Municipals were stronger on the short end Thursday, but otherwise little changed, once again ignoring the moves higher in Treasuries, as many participants are in wait-and-see mode with a brand-name heavy calendar building and legislative news out of Washington remaining fluid.

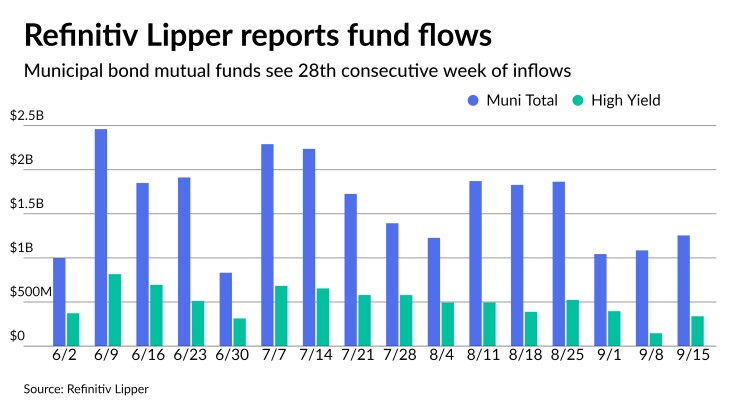

For the 28th straight week, Refinitiv Lipper reported inflows into municipal bond funds. Investors put $1.3 billion of cash into the mutual funds, with high-yield seeing $338 million of that amount.

Triple-A benchmarks were bumped on the one-year as large blocks of high-grade names were trading below benchmark yields, but scales were little changed outside of that on the day.

Ratios continue to hover in a tight range with the 10-year at 70% and the 30-year at 81%, according to Refinitiv MMD. The 10-year muni-to-Treasury ratio was at 74% while the 30-year was at 81%, according to ICE Data Services.

Several large new issues are being posted on MuniOS, building a robust calendar further into September. Thirty-day visible supply is at $12.37 billion.

The Golden State Tobacco Securitization posted a $1.8 billion taxable refunding, Ohio State University plans $600 million of green bonds, the Triborough Bridge and Tunnel Authority will price $850 million MTA Bridge/Tunnels payroll mobility tax senior lien bonds, while the New York Thruway Authority plans $546 million on the competitive calendar. An $875 million deal is planned for the Los Angeles Department of Airports, the New Jersey Healthcare Facilities Authority plans a $750 million RWJ Barnabas Obligated Group deal, Orange County, California, has $663 million of I-405 bond anticipation notes and Massachusetts has nearly $1 billion of GOs slated for competitive issue next week.

All of this supply is expected from a historical standpoint; issuance typically grows into September and October.

The difference this year is just how well municipals have continued to perform with the uptick of that supply, with inflows nearing records, a continued steady credit picture despite coronavirus-related pressures, and the expectation of rising tax rates both individual and corporates keeping demand for municipals strong.

Many participants point to potential rising rates and pressure on the asset class as typical, but some argue the fundamentals are simply too strong to move rates higher, at least in the near term.

"I know there is a drumbeat that yields will move higher, pressure will be on, fund flows may peter off, but when you really look at this market, it is hard to see when all of that, any of that will hit, if at all," a New York strategist said. "From a historical perspective, yes, we should see some pressure come on as supply increases and redemptions are fewer, but there are a lot of atypical things happening right now that might not allow for history to repeat as neatly."

He said outside of market technicals, Washington has changed the picture for munis, given that both issuers and investors are now looking at a much stronger likelihood of

If a direct-pay bond program comes along, tax-exempt advanced refundings are resurrected and the bank-qualified limit raised, these factors may put a dent in near-term supply outside of cyclical borrowings as issuers await the additional tools. Even if supply does lessen, there is still a lot of cash on the sidelines.

He noted that while fund inflows have fallen from summer highs, "we have got to consider that $2.5 billion was the outlier. A solid $1.3 billion is just that, solid. So getting anxious about a billion drop doesn't make much sense when we're still above a billion," he said. "The money is still there and it is still coming in. You also have to consider the broader investor demand component that taxables have brought into this market, lessening the exempt volume.

