The municipal market had offerings for both retail and institutional investors, as new paper started flowing into a supply-starved market.

Citi priced California’s (Aa3/AA-/AA-) $2.28 billion of general obligation various purpose bonds and refunding bonds for retail investors on Tuesday, ahead of Wednesday’s institutional pricing. It is the biggest deal of the year thus far.

Siebert Cisneros Shank priced New York City’s (Aa1/AA/AA) $913 million of GO bonds, on the second day of a retail order period, ahead of institutional pricing on Wednesday.

The timing and large availability of New York City GOs helped boost demand for one of the week’s largest deals during the second day of the retail order period, according to a New York trader close to the deal.

The trader reported that $543 million in total retail orders were spoken for after the second day’s order period — on the heels of garnering $383 million after Monday’s first day of the order period.

Maturities in 2020, 2030, and 2031 were oversubscribed, as demand was spread throughout the yield curve, according to the trader, who said the short to intermediate slope of the yield curve is in high demand among retail investors lately. The longest 2031 maturity on both series E and F was priced with a 5% to yield 2.60% during the retail order period.

“It’s a very good time to be in the market,” he said on Tuesday afternoon, noting that the city and underwriters were “taking advantage of the Moody’s upgrade.”

Moody's Investors Service upgraded New York City’s general obligation bonds to Aa1 from Aa2 Friday, noting that the upgrade — which affects about $38 billion of GO debt — “reflects continued strengthening and diversification of New York City's economy, reducing its reliance on volatile financial services.”

“The estimated demand is still going strong,” with strong demand and “a decent amount of orders” present for the remaining maturities, the trader said.

John Mousseau, president of Cumberland Advisors, described the retail pricing as “pretty aggressive,” adding that it underscores that demand is being and will continue to be driven by the reduction of the state and local tax deductions under tax reform.

"It may be causing some investors to leave the state, but the investors who are staying will need a heck of a lot more tax-exempt bonds,” Mousseau said on Tuesday afternoon.

With the lack of federal deductibility of state and local income taxes, local property taxes and now a cap on mortgage deduction on mortgages above $750,000, Mousseau said investors may opt to own more municipal bonds going forward rather than owning more real estate in New York.

"At the margin, I think that’s certainly happening,” he said. “And to the extent that New York and New York City may be seeing some residents leave, the state and city are certainly seeing some of the best relative financing numbers they have ever seen.”

Amazon may be skipping a New York location for one of its new major locations, but the city continues to thrive, in part from technology industry employment, according to Alan Schankel, mnaging director, municipal strategist at Janney.

Schankel added that in its report supporting the upgrade of New York City to Aa1, Moody’s noted that tech sector jobs and wages are “skyrocketing.” In the decade after 2007, the city increased technology-related employment from about 15,000 jobs to almost 40,000, with average wages for the sector rising from about $80,000 annually to $160,000 a decade later.

“The city benefits from a large diverse economy, which is growing less dependent on financial services sector employment,” Schankel said. “Unlike many larger cities, New York’s pension plans are relatively well funded. Using Moody’s adjusted net pension liability metric, New York’s unfunded liability is equal to about 147% of annual revenues, a manageable liability level compared to cities such as Chicago (782%), Los Angeles (424%), and Philadelphia (231%).”

He added that with a debt load exceeding $70 billion, New York is one of the most prolific issuers in the country through both its GOs ($38.6 billion) and future tax-secured bonds ($35.6 billion).

“Debt service requirements on these liabilities (along with required pension and OPEB payments) translate into fixed expenses. New York City begins each year with a fixed expense total equal to 18% of budgeted expenditures, offering more fiscal flexibility than other cities such as Chicago,” he said.

JPMorgan priced Alvin Independent School District, Texas’ (Aaa/NR/AAA) $169 million of unlimited tax schoolhouse and refunding bonds.

BofA Securities priced Kenton County Airport Board, Kentucky’s (A3/NR/A-) $103.14 million of senior customer facility charge taxable revenue bonds for the Cincinnati/Northern Kentucky International Airport.

In the competitive market, Boston (Aaa/AAA/NR) sold $145.13 million of GOs on Tuesday. The bonds were won by JPMorgan with a true interest cost of 2.7494%.

Since 2009 Bean Town has sold about $2.01 billion of securities, with the most issuance occurring in 2015 when it sold $267 million and the lowest back in 2016 when it sold $148 million.

Baltimore County, Md., (MIG-1/SP-1-plus/F1-plus) sold $246 million of consolidated public improvement bond anticipation notes. JPM won with a TIC of 1.7389%.

Forsyth County, N.C., (Aaa/AAA/AAA) sold $98.42 million of GO public improvement bonds. JPM got a hat trick for the day, winning the bonds with a TIC of 2.7456%.

Carrollton-Farmers Branch Independent School District, Texas, (NR/AAA/NR) sold $109.44 million of unlimited tax school building bonds. Robert W. Baird won the bonds with a TIC of 2.8084%. The deal is backed by the Texas Permanent School Fund Guarantee Program.

Muni supply/demand

The technical imbalance of today’s municipal market, with more demand than supply, has contributed to declining ratios, and we do not expect that dynamic to change near term, according to Schankel.

“Through two months, municipal new issuance is ahead of 2018’s lethargic pace by 21%, much of this year’s increase comes from a 53% jump in refundings, following last year’s dearth of refundings after the Tax Cuts and Jobs Act’s (2017) elimination of the use of tax free debt to advance refund outstanding issues,” he said.

He noted that new-money borrowing, which is usually associated with capital investment (infrastructure), has grown by 15% in 2019 vs January/February 2018.

“While we do not expect new-issue volume to rise back to the record levels of 2016 and 2017, it should rise by about 10% this year to roughly $371 billion,” Schankel said. “Solid demand for tax-free income, as evidenced by strong municipal bond mutual fund inflows, has been the bigger story this year.”

He added that Investment Company Institute data indicates that more than $15 billion of new cash has flowed into municipal mutual funds so far in 2019, the strongest pace since at least 2007, the earliest date for which fund flow data is available.

“Of course the trend could reverse or slow as it did last year following a strong start, but as tax day approaches, and as the impact of the 2017 tax law’s cap on deducting state tax payments on federal returns becomes increasingly apparent and painful to taxpayers in high tax states such as California and New York, we expect strong inflows to continue.”

Tuesday’s bond sales

Secondary market

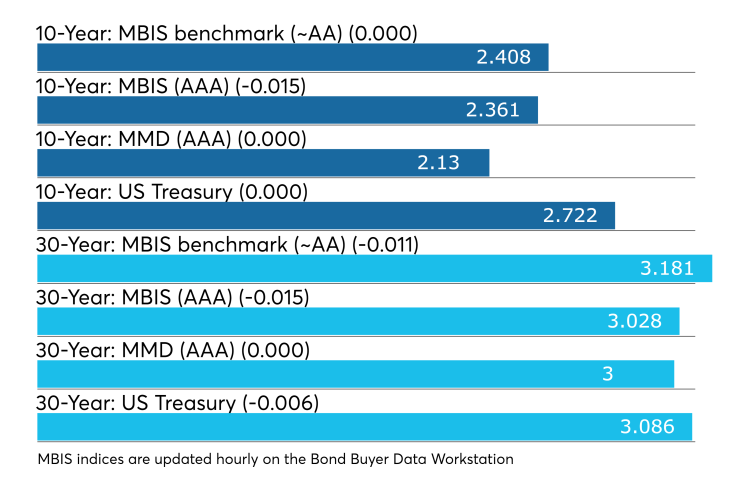

Municipal bonds were mostly stronger Tuesday, according to the MBIS benchmark scale, with muni yields falling as much as one basis point in the one- to 18-year and 27-year- to 30-year maturities. Yields rose less than one basis point in the 19- to 25-year maturities. The remaining maturity was flat.

High-grade munis were mostly stronger, with yields falling no more than one basis point in the four- to 18-year and 23- to 30-year maturities. Yields were higher by one basis point in the one- to two-year, 20-year and 22-year maturities. The remaining three maturities were unchanged.

Investment-grade municipals were steady on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year and 30-year muni unchanged.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 78.3% while the 30-year muni-to-Treasury ratio stood at 97.2%, according to MMD.

Two months into the New Year, municipal to Treasury ratios are dropping, with the 10-year ratio falling below 80% in recent days, the lowest level in a decade, according to Schankel.

“Although some commentators suggest that falling ratios describe an ‘overbought’ municipal market, we believe that ratios are reverting to pre-recession levels in reaction to the general supply/demand imbalance of the municipal market as well as the longer term improvement to municipal credit stability,” Schankel said.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,173 trades on Monday on volume of $9.280 billion.

Texas, California and New York were the municipalities with the most trades, with the Lone Star State taking 12.263% of the market, the Golden State taking 12.259% and the Empire State taking 8.697%.

Treasury to sell $60B 4-week bills

The Treasury Department said it will sell $60 billion of four-week discount bills Thursday. There are currently $34.997 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Treasury sells CMBs

The Treasury Department on Tuesday sold $30 billion 42-day cash management bills, dated March 7, due April 18, at a 2.410% high tender rate.

The bid to cover ratio was 3.06.

The coupon equivalent was 2.457%. The price was 99.718833.

The low bid was 2.360%. The median bid was 2.400%. Tenders at the high were allotted 50.06%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.