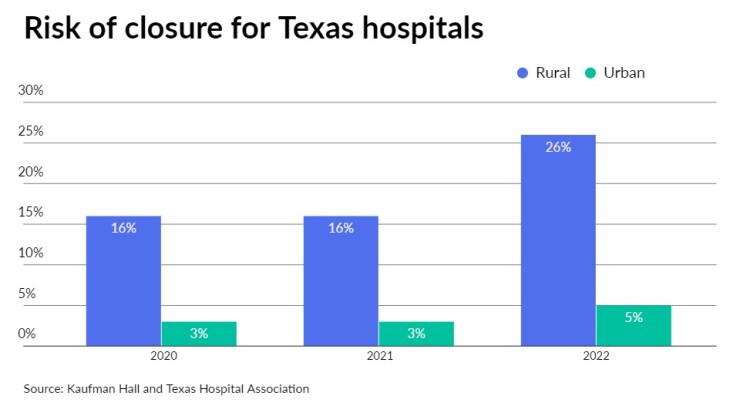

The percentage of Texas hospitals at serious risk of closing nearly doubled since 2020 to 9.2% in 2022 with rural facilities facing the highest peril, as operating margins fell amid soaring expenses that are outpacing revenue growth, according to a report released this month by the state's hospital association.

But public finance analysts said big health systems in urban areas of the Lone Star State are actually performing well, helped by a growing population and a strong economy.

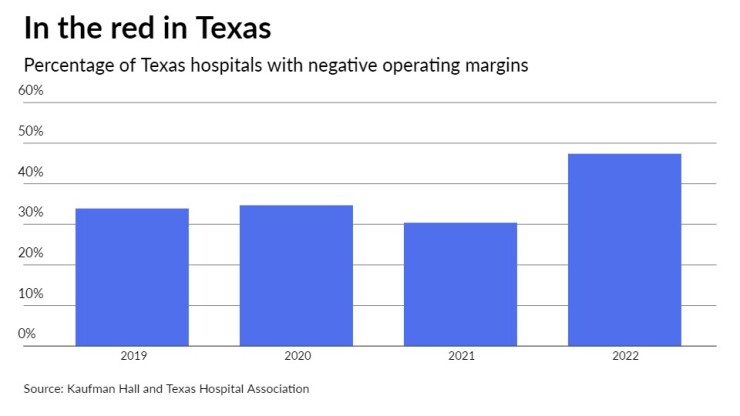

The Kaufman Hall report for the Texas Hospital Association said operating margins are 24.1% below 2019 levels with nearly half of hospitals experiencing negative margins this year, compared to about a third in 2019 as revenue lags the cost of patient care.

"Hospitals have incurred serious losses relative to pre-pandemic levels — including approximately $3.2 billion in 2022 to date — and future federal support is uncertain, as CARES Act funding has largely concluded," the report said.

Total expenses for this year, including labor and medical supplies, are $33.2 billion higher than pre-pandemic levels, while hospital volumes that include lucrative operating room minutes are significantly lower, it added.

The report comes

Fitch Ratings gave nonprofit hospitals and health systems a deteriorating outlook for 2023.

"The sector is seeing labor pressures and generationally elevated inflation, compressing margins for virtually all providers," the rating agency said. "These macro headwinds, specifically the labor supply, became highly pronounced in a very short period of time, with sector pressure further compounded by investment losses in 2022."

S&P Global Ratings assigned a negative outlook to nonprofit acute health care earlier this month.

"Margins and cash flow recently have at best demonstrated limited sustainability of a post-pandemic recovery and at worst have accelerated to uncharacteristically high losses," S&P said. "We do not expect full margin recovery in 2023 and will likely see continued operating losses, albeit at lower levels than 2022, for many institutions."

Concern about hospitals has increased since last year, according to a

"The health care/hospital sector registered in fourth place," the survey results said. "This is a very interesting change because investors were least concerned about the health care sector last year."

In Texas, the Kaufman Hall report says that rural hospitals have a much higher risk of closure than their urban counterparts.

"It really is a tale of two different types of credits," said Kevin Holloran, a Fitch analyst. "Small, rural kind of weaker, if you will, largely unrated versus the urban, bigger, almost all rated. Those are radically different credit profiles."

He added that hospitals without "some fat cash reserves" face a higher risk of closure as it will take multiple years for expenses and revenue to realign to a financially favorable relationship.

Most of the hospitals, health systems, and local government-run provider districts in Texas rated by S&P are investment grade, with the largest credits all doing well, said Patrick Zagar, a S&P analyst.

"Just from a financial standpoint, in the key measures we look at, Texas providers were incrementally stronger," he said. "Most of them have continued to make money in 2022 with positive operations. That's certainly an outlier."

On the other end of the credit spectrum is junk-rated Dawson County Hospital District in rural northwest Texas, which had its property tax-backed bonds upgraded to CCC-plus from CCC by S&P in July based on a lessened risk associated with default, bankruptcy, and liquidity over 12 months.

"The rating further reflects the district's small size and precarious financial profile that, though improved from prior years, is expected to continue to attenuate over the outlook period and remain exposed to the severe industry pressures facing rural health care providers such as heightened labor costs," S&P said in a report.

Nearly 11% of Texas' 28.6 million population live in non-metro areas, according to the

Out of the 600 hospitals in the state, only 160 are in rural counties, where they serve a larger proportion of older, uninsured, and publicly insured patients than urban hospitals,

In Texas, the uninsured accounted for 18% of the population, the highest percentage among states, according to

Medicaid expansion would be a credit positive for hospitals in Texas, according to Zagar.

"You unlock in Texas' case billions of dollars of reimbursements," he said.

The Texas Hospital Association said state and federal support is needed to ensure hospitals stay open.

"Texas hospitals are asking for assistance in the areas of financial stability, workforce growth to fill critical open jobs, public health resources, behavioral health resources and greater access to care and health care coverage" the group said in a statement. "At the federal level, hospitals are pushing Congress for solutions to prevent harmful Medicare cuts and a Statutory PAYGO sequester from taking effect."

Meanwhile, some Texas hospital systems are eying expansions.

This fall, the Tarrant County Cultural Education Facilities Finance Corporation issued $500 million of revenue bonds on behalf of BSW Holdings for a Baylor Scott & White Health project.

Proceeds will fund expansions and modernizations at medical centers in the Dallas and Austin areas and in College Station as part of an anticipated $1.1 billion capital plan.

The bonds were rated Aa3 by Moody's Investors Service and AA-minus by S&P.

"The rating is based on our view of Baylor Scott & White's expansive and growing market position throughout Texas, characterized by a diverse portfolio of access points and strong revenue and earnings diversity, which has contributed to the system's healthy operating performance and robust cash flow amidst the COVID-19 pandemic and ensuing inflationary pressures," S&P said in a rating report.

A Texas public hospital district has been thwarted in its debt-financed expansion plans. A successful petition drive