"This market sometimes operates with blinders on and I think we need to look to the periphery right now," he added.

Refinitiv Lipper reports $1.3B inflow

In the week ended Sept. 15, weekly reporting tax-exempt mutual funds saw $1.256 billion of inflows, Refinitiv Lipper said Thursday. It followed an inflow of $1.086 billion in the previous week.

Exchange-traded muni funds reported inflows of $380.373 million, after inflows of $202.246 million in the previous week. Ex-ETFs, muni funds saw inflows of $875.434 million after inflows of $883.623 million in the prior week.

The four-week moving average remained positive at $1.313 billion, after being in the green at $1.456 billion in the previous week.

Long-term muni bond funds had inflows of $967.897 million in the latest week after inflows of $690.739 million in the previous week. Intermediate-term funds had inflows of $178.449 million after inflows of $138.236 million in the prior week.

National funds had inflows of $1.178 billion after inflows of $993.942 million while high-yield muni funds reported inflows of $337.970 million in the latest week, after inflows of $144.825 million the previous week.

Secondary trading and scales

Wisconsin 5s of 2022 traded at 0.06%. Minnesota 5s of 2022 at 0.06%. Maryland 5s of 2022 at 0.06%. Georgia 5s of 2023 at 0.11%.

Wake County, North Carolina 5s of 2025 at 0.21%-0.20%. Maryland 5s of 2025 at 0.28%-0.26%.

Ohio 5s of 2026 at 0.49%. Charlotte, North Carolina 5s of 2026 at 0.40%-0.39%. Illinois Finance Authority Ascension Health 5s of 2026 at 0.41% and 5s of 2027 at 0.55%.

Wisconsin 5s of 2030 at 0.85%-0.84% versus 0.86% Wednesday. New York City TFA 5s of 2031 at 1.06%-1.05%. (Priced on 8/2 at 1.04%.) Denver City and County waters 5s of 2033 at 1.05% (1.06% on 9/1).

New York City 5s of 2047 traded at 1.87% versus 1.90% Tuesday. New York City TFA 4s of 2048 at 2.00%-1.99% versus 2.01% Wednesday.

Austin, Texas waters 5s of 2050 at 1.64%-1.62%. Triborough Bridge and Tunnel 5s of 2051 at 1.82%, the same as Wednesday.

Refinitiv MMD's scale showed the one-year fall one basis point to 0.07% in 2022 and steady at 0.11% in 2023. The yield on the 10-year sat at 0.93% while the yield on the 30-year stayed at 1.53%.

The ICE municipal yield curve showed bonds in 2022 at 0.08%, down one basis point, and at 0.11% in 2023. The 10-year maturity sat at 0.95% and the 30-year yield was at 1.52%.

The IHS Markit municipal analytics curve showed the one-year down one to 0.08% and steady at 0.11% in 2023. The 10-year yield at 0.93% and the 30-year at 1.52%, both steady.

The Bloomberg BVAL curve showed short yields steady at 0.07% and 0.07% in 2022 and 2023. The 10-year yield sat at 0.93% and the 30-year yield stayed at 1.52%.

The 10-year Treasury was yielding 1.337% and the 30-year Treasury was yielding 1.885% in late trading. The Dow Jones Industrial Average fell 5 points or 0.013%, the S&P 500 lost 0.02% while the Nasdaq gained 0.16% near the close.

Economic Indicators

Data released Thursday indicate the employment situation weakened slightly as prices remain elevated.

The Labor Department reported that seasonally adjusted initial jobless claims rose to 332,000 in the week ended Sept. 11, up 20,000 from the previous week's revised level of 312,000, originally reported at 310,000.

Economists surveyed by IFR Markets had expected 318,000 claims being filed for the week.

The four-week moving average fell 4,250 to 335,750, a decrease of 4,250 from the previous week's upwardly revised average of 340,000, originally reported as 339,500. This is its lowest level since March 14, 2020 when it was 225,500.

