When Oregon voters consider $1.23 billion in bond measures on the May 21 ballot, issuers will be hoping for a more favorable outcome than local issuers received in November.

Only two bond measures totaling $19 million were approved in November out of the $474.95 million requested during the special election.

"Historically, the November election has been an important source of municipal bond issuance in Oregon and an indication of the level of issuance for the following year," said Tim Iltz, a portfolio manager at Aquila Group of Funds. The results of Oregon's November special election were "very anemic compared to previous elections. For reference, in November 2022, Oregon voters approved $1.45 billion in new bond measures."

Iltz said bond measure passage tends to drive issuance for the year. Issuers throughout Oregon only sold $252 million in the first quarter of 2024, according to data from LSEG, formerly Refinitiv, down more than 88% from $2.24 billion a year earlier in a

The state also typically comes earlier in the year with its bond sales, so that may have affected the numbers, but Iltz said lowered local issuance appears to be the primary factor.

Turnout for elections like November's without many candidates or measures on the ballot is generally much lower than even-year elections that match up with congressional mid-terms and the presidential election.

The May election is the statewide primary, covering members of Congress, the state legislature, and three state executive positions below the governor on the organization chart, including the race to succeed term-limited State Treasurer Tobias Read. The already-decided U.S. presidential nominations are also on the ballot.

But even taking that into consideration, Iltz said November's results were surprising.

The May 21 primary election has $1.23 billion in bond measures from school districts, cities and special districts on the ballot, according to data provided by Iltz — well over twice the amount requested in November.

In November, fewer measures may have been on the ballot because schools and cities didn't expect a warm reception from voters given inflation, according to an Oregon financial advisor, who asked to not be named.

Many issuers also had to rethink their capital programs as construction costs soared, he said.

An Oregon muni banker, who asked not to be named, thinks May's issuance follows the typical cycle for the state, reflecting both maintenance needs and the state having a lot of older school buildings that need to be upgraded or replaced.

This month's election slate includes 22 local governments and school districts seeking amounts ranging from $2.5 million to $380 million.

The largest measures are the $380 million Measure 26-244 that asks voters to authorize bonds

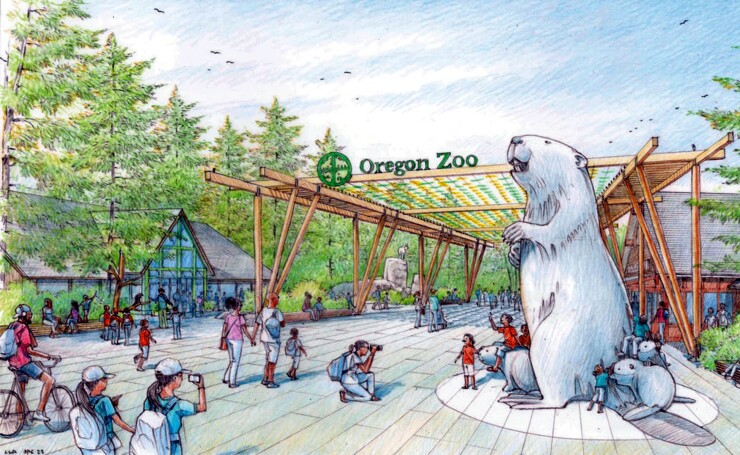

If voters in the three metropolitan Portland counties of Multnomah, Clackamas and Washington approve the zoo bond, it would fund new projects to protect animal health and well-being, provide conservation education, and conserve water and energy at the zoo, according

Voters last approved a zoo bond measure in 2008. Projects funded by that measure were completed in 2021, having upgraded roughly 40% of the zoo, including projects Elephant Lands, Primate Forest, Polar Passage, Condors of the Columbia, and a veterinary medical center and an education center, according to the findings of the citizen's bond committee.

Measure 26-244 would initiate a second phase of projects in parts of the campus not upgraded with funding from a $125 million 2008 bond measure, which funded a new educational facility and habitats for polar bears and animals and many other improvements. What would be funded if the new bond measure passes are improvements to some of the zoo's oldest animal areas, educational exhibits, visitor facilities and infrastructure.

"I absolutely believe Oregon residents view the Zoo as a community treasure," said Metro Councilor Christine Lewis, of why she voted for the bond measure that was approved by the six council members and Metro president in February.

The funding will enable the zoo to continue to do conservation work like breeding programs for endangered species and to provide good animal care, Lewis said.

The Oregon Zoo and the Philadelphia Zoo were the first to be accredited in 1974 by the Association of Zoos and Aquariums, which now accredits more than 200 zoos using standards to gauge standard of care using scientific principles, Lewis said.

The projects to be funded by the bonds are part of the zoo's 20-year master plan. The bonds issued off the 2008 projects completed 40% of those projects, leaving the remainder to be covered with new bonds issued off the proposed bond measure, she said.

Since the existing bonds will be repaid before the zoo would tap the new measure, the new levy will collect slightly less money from taxpayers, Lewis said.

The measure would authorize a property tax of about 8.5 cents per $1,000 of assessed value to the tax bills of people living in the three Metro counties, down from the 9% assessed by the 2009 measure that expires in January 2025.

The bond oversight committee praised the zoo's use of the 2008 bonds

"The committee is pleased to report that throughout the thirteen years since the bond measure was approved by voters in November 2008, the bond funds were spent wisely, bond projects were completed on schedule and within budget, and the bond program successfully delivered on voter expectations," wrote committee chair Susan G. Hartnett in a letter introducing the group's final report.

Though Harnett believes the 2008 bond was well spent, she added in her letter that further improvements are needed.

"However, if you walk further you will find habitats in need of improvements, aged buildings in need of replacement, and infrastructure in need of upgrading," Harnett said. "It is my sincere hope that the success of the 2008 bond inspires regional leaders and voters to continue addressing the needs of all the wildlife in our care."

The measure faces opposition

More than 60% of residents voted in favor of the measure in 2008, and Lewis said she expects similar support this go-round.

The next largest bond measure comes from the Urban Flood Safety and Water Quality District, which

The district voted in February to place the

The upgrades are necessary for the levees to remain accredited by the federal government; and if they don't retain accreditation businesses and homeowners along the river would see their flood insurance costs spike. It would also put the levees at risk of failure. Plus, the federal government agreed to provide $100 million in funding toward the effort, but only if the water district submitted a funding plan to it by spring 2025.