The municipal bond market is ready to see a variety of negotiated and competitive offerings hit the screens on Tuesday from issuers in New York, Washington, Ohio and Maryland.

Primary market

RBC Capital Markets is set to price the New York City Transitional Finance Authority’s $840 million of future tax secured subordinated bonds for institutions on Tuesday after holding a two-day retail order period.

The $800 million of Fiscal 2017 Series E Subseries E-1 tax-exempt bonds were priced for retail on Monday to yield from 1.18% with a 4% coupon in 2020 to 3.712% with a 3.625% coupon in 2045. No retail orders were taken in the 2032, 2035-2036, 2039 or 2041-2043 maturities. A 2019 maturity was offered as sealed bid.

The $40 million of Fiscal 1999 Series A Subseries A-2 tax-exempt bonds were priced for retail on Monday as a remarketing to yield 1.15% with 3%, 4% and 5% coupon in a triple-split 2019 maturity.

The bonds are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

Also on Tuesday, the TFA will competitively sell $300 million of taxable bonds in two separate sales consisting of $234.21 million of future tax secured subordinate bonds, Fiscal 2017, Subseries E-2, and $65.79 million of future tax secured subordinate bonds, Fiscal 2017, Subseries E-3.

JPMorgan Securities is slated to price Energy Northwest’s $592 million of electric revenue refunding tax-exempt and taxable bonds on Tuesday.

The offering is comprised of Series 2017A Project 1 bonds, Series 2017A Columbia Generating Station bonds, Series 2017A Project 3 bonds, Series 2017B Project 1 taxable bonds, Series 2017B Columbia Generating Station taxable bonds and Series 2017B Project 3 taxable bonds.

The deal is rated Aa1 by Moody’s, AA-minus by S&P and AA by Fitch.

JPMorgan is also expected to price the Miami-Dade County Health Facilities Authority, Fla.’s $150 million of Series 2017 hospital revenue and revenue refunding bonds for the Nicklaus Children’s Hospital.

The deal is rated A-plus by S&P and Fitch.

In the competitive arena on Tuesday, Howard County, Md., is selling $358.76 million of bonds in three separate sales consisting of $145.45 million of Series 2017B consolidated public improvement refunding bonds, $133.57 million of Series 2017A consolidated public improvement project bonds, and $79.75 million of Series 2017C metropolitan district project and refunding bonds.

All three deals are rated triple-A by Moody’s, S&P and Fitch.

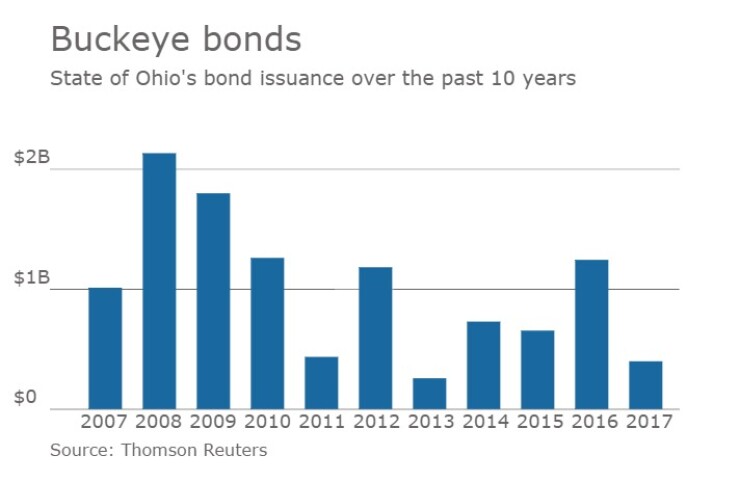

Ohio is selling $310 million of higher education general obligation bonds in two separate sales of $300 million Series 2017A tax-exempts and $10 million of Series 2017B taxables.

Since 2007, the Buckeye state has sold over $11 billion of debt, with the most issuance occurring in 2008 when it sold $2.13 billion of securities. It sold the least amount of bonds in 2013 when it offered $258.6 million of debt.

Both deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $616.0 million to $11.99 billion on Tuesday. The total is comprised of $5.72 billion of competitive sales and $6.27 billion of negotiated deals.

Secondary market

U.S. Treasuries were stronger on Tuesday. The yield on the two-year Treasury declined to 1.25% from 1.27% on Monday, while the 10-year Treasury yield dropped to 2.33% from 2.36%, and the yield on the 30-year Treasury bond decreased to 2.96% from 2.99%.

Top rated municipal bonds finished steady on Monday. The yield on the 10-year benchmark muni general obligation was unchanged from 2.17% on Friday, while the 30-year GO yield was flat from 2.97%, according to the final read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni to Treasury ratio was calculated at 91.9% compared to 91.4% on Friday, while the 30-year muni to Treasury ratio stood at 99.3%, versus 99.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 35,968 trades on Monday on volume of $7.89 billion.