The advance seasonally adjusted insured unemployment rate fell to 1.9% in the week ending Sept. 4, a drop of 0.2% from the previous week's revised rate of 2.1%, originally reported as 2.0%.

“A bit of sobering news on the labor market front as first-time jobless claims jumped to 332,000 in the week ending Sept. 11, above the expected reading of 322,000 and up from a pandemic-low of 312,000 in the prior week,“ said Scott Anderson, Ph.D., chief economist at Bank of the West Economics. “Despite the larger-than-expected increase, the four week moving average, which smooths out the volatility in the data, fell to 336,000. This is a fresh pandemic low and the fifth successive weekly decline.”

On an unadjusted basis, the advance number of actual initial claims under state programs totaled 262,619 in the week ending Sept. 11, down 8.2% to 23,331 from the previous week.

In addition, for the week ending Sept. 11, 45 states reported 28,456 initial claims for Pandemic Unemployment Assistance.

In the week ending Aug. 28, extended benefits were available in Alaska, California, Connecticut, District of Columbia, Illinois, Nevada, New Jersey, New Mexico, New York and Texas.

For the week ending Aug. 28, 47 states reported 5,487,233 continued weekly claims for PAU benefits and 47 states reported 3,805,795 continued claims for Pandemic Emergency Unemployment Compensation benefits.

Manufacturing activity in the Mid-Atlantic region continued to expand this month, the Federal Reserve Bank of Philadelphia reported, while employment softened and prices remained high.

The Fed’s September Manufacturing Business Outlook Survey showed the diffusion index for current general activity rose 11 points to 30.7 this month.

Economists polled by IFR Markets had expected a reading of 19.0.

Responses to the survey showed that firms continued to report increases in employment. However, the employment index declined to 26.3 in September from 32.6 in August.

Of responding firms, 62% reported steady employment levels and the share reporting increases at 31% exceeded the share reporting decreases at 5%. The average workweek index increased five points to 29.3.

The indicators for prices paid and prices received remained high, but showed small declines in September. The prices paid index dropped four points to 67.3 while the current prices received index slipped one point to 52.9.

Firms reporting increases in input prices at 71% exceeded the 4% who saw decreases; 23% reported no change. Almost 55% of the firms reported increases in prices received for their own goods, 2% reported decreases and 42% said there was no change.

The current shipments index rose 11 points to 29.9 in September. Over 34% of the responding firms saw increases in shipments while only 4% reported decreases.

The index for new orders fell 7 points to a reading of 15.9. Nearly 31% of the firms reported increases in new orders this month, while 15% reported decreases.

Looking ahead, the survey’s future general activity and new orders indexes moderated, but firms remained optimistic about the next six months.

Also on Thursday, the Commerce Department reported that seasonally adjusted retail and food services sales rose 0.7% in August to $618.7 billion.

Retail sales for July were revised to show a fall of 1.8% originally reported as a 1.1% decline. Compared to a year ago, retail sales were 15.1% higher.

Economists surveyed by IFR Markets had expected retail sales to have fallen by 0.1%.

Total sales for the June through August period were up 16.3% from the same period a year ago.

“Defying expectations for another monthly decline, total retail sales rebounded 0.7% in August. This was a significant improvement from the downwardly revised 1.8% decrease in July, suggesting underlying household demand remains firm despite the resurgence of COVID cases,” Anderson said.

Retail trade sales rose 0.8% in August and were up 13.1% on the year. Sales at clothing and accessories stores were up 38.8% from August 2020, while gasoline station sales were 35.7% higher than last year.

Commerce also reported that business inventories rose 0.5% in July after a 0.8% gain in June. Inventories were up 7.2% from the same time a year earlier.

Economists polled by IFR Markets had expected a gain of 0.5%.

Sales also rose 0.5% in July and were 16.3% higher than June 2020. The total business inventories/sales ratio was 1.25 compared to 1.36 in July 2020.