pension Forfeiture Act. In addition, he called on PSERS to improve some internal operations.

He called the pension forfeiture law too restrictive, given that statutory language in a 2004 amendment limits forfeiture to PSERS members who commit crimes against students.

Last month, Gov. Tom Wolf and state Treasurer Joe Torsella sent a

Torsella said Thursday he would ask the PSERS board to consider his proposal to reduce fees by 20 basis points over a three-year period at its June meeting.

“While lowering fees alone will not solve our pension challenges, there is no reason we should delay in finding every dollar we can save and every efficiency we can find to improve the health of our pension systems,” said Torsella.

In an

“There's a whole host of things that we believe need to happen, including revising the municipal aid formula to help some of the cities that are struggling more,’ he said.