As firefighters get control of large wildfires in Oregon and Washington, the Pacific Northwest states are expected to see minimal credit impacts, according to a ratings agency.

As with California, the two states are seeing larger fires and a fire season starting earlier in the summer than in past years.

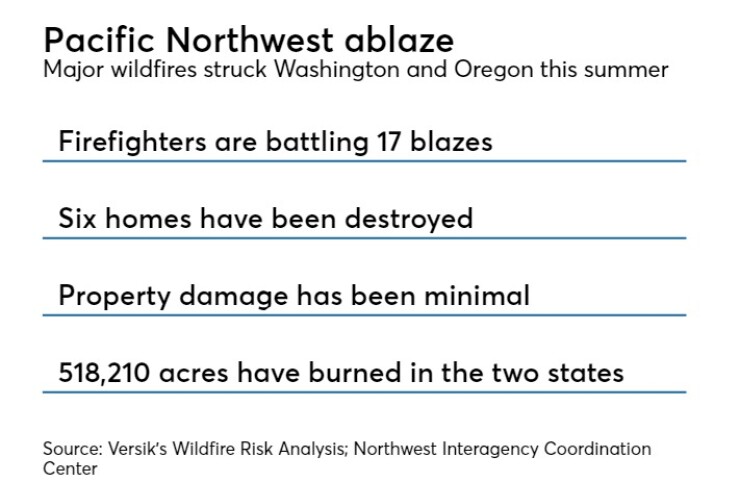

Since July, firefighters have battled more than a dozen fires burning hundreds of acres in Oregon and Washington, according to the Northwest Interagency Coordination Center.

In Washington, Gov. Jay Inslee signed an emergency declaration for all 39 of the state’s counties on July 31 saying “Catastrophic fires are burning up and down the West Coast, putting a strain on our firefighting resources."

The order allowed for state resources and coordination during what Inslee called “another unprecedented fire season.”

Oregon Gov. Kate Brown also declared a statewide wildfire emergency last month, stating that the fire season was escalating earlier than normal.

“Given drought conditions and hotter than usual temperatures, Oregonians should be prepared for an intense wildfire season this year,” she said.

So far the fires have not turned deadly like the devastating Carr Fire in California’s Shasta and Trinity counties. To date Oregon and Washington have not seen any major property loss with the fires mostly consuming wildland areas.

In a July report, S&P Global Ratings said wildfires pose challenges to local government but most bounce back

“In general, we find that federal and state programs and fiscal backstops have helped with both immediate fiscal needs and the longer-term path to recovery in the wake of fires,” the report said. “However, any data on the fires' long-term economic effects will take longer to emerge. We do not anticipate significant rating changes or material credit weakness in the affected areas.”

Looking at California’s 2017 wildfires, the report found that tax bases continued to grow despite significant damage in some areas.

“By and large, our general expectation is that communities tend to recover,” said S&P analyst Benjamin Geare.

In the short-term, credit analysts look at how a large fire might affect a local agency’s liquidity, he said. Over time, whether property-owners choose to rebuild is an important factor.

“The key thing is if the damage is such it really changes people’s attitudes about whether they want to live there,” Geare said.

Compared to California, few issuers were in the path of fires in Oregon and Washington. S&P only identified three fires with obligors that could be affected.

The largest such potential threats are from the Cougar Creek Fire in Washington, which impacts Chelan County, with $144.2 million in local outstanding debt, and Leavenworth, with $8 million.

The fire in the northeastern part of the state has burned nearly 42,000 acres since it started July 28. By earlier this week, it was 45% contained, according to the U.S. Forest Service.

While authorities issued evacuation orders and some structures were threatened, none were lost in the fire, which spread mostly in steep forest terrain.

In Oregon, $8.9 million in outstanding debt is held in Josephine County -- one of the areas in the southwest part of the state where the Garner Complex fire has burned.

The 8,886-acre fire began July 16 when a series of region-wide lightning strikes started 12 fires that grew into one large blaze threatening hundreds of homes, according to the U.S. Forest Service. The fire was 86% contained with no loss of structures.

In Shady Cove, a small town about 50 miles north of the California border, S&P identified $3 million in outstanding debt near the Miles Fire.

One house was destroyed in the fire which burned 49,996 acres after it was ignited due to a lightning strike July 16. It was 55% contained.

Washington’s most damaging fire this season has been the Boyds Fire in the small town of Kettle Falls, 20 miles south of the Canadian border, with a population of 1599 “plus one grouch,” according to its website.

Five homes were destroyed and another 529 were threatened in the blaze which also burned 4,712 acres since it began Aug. 11, according to the U.S. Forest Service. As of this week, it was 89% contained.

S&P found no local issuers in the Kettle Falls area. However the Kettle Falls school district has a four-year levy on property taxes approved last year that raises $1.3 million for capital improvements.

Due to differences in property tax structures, Oregon and Washington are more insulated from any changes in value following a fire, Geare said. In California, property owners can get their property reassessed and dropped to a lower rate.

In a 2017 report, Verisk Analysis said that wildfire activity is rising in California and other western states. It found that 4.5 million U.S. homes were at high or extreme risk of wildfire while $5.1 billion was lost over the past decade from wildfires.

Geare said analysts are watching closely to see how increased fires due to climate change may impact credit risks. So far, he said there’s no evidence of insurers or mortgage underwriters changing practices in areas that are at greater risk of fires.

“It’s definitely something we’re trying to keep an eye on as the risk may evolve in the future,” he said.

Keeley Webster contributed to this story.