Municipals were holding firm on Tuesday as new deals came to market, topped by the New York State green bond deal and the Arkansas recycling bond offering.

Primary market

RBC Capital Markets priced the NYS Environmental Facilities Corp.’s (Aaa/AAA/AAA) $125.79 million of Series 2019A state revolving funds revenue bonds, 2010 Master Financing Program, green bonds. The deal had been priced for retail investors on Monday.

The split 2029 maturity was priced as 5s to yield 1.70% and 1.72%, in line with Refinitiv MMD’s AAA and New York scales. The 2044 term maturity was priced as 5s to yield 2.43% while the 2049 term was priced as 5s to yield 2.48%.

Since 2009, the EFC has issued about $7.7 billion of debt, with the most issuance occurring in 2017 when it sold $1.4 billion. Prior to this year, it sold the least amount of bonds in 2010 when it issued $505 million.

Also on Tuesday, Goldman Sachs priced the Arkansas Development Finance Authority’s (B3/B/NR) $487 million of industrial development revenue bonds for the Big River Steel project. The issue will finance an expansion of the firm’s Arkansas-based scrap recycling and steel production facility.

And Raymond James & Associates priced the Polk County School District, Fla.’s (Aa3/NR/NR) $160.02 million of sales tax revenue bonds.

Tuesday’s bond sales

Secondary market

Munis were little changed on the

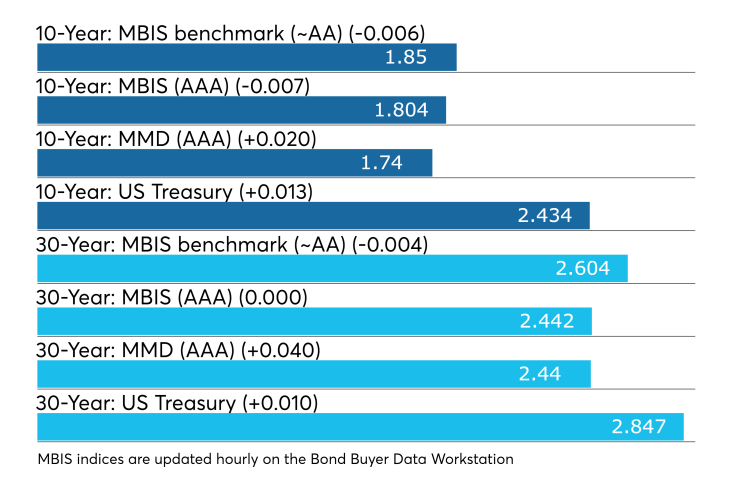

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO rose two basis points while yield on the 30-year muni yield rose four basis points.

“Demand remains strong across municipal bonds as investors continue to look for name diversity particularly in the high-yield space, which is unchanged despite the ICE Muni Yield curve steepening today with the five-year up ½ basis point and the 30-year up almost three basis points,” ICE Data Services said in a market comment. “The two-year/10-year spread backed out to 27 basis points. Tobacco bonds are one basis point higher and taxables are up by 2.6 basis points in the five-year. Puerto Rico is unchanged. Yields in the muni healthcare sector are moving in tandem with the ICE Muni Yield Curve.”

The 10-year muni-to-Treasury ratio was calculated at 71.6% while the 30-year muni-to-Treasury ratio stood at 85.9%, according to MMD.

Treasuries were weaker as stock prices traded higher on eased trade concerns.

Two positive developments in U.S. trade relations with its allies happened last week, according to a Tuesday report from Cumberland Advisors. The first was a decision to hold off on scheduled imposition of tariffs on cars and car parts from the European Union, Japan and South Korea for six months and the second was the lifting of a 25% U.S. tariff on steel imports from Canada and a 10% tariff on aluminum imports.

These steps will let U.S. negotiators focus on China in the coming months, according to Cumberland.

“The worsening U.S.-China trade war will remain at the forefront of investor concerns in the coming months,” the report said. “We will continue to report on developments in this dispute and discuss the implications for investors. We will also not neglect the postponed but not resolved trade disputes with the E.U. and Japan. The E.U. countries, which have a common trade policy, are together a more important trading partner of the U.S. than is China, and Japan is the U.S.’s fourth most important trading partner.”

Meanwhile, Morgan Stanley Research said that “tariff escalation risk has risen and investors should plan accordingly.”

Morgan Stanley also warned about the impact on the market.

“We think inflation markets have not priced in the impact of tariffs so far and instead seem complacent about the probability and impact of tariffs. An empirical analysis of CPI suggests that the 10% tariffs last September likely added 10 basis points to CPI, and extrapolation would suggest 25% tariffs could be worth 25 basis points on CPI, which could go up non-linearly given a higher fraction of consumer goods in the final tranche. The inflation market is however pricing benign outcomes.”

The report also looked at China's possible responses.

“China is limited in a tariff response because it imports a lower amount of goods from the U.S. than the U.S. does from China, and therefore could consider non-tariff measures,” the report said. “We think China will continue to sell Treasuries, but we think the pace will continue to track at the pace of capital inflows as opposed to being used as a response measure for tariffs.”

Previous session's activity

The MSRB reported 34,862 trades on Monday on volume of $9.78 billion. The 30-day average trade summary showed on a par amount basis of $12.47 million that customers bought $6.02 million, customers sold $4.29 million and interdealer trades totaled $2.16 million.

California, New York and Texas were most traded, with the Golden State taking 18.165% of the market, the Lone Star State taking 11.221% and the Empire State taking 8.688% of the market.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured A-2 revenue zeros of 2051, which traded 59 times on volume of $37.93 million.

Treasury auctions bills

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.280% high yield, a price of 97.694667. The coupon equivalent was 2.359%. The bid-to-cover ratio was 2.95.

Tenders at the high rate were allotted 94.79%. The median yield was 2.255%. The low yield was 2.230%.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $45 billion of four-week discount bills Thursday. There are currently $34.999 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.