Oklahoma City is looking at short-term financing for an at least $900 million arena for the National Basketball Association's Thunder if voters approve the continuation of a one-cent sales tax for six years.

The city council last week set a Dec. 12 election on the tax and approved a letter of intent with the team, which would, if the arena is built, commit to remain for 25 years in Oklahoma City, its home since the 2008-09 season.

While its lease for the city owned Paycom Center expired this year, the Thunder agreed to a three-year extension in order to have a conversation about a new downtown arena, according to Mayor David Holt, who signed the letter of intent Sept. 26.

Under his arena plan aimed at averting the team's potential move out of Oklahoma City, voters will decide on the tax earmarked for the arena and collected for six years once the current Metropolitan Area Projects (MAPS 4) one-cent sales tax expires April 1, 2028.

"For the concerts, the major league sports, for the quality of life, the community unity, the economic impact in growth, the international brand, the economic ability to help all people…and the philanthropy – the fact we can do all that without a tax increase I think is a win-win," Holt told the city council.

MAPS financing

Holt's plan taps $70 million of the center's MAPS 4 funding for the new arena targeted to open for the 2029-30 basketball season, while the team would contribute $50 million.

Oklahoma City Chief Financial Officer M. Brent Bryant said those two revenue sources would be used to fund upfront costs.

To bridge the gap until the arena facility sales tax collections would begin in 2028, the city envisions financing through tax anticipation notes structured like a line of credit, according to Bryant.

"We think the best approach will be to do a kind of a construction-type loan that you term up over the life of the sales tax," he said, adding the goal is to minimize borrowing costs as much as possible and that issuing eight- or nine-year bonds was rejected due to interest costs.

Bryant said Oklahoma City has successfully used this type of structure in the past, particularly with tax increment financing district projects that he acknowledged were "not at this magnitude."

The notes would be privately placed with a bank pursuant to a request for proposals that could be issued in 2026 when the need for cash is projected, he said, adding multiple banks have already expressed interest.

"We're talking to local banks, we're talking to large banks, and our municipal advisor, Public Financial Management, is talking to banks too to see if there's interest in this," Bryant said.

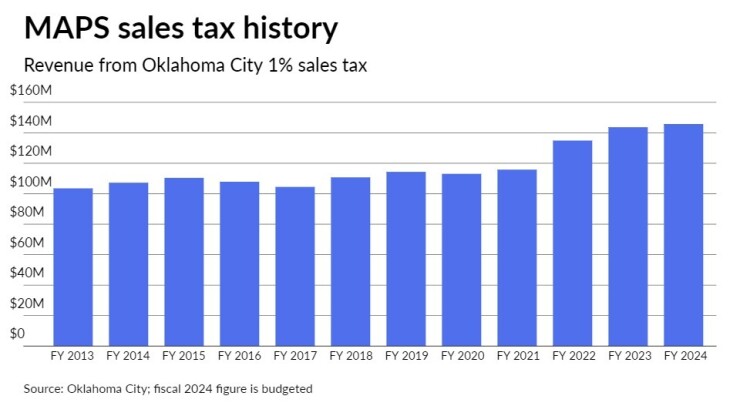

The city is projecting "reasonable and conservative" growth in the one-cent sales tax, according to Bryant. The MAPS 4 tax is forecast to raise $145.77 million in fiscal 2024, up 1.45% from fiscal 2023.

Holt's plan faced pushback by two city council members who said the proposal was not adequately vetted or the team's contribution was too little.

"I cannot vote to send this to people to vote on because it is not something I believe was negotiated in good faith with good information provided to me to make an actually informed decision at the end of the day," Council Member JoBeth Hamon said.

Council Member Nikki Nice said there is an expectation the arena will cost well over $1 billion, while the team, which is only providing $50 million, is charging ticket prices many can't afford.

"The math is not mathing as far as 95% and 5% is concerned for costs of these types of what this can do, and 72 months is a long time for people to pay for something they never get to experience," she said.

Joel Maxcy, a sports economist at Drexel University, said the Thunder's contribution "is very much on the low end," with private funding as part of recent sport venue deals coming in at 50% or more.

He also noted $900 million "is quite a high price tag, especially in a small city like OKC where real estate and construction wages/costs would be much less than on either coast," although higher construction prices have been a factor in increasing arena costs in the past few years.

"That will put the new building in the top five most expensive arenas in the NBA," Maxcy said in an email.

Oklahoma City Council Member Todd Stone warned losing the team could make the city less attractive for new investment and would dent revenue.

Bryant said 70% of Oklahoma City's general fund depends on sales and use tax collections, while property taxes are exclusively used to pay off $1.075 billion of outstanding triple-A-rated general obligation bonds.

Sales and use tax revenue

Organized opposition to the arena plan has emerged at

"OKC has real problems to solve like affordable housing, public transportation and infrastructure." Nabilah Rawdah, executive director of Oklahoma Progress Now, said in a statement. "Asking the taxpayers of OKC to subsidize 95% of the project for the benefit of a privately owned asset shows a complete lack of fiscal responsibility by Mayor Holt."

The Thunder were moved to Oklahoma City after the Seattle SuperSonics

An earlier version of the one-percent sales tax

Tempe, Arizona, voters in May rejected a $2.1 billion

With a value of $1.875 billion, the Thunder

In a statement, the team's chairman, Clay Bennett, called the council's vote "a vital step for the future of Oklahoma City and an opportunity to continue to build on the tremendous growth our city has enjoyed."

The new city-owned arena would be built to and maintained at NBA standards with the team committing to playing there for 25 years starting with the 2029-30 season.

Paycom Center, which has 581,000 square feet and a seating capacity of 18,203, is the

"There are U.S. markets larger than Oklahoma City that don't have an NBA team, some of which already have or are planning an NBA-ready arena," a city statement said. "Also, without a new arena, it will prove more and more difficult for Oklahoma City to retain and attract new major concerts, family shows, and other similar